General Power of Attorney Template for Vermont State

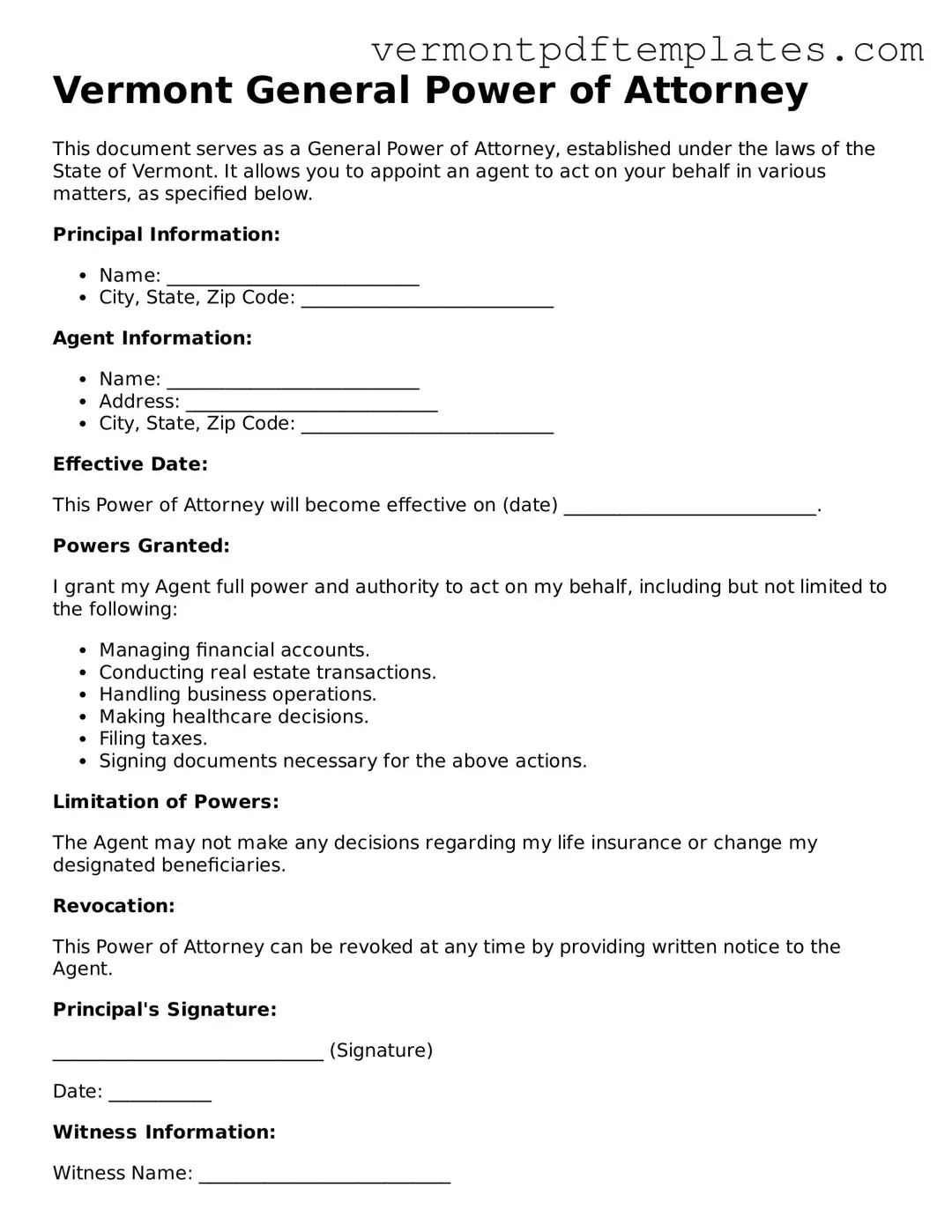

In the beautiful state of Vermont, planning for the future often includes important legal documents that ensure your wishes are honored, even when you may not be able to express them yourself. One such document is the General Power of Attorney (GPOA) form, which allows you to designate a trusted individual to make decisions on your behalf regarding financial matters and other affairs. This form empowers your chosen agent to handle a variety of tasks, from managing bank accounts and paying bills to making real estate transactions and handling tax matters. It’s essential to understand that while the GPOA grants significant authority to your agent, it can also be tailored to limit their powers or specify particular responsibilities. Vermont law provides a framework for creating this document, ensuring that your intentions are clear and legally binding. By taking the time to establish a General Power of Attorney, you can have peace of mind knowing that your financial and legal matters will be managed according to your preferences, even if you are unable to do so yourself.

Misconceptions

When considering the Vermont General Power of Attorney form, it is essential to separate fact from fiction. Misunderstandings can lead to poor decisions regarding financial and legal matters. Here are six common misconceptions:

- It only applies to financial matters. Many believe that a General Power of Attorney is limited to financial decisions. In reality, it can encompass a wide range of responsibilities, including healthcare decisions, unless specifically restricted.

- It becomes invalid upon the principal's incapacitation. A common myth is that a General Power of Attorney ceases to be effective if the principal becomes incapacitated. However, if the document includes durable provisions, it remains valid even in such circumstances.

- Anyone can be appointed as an agent. Some people think that any individual can serve as an agent under a General Power of Attorney. While it is true that the principal has the freedom to choose, it is advisable to select someone trustworthy and capable of handling the responsibilities.

- It must be notarized to be valid. There is a belief that notarization is a requirement for the General Power of Attorney to be effective. While notarization can add an extra layer of legitimacy, the form can still be valid without it, depending on the specific circumstances.

- It cannot be revoked. Many assume that once a General Power of Attorney is established, it cannot be revoked. In fact, the principal retains the right to revoke the document at any time, as long as they are mentally competent.

- It is a permanent arrangement. Some individuals mistakenly think that a General Power of Attorney is a permanent solution. In reality, it can be temporary or limited to specific tasks, and its duration can be defined by the principal.

Understanding these misconceptions can empower individuals to make informed choices regarding their legal and financial affairs in Vermont.

Form Features

| Fact Name | Description |

|---|---|

| Definition | A Vermont General Power of Attorney form allows an individual (the principal) to designate another person (the agent) to manage their financial and legal affairs. |

| Governing Law | This form is governed by the Vermont Statutes, specifically Title 14, Chapter 31, which outlines the laws regarding powers of attorney. |

| Durability | The General Power of Attorney can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent has the authority to perform a variety of actions, including managing bank accounts, paying bills, and making investment decisions. |

| Revocation | The principal can revoke the General Power of Attorney at any time, provided they are mentally competent to do so. |

| Signing Requirements | The form must be signed by the principal in the presence of a notary public or two witnesses to be considered valid. |

| Limitations | While the agent has broad powers, they cannot make healthcare decisions unless a separate healthcare power of attorney is established. |

Fill out More Templates for Vermont

Colst - May involve consultation with healthcare professionals to ensure understanding.

For those navigating payroll processes, understanding the Adp Pay Stub documentation is essential, as it provides vital insights into employee compensation and the necessary deductions that impact take-home pay.

Vermont Divorce Laws Property Distribution - Fostering clear communication is an important aspect of maintaining a peaceful separation.

Similar forms

The Vermont General Power of Attorney form shares similarities with the Durable Power of Attorney. Both documents allow an individual, known as the principal, to appoint another person, called the agent, to make decisions on their behalf. The key difference lies in the durability; while a General Power of Attorney may become invalid if the principal becomes incapacitated, a Durable Power of Attorney remains effective even in such circumstances. This ensures that the agent can continue to act for the principal's benefit, providing peace of mind in situations where the principal may no longer be able to manage their affairs.

Another document akin to the General Power of Attorney is the Healthcare Power of Attorney. This specific form allows individuals to designate someone to make medical decisions for them if they are unable to do so themselves. While the General Power of Attorney can cover a wide range of financial and legal matters, the Healthcare Power of Attorney is focused solely on health-related decisions. Both documents emphasize the importance of appointing a trusted individual to act in the principal’s best interest, ensuring that their wishes are respected in critical situations.

The Financial Power of Attorney is also comparable to the General Power of Attorney. This document specifically grants the agent authority to handle financial matters, such as managing bank accounts, paying bills, and filing taxes. While the General Power of Attorney can encompass both financial and legal decisions, the Financial Power of Attorney is tailored for financial management. This distinction can help clarify the scope of authority granted to the agent, making it easier for all parties involved to understand their roles and responsibilities.

A Living Will can be considered similar in purpose to the General Power of Attorney, particularly regarding healthcare decisions. While the General Power of Attorney allows an agent to make decisions on behalf of the principal, a Living Will outlines the principal's wishes regarding medical treatment in end-of-life situations. Both documents serve to ensure that an individual's preferences are honored, but they do so in different contexts. The Living Will focuses specifically on medical care, while the General Power of Attorney has a broader application.

When setting up a corporation in Florida, it is essential to understand the various documentation needed to ensure compliance with state regulations. This includes the Articles of Incorporation form, which serves as a foundational document for establishing your business. A comprehensive understanding of this form, alongside resources like All Florida Forms, can greatly simplify the registration process and ensure that your corporation is recognized legally and functionally in the state.

The Revocable Trust is another document that shares some characteristics with the General Power of Attorney. A Revocable Trust allows individuals to transfer assets into a trust during their lifetime, with the ability to amend or revoke it as needed. Like the General Power of Attorney, a Revocable Trust can help manage an individual's assets and provide for their beneficiaries. However, the Revocable Trust also offers additional benefits, such as avoiding probate and providing greater privacy regarding asset distribution after death.

Lastly, the Advance Directive is similar to the General Power of Attorney in that it allows individuals to communicate their preferences regarding medical treatment and appoint someone to make decisions on their behalf. While the General Power of Attorney can encompass a wide range of decisions, the Advance Directive is specifically focused on healthcare choices. This ensures that individuals can express their wishes clearly and designate someone they trust to advocate for them in medical situations where they may be unable to speak for themselves.

Key takeaways

When considering the Vermont General Power of Attorney form, it is essential to understand its significance and how to effectively fill it out. Here are some key takeaways:

- The General Power of Attorney allows you to appoint someone to manage your financial and legal affairs if you become unable to do so.

- Choose your agent wisely; this person will have significant authority over your decisions and finances.

- Make sure to clearly outline the powers you are granting. This can include handling bank transactions, signing documents, and managing real estate.

- The form must be signed in front of a notary public to ensure its validity.

- Consider discussing your wishes with your agent before completing the form to ensure they understand your intentions.

- You can revoke the General Power of Attorney at any time as long as you are mentally competent.

- It is advisable to keep copies of the completed form in a safe place and provide copies to your agent and any relevant institutions.

- Be aware that this document does not allow your agent to make healthcare decisions on your behalf; a separate healthcare power of attorney is needed for that.

- Review the document periodically to ensure it still reflects your current wishes and circumstances.

- If you have questions or concerns, seeking legal advice can provide clarity and ensure that your rights are protected.