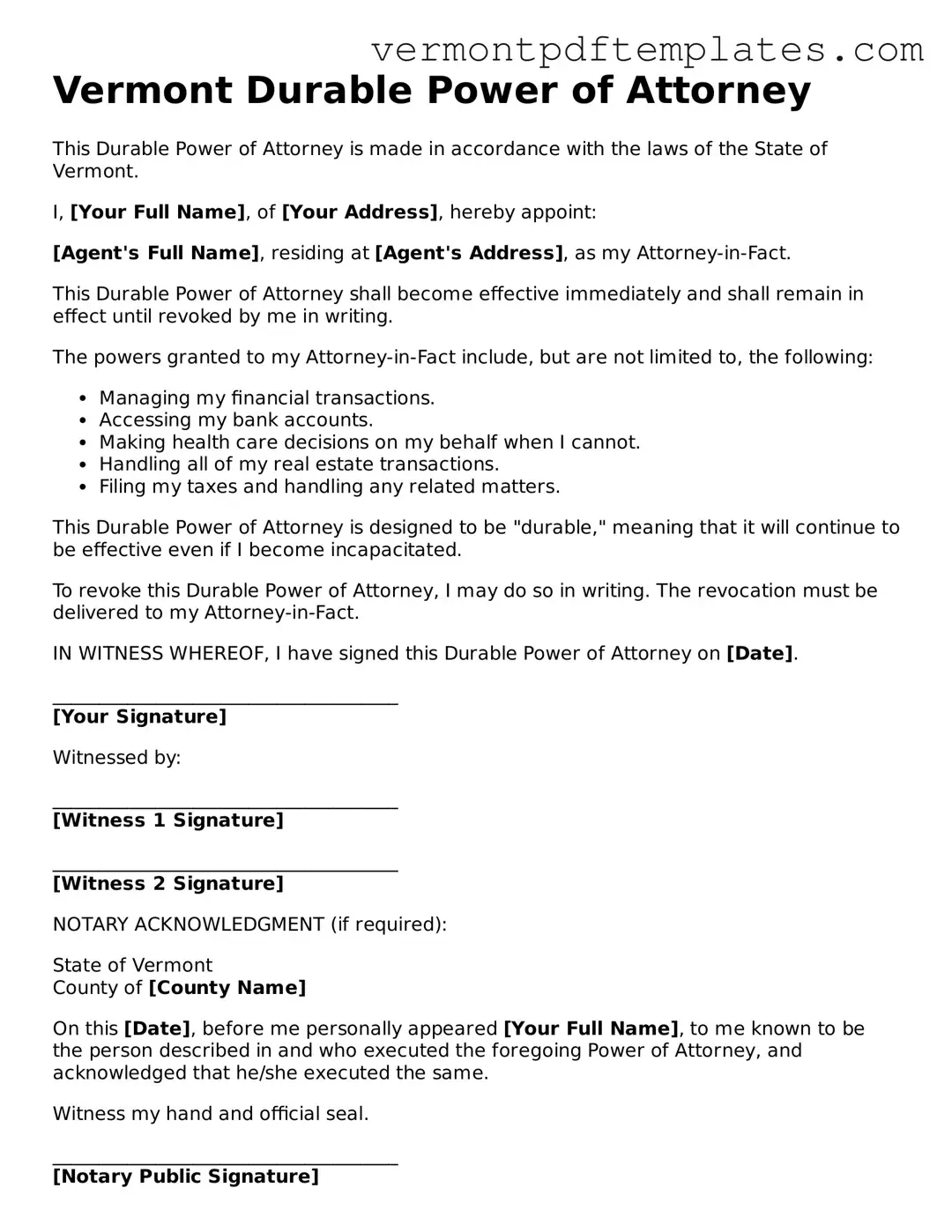

Durable Power of Attorney Template for Vermont State

The Vermont Durable Power of Attorney form serves as a critical legal document that allows individuals to designate someone they trust to make financial and legal decisions on their behalf in the event they become incapacitated. This form is particularly important for ensuring that personal and financial matters are managed according to one's wishes when the individual is unable to do so themselves. It is essential to understand that the authority granted through this document can be broad or limited, depending on the specific needs and preferences of the person creating it, often referred to as the principal. The appointed individual, known as the agent or attorney-in-fact, can handle various responsibilities, including managing bank accounts, paying bills, and making investment decisions. Importantly, the durable aspect of this power of attorney means that it remains effective even if the principal loses the ability to make decisions due to illness or injury. Proper execution of the form, including signatures and notarization, is necessary to ensure its validity and enforceability. Understanding these key elements can help individuals in Vermont navigate the complexities of planning for future contingencies effectively.

Misconceptions

Understanding the Vermont Durable Power of Attorney form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

It only works when I am incapacitated.

Many people believe that a Durable Power of Attorney (DPOA) only becomes effective when they are unable to make decisions. In reality, you can grant authority to your agent while you are still capable of making your own choices.

