Lady Bird