Printable 8879 Vt Template

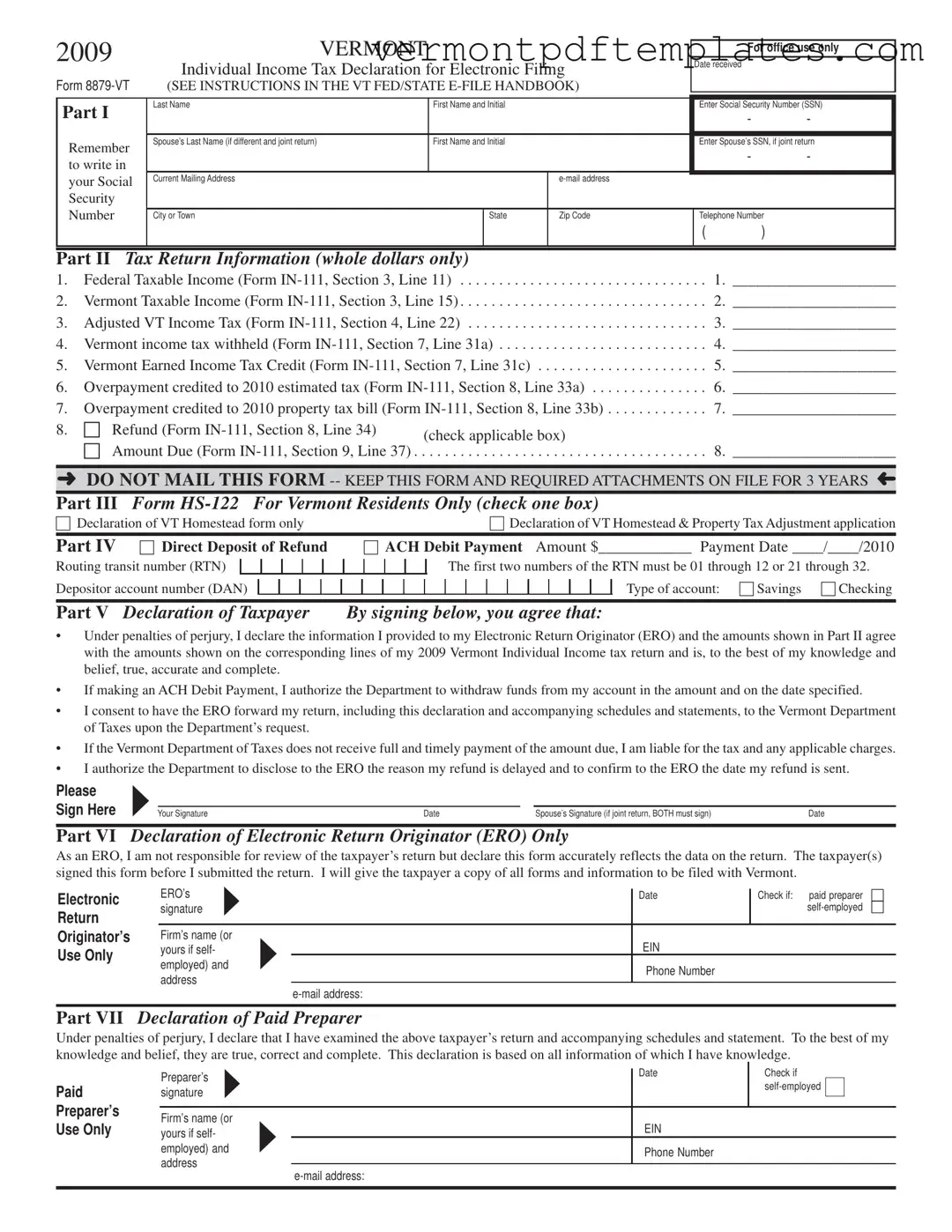

The 8879-VT form is a crucial document for Vermont taxpayers who choose to file their individual income tax returns electronically. This form serves as a declaration of the taxpayer's consent for their Electronic Return Originator (ERO) to submit their tax return on their behalf. It captures essential personal information, including names, Social Security numbers, and contact details. Additionally, the form requires the taxpayer to provide specific financial details such as federal and Vermont taxable income, adjustments to income tax, and any applicable credits or refunds. A section dedicated to direct deposit options allows for a seamless refund process, while the declaration section emphasizes the importance of accuracy and the legal implications of providing false information. By signing the 8879-VT, taxpayers affirm that the information aligns with their tax return and authorize the ERO to act on their behalf, ensuring a smooth filing experience with the Vermont Department of Taxes.

Misconceptions

Here are some common misconceptions about the Vermont Individual Income Tax Declaration for Electronic Filing, known as Form 8879-VT:

- Form 8879-VT is not necessary for all taxpayers. Some believe that everyone must submit this form. However, it is only required if you are filing electronically through an Electronic Return Originator (ERO).

- Signing the form means you are submitting your tax return. Many think that signing Form 8879-VT automatically sends their tax return. In reality, the ERO uses this form to file the return on your behalf.

- You cannot make changes after signing. Some assume that once they sign the form, they cannot make any changes. You can still amend your return even after signing Form 8879-VT.

- Form 8879-VT is only for joint returns. There is a belief that this form is only for couples filing jointly. In fact, both single and joint filers can use this form.

- It is a tax payment form. Some think that Form 8879-VT is used to make tax payments. This form is solely a declaration for electronic filing, not a payment method.

- Once filed, the form is discarded. Many believe that they can throw away the form after filing. It is important to keep it on file for at least three years.

- Only the taxpayer needs to sign the form. Some think that only one signature is required. However, both spouses must sign if it is a joint return.

- The form guarantees a refund. There is a misconception that signing this form ensures a tax refund. The form does not affect the amount of refund or payment due; it simply allows for electronic filing.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The 8879-VT form is used for declaring an individual's income tax return for electronic filing in Vermont. |

| Governing Law | This form is governed by the Vermont Department of Taxes regulations and is part of the state's income tax filing process. |

| Retention Requirement | Taxpayers must keep this form and any required attachments on file for three years after filing. |

| Joint Filers | Both spouses must sign the form if filing a joint return, ensuring both are accountable for the information provided. |

| Electronic Submission | The form must be submitted electronically, and taxpayers authorize the ERO to forward their return to the Vermont Department of Taxes. |

Different PDF Forms

What Is Exempt From Sales Tax in Vermont - Filers must include their Federal Employer Identification Number (FEIN) on the form.

For those looking to understand their finances better, the important Adp Pay Stub information can provide clarity on earned income and deductions for accurate payroll management.

Vermont Dcf - The report needs to indicate if the operator was driving commercially.

Similar forms

The IRS Form 8879, known as the IRS e-file Signature Authorization, serves a similar purpose to Form 8453, which is also used for electronic filing of tax returns. Both forms allow taxpayers to authorize their Electronic Return Originator (ERO) to file their tax return electronically on their behalf. While Form 8879 is specific to e-filed returns, Form 8453 is used for returns that include certain attachments that cannot be electronically filed. Both documents require signatures from the taxpayer and, if applicable, the spouse, confirming the accuracy of the information provided.

To enhance your understanding of essential documentation in property transactions, you can explore the comprehensive Arizona bill of sale form available at this link. This form serves as a crucial legal record, ensuring that all necessary details of the sale are properly documented and acknowledged by the parties involved.

Another document that shares similarities with Form 8879 is the IRS Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Like Form 8879, it requires the taxpayer’s signature and provides an avenue for the taxpayer to confirm their intention regarding their tax obligations. Form 4868 allows individuals to request an extension for filing their tax return, while Form 8879 ensures that the return is filed electronically with the taxpayer's consent. Both forms emphasize the importance of timely communication with the IRS.

Form 1040, the U.S. Individual Income Tax Return, is another document related to Form 8879. While Form 1040 is the primary tax return form, Form 8879 acts as a supplementary authorization for e-filing. Taxpayers must complete Form 1040 to report their income and deductions, and then use Form 8879 to give permission for the ERO to submit that information electronically. Both documents are integral to the tax filing process, ensuring that the IRS receives accurate and timely information.

Form W-2, the Wage and Tax Statement, also bears a resemblance to Form 8879 in that it is essential for tax reporting. Employers provide Form W-2 to employees, detailing their earnings and the taxes withheld throughout the year. While Form 8879 focuses on the authorization for electronic filing, it is often used in conjunction with Form W-2, as the information from W-2s is necessary for completing the tax return. Both forms play crucial roles in the overall tax filing process, ensuring that all reported income is documented and verified.

Lastly, Form 1099, specifically the 1099-MISC or 1099-NEC, is comparable to Form 8879 in the context of income reporting. Independent contractors and freelancers receive Form 1099 to report income earned outside of traditional employment. Similar to how Form 8879 authorizes the electronic filing of tax returns, Form 1099 serves as a record that taxpayers must include when filing their returns. Both forms contribute to the accurate reporting of income and expenses, ensuring compliance with tax regulations.

Key takeaways

When filling out and using the Vermont Individual Income Tax Declaration for Electronic Filing Form 8879-VT, consider the following key takeaways:

- Personal Information: Ensure that all personal details, such as names and Social Security Numbers (SSNs), are accurate and match the information on your tax return.

- Income Reporting: Carefully report your federal and Vermont taxable income as specified in the appropriate sections of your tax return. Double-check these amounts for accuracy.

- Tax Credits: Include any Vermont Earned Income Tax Credit and other relevant credits. This can affect your overall tax liability and potential refund.

- Refund or Amount Due: Clearly indicate whether you are expecting a refund or if you owe taxes. Fill in the appropriate amounts as indicated on your tax return.

- Direct Deposit: If you prefer direct deposit for your refund, provide the necessary banking information, including the routing transit number and account number.

- Signature Requirement: Both spouses must sign the form if filing jointly. This confirms agreement with the information provided and the accuracy of the tax return.

- Retention of Records: Do not mail the form. Keep it along with all required attachments on file for at least three years, as it may be needed for future reference or audits.

By following these guidelines, you can ensure that your Form 8879-VT is completed correctly and that your electronic filing process goes smoothly.