-

It is the same as a regular Power of Attorney.

A DPOA remains effective even if you become incapacitated, unlike a regular Power of Attorney, which typically becomes void under such circumstances. This distinction is crucial for ensuring your wishes are honored.

-

My agent can do anything they want.

While a DPOA gives your agent significant authority, it does not grant them unlimited power. The agent must act in your best interest and according to the guidelines you set in the document.

-

It is difficult to revoke.

Some believe that once a DPOA is established, it cannot be changed. In fact, you can revoke or amend it at any time, as long as you are mentally competent.

-

It does not need to be notarized.

In Vermont, a DPOA must be signed in front of a notary public to be legally valid. Failing to have it notarized can lead to complications when you need it to be enforced.

-

It is only for financial matters.

While a DPOA is often associated with financial decisions, it can also cover health care decisions. You can specify what powers you want to grant, which may include medical choices.

By clarifying these misconceptions, individuals can better navigate the complexities of the Vermont Durable Power of Attorney form and ensure their wishes are respected.

Form Features

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate someone to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Vermont Durable Power of Attorney is governed by Title 14, Chapter 31 of the Vermont Statutes Annotated. |

| Durability | This document remains effective even if the principal becomes mentally incapacitated, unlike a regular power of attorney. |

| Agent Authority | The agent can be granted broad or limited authority, depending on the principal's preferences outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Signing Requirements | The form must be signed by the principal and witnessed by at least one individual or notarized to be valid. |

| Use Cases | This form is often used for financial decisions, healthcare decisions, or managing property when the principal cannot do so themselves. |

Fill out More Templates for Vermont

Vermont Business Entity Search - Details regarding the board of directors are included in the form.

In Florida, completing a transaction for personal property often involves the use of a legal document known as the Bill of Sale. This document formalizes the transfer of ownership between parties, serving not only as a receipt but also as proof of purchase. It is particularly essential in sales of items such as vehicles and boats. For those looking to create this important record, a helpful resource is the Bill of Sale form, which outlines the agreement details including item description, sale price, and the date of sale.

House Quit Notice Letter - A legal document that demands a tenant to vacate the rental property.

Similar forms

The Vermont Durable Power of Attorney form is similar to a General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, called the agent, to make decisions on their behalf. However, the key difference lies in durability. The General Power of Attorney becomes ineffective if the principal becomes incapacitated, while the Durable Power of Attorney remains valid even in such circumstances, ensuring continuous representation.

Another document that shares similarities is the Medical Power of Attorney. This form specifically designates an agent to make healthcare decisions for the principal if they are unable to do so. Like the Durable Power of Attorney, it grants authority to the agent but focuses solely on medical matters, ensuring that the principal’s healthcare preferences are honored during times of incapacity.

In the realm of estate planning, the California Last Will and Testament form holds significant importance, as it allows the testator to determine how their assets will be handled after they pass away. This legal document not only ensures that the testator's wishes are respected but also aids in reducing conflicts among heirs. For those looking into comprehensive estate planning resources, you can find a variety of documents at All California Forms, which can further assist in shaping a well-structured plan that addresses personal and financial wishes.

The Healthcare Proxy is also comparable to the Durable Power of Attorney. It allows an individual to appoint someone to make healthcare decisions on their behalf. While the Healthcare Proxy is limited to medical decisions, the Durable Power of Attorney covers a broader range of financial and legal matters, providing a more comprehensive approach to representation.

A Living Will is another document that relates to the Durable Power of Attorney. While the Durable Power of Attorney designates someone to make decisions, a Living Will outlines the principal's wishes regarding medical treatment in specific situations. It serves as a guide for the appointed agent, ensuring they understand the principal's preferences when making healthcare choices.

The Revocable Trust shares some characteristics with the Durable Power of Attorney, particularly in terms of asset management. Both allow for the management of an individual's assets, but a Revocable Trust involves transferring ownership of assets into the trust. This can facilitate smoother management and distribution of assets, whereas the Durable Power of Attorney authorizes an agent to manage assets without changing ownership.

Lastly, the Financial Power of Attorney is akin to the Durable Power of Attorney, as both empower an agent to handle financial matters. However, the Financial Power of Attorney typically focuses solely on financial transactions, such as managing bank accounts or paying bills. The Durable Power of Attorney encompasses a wider range of responsibilities, including legal and healthcare decisions, making it a more versatile option for comprehensive representation.

Key takeaways

When filling out and using the Vermont Durable Power of Attorney form, it is important to keep the following key takeaways in mind:

- The form allows you to designate someone you trust to make decisions on your behalf if you become unable to do so.

- Ensure that the person you choose as your agent understands your wishes and is willing to act in your best interest.

- The Durable Power of Attorney remains effective even if you become incapacitated, which distinguishes it from other types of power of attorney.

- It is advisable to have the document notarized to enhance its validity and acceptance by financial institutions and healthcare providers.

- Review the form periodically to ensure that it still reflects your current wishes and to update it as necessary.