Articles of Incorporation Template for Vermont State

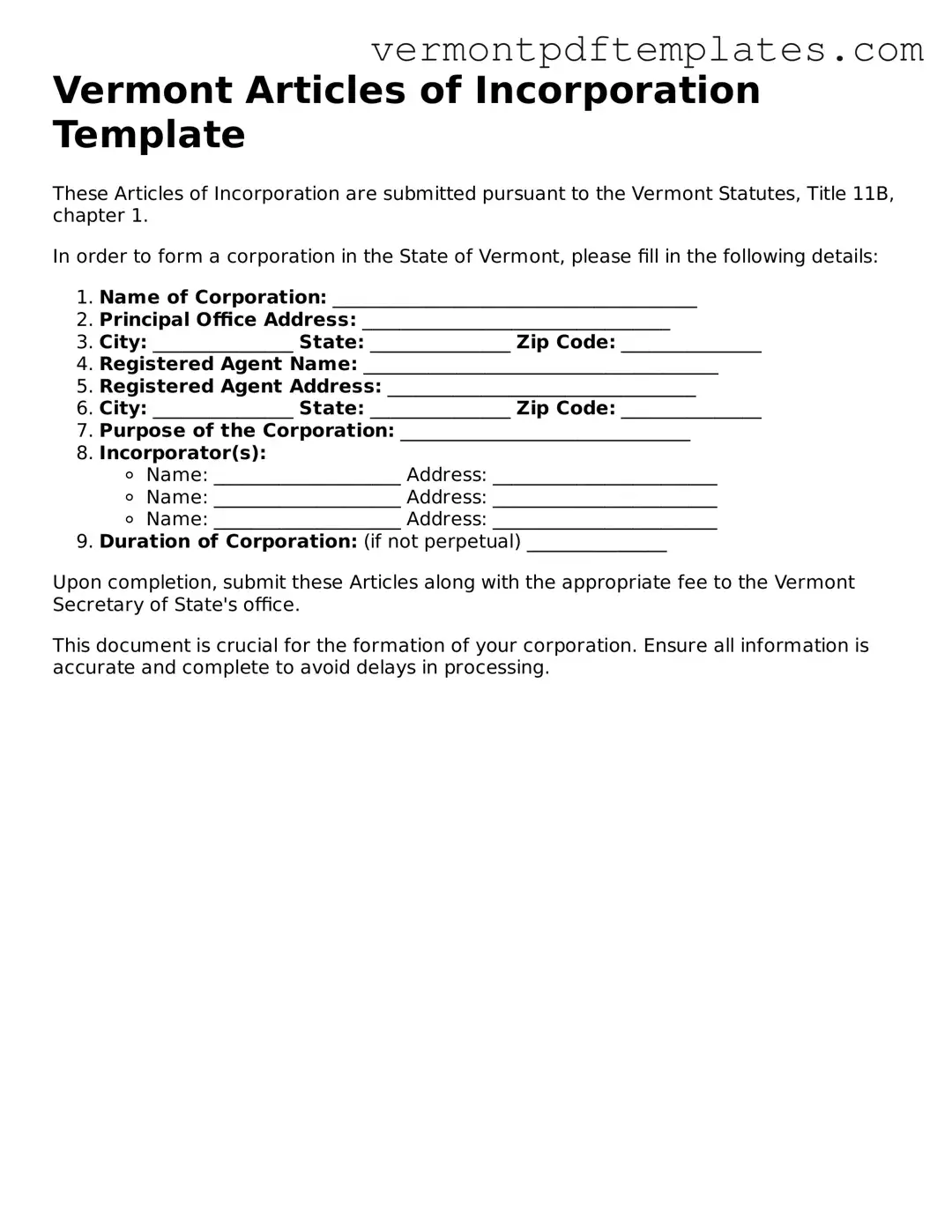

Incorporating a business in Vermont is an important step for many entrepreneurs seeking to establish a formal business structure. The Vermont Articles of Incorporation form serves as a foundational document that outlines key details about your corporation. This form requires essential information, such as the name of the corporation, the purpose of the business, and the address of the principal office. Additionally, it includes details about the registered agent, who will receive legal documents on behalf of the corporation. The form also necessitates the names and addresses of the initial directors, providing transparency and accountability from the outset. Completing the Articles of Incorporation is a crucial part of the process, as it not only helps to define your business's identity but also ensures compliance with state regulations. By understanding the major aspects of this form, you can take a significant step toward bringing your business vision to life in Vermont.

Misconceptions

Understanding the Vermont Articles of Incorporation form is essential for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are ten common misconceptions explained.

-

Only large businesses need to file Articles of Incorporation.

This is not true. Any business, regardless of size, can benefit from incorporating. This includes small businesses and startups.

-

The process is too complicated for the average person.

While there are specific requirements, the process can be straightforward with the right guidance. Many resources are available to help individuals navigate the form.

-

Articles of Incorporation are the same as a business license.

These are different documents. Articles of Incorporation establish the existence of a corporation, while a business license permits operation within a locality.

-

Filing Articles of Incorporation guarantees business success.

Incorporating provides legal protections and benefits, but it does not ensure that a business will be successful. Success depends on various factors, including market conditions and management.

-

Once filed, Articles of Incorporation cannot be changed.

Changes can be made. Amendments to the Articles of Incorporation can be filed with the state to reflect changes in business structure or purpose.

-

All states have the same requirements for Articles of Incorporation.

Each state has its own requirements and processes. It is important to understand Vermont's specific rules when filing.

-

You need a lawyer to file Articles of Incorporation.

While legal assistance can be beneficial, it is not required. Many individuals successfully file the form without legal representation.

-

Articles of Incorporation are only for for-profit businesses.

This is incorrect. Nonprofit organizations also need to file Articles of Incorporation to gain legal recognition.

-

The filing fee is prohibitively expensive.

The filing fee in Vermont is relatively affordable compared to other states. It is a small investment for the benefits of incorporation.

-

Once incorporated, you cannot operate as a sole proprietorship.

This is a misconception. A business can be incorporated while also maintaining a sole proprietorship for different aspects of its operations.

Clarifying these misconceptions can help individuals make informed decisions about incorporating their businesses in Vermont.

Form Features

| Fact Name | Description |

|---|---|

| Governing Law | The Vermont Articles of Incorporation are governed by Title 11B of the Vermont Statutes Annotated. |

| Purpose | This form is used to officially create a corporation in the state of Vermont. |

| Filing Requirement | Incorporators must file the Articles of Incorporation with the Vermont Secretary of State. |

| Information Required | The form typically requires the corporation's name, registered agent, and the number of shares authorized. |

Fill out More Templates for Vermont

Vermont Mobile Home Bill of Sale - Outline any agreed-upon contingencies with this straightforward document.

For travelers seeking to drive abroad, the process of obtaining an Aaa International Driving Permit Application form is crucial for ensuring legal compliance while on the road. This form can significantly enhance your travel experience, providing clarity and facilitating smoother journeys. To learn more about this important step, visit the essential guide to Aaa International Driving Permit Application.

Vermont Education - Can be a prerequisite for participation in homeschooling networks and resources.

Similar forms

The Vermont Articles of Incorporation form is similar to the Certificate of Incorporation, which is used in many states. Both documents serve the same fundamental purpose: to officially create a corporation. They outline essential information such as the corporation's name, purpose, and registered agent. While the specific requirements may vary by state, the core function remains consistent. Both documents provide a legal foundation for the corporation, allowing it to operate within the law and protect its owners from personal liability.

Another document that shares similarities with the Vermont Articles of Incorporation is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws govern its internal operations. They detail how the corporation will be managed, including rules for meetings, voting procedures, and the roles of officers and directors. Together, these documents ensure that a corporation not only exists legally but also operates smoothly and effectively.

For those looking to navigate the complexities of asset transfer, obtaining a reliable bill of sale is crucial. This document serves not only to formalize transfers but also to provide clarity during transactions. You can find more detailed information by visiting our guide on the essential bill of sale process.

The Operating Agreement is another document comparable to the Articles of Incorporation, particularly for limited liability companies (LLCs). Like the Articles, the Operating Agreement is essential for defining the structure and operation of the business. It outlines the ownership, management responsibilities, and distribution of profits among members. While the Articles of Incorporation are specific to corporations, the Operating Agreement serves a similar purpose for LLCs, providing clarity and legal protection for its members.

Finally, the Statement of Information is akin to the Vermont Articles of Incorporation in that it is a required document for maintaining corporate status. This document is often filed annually and provides updated information about the corporation, such as its address, officers, and registered agent. While the Articles of Incorporation are filed once to establish the corporation, the Statement of Information ensures that the state has current details, helping to keep the corporation in good standing.

Key takeaways

Filling out the Vermont Articles of Incorporation form is a crucial step in establishing your business. Here are some key takeaways to keep in mind:

- Ensure you have a unique name for your corporation. It must not be similar to existing entities registered in Vermont.

- Include the purpose of your corporation clearly. This helps define the scope of your business activities.

- Designate a registered agent. This individual or entity will receive legal documents on behalf of your corporation.

- Provide the principal office address. This is where your business will be officially located.

- List the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Be mindful of the filing fees. Confirm the current fee schedule before submitting your form.

- Review the form for accuracy. Mistakes can lead to delays in processing your application.

- Consider the tax implications. Understanding how incorporation affects your tax status is essential.

- File the form with the Vermont Secretary of State. This step officially creates your corporation.

Following these guidelines will help ensure a smooth incorporation process in Vermont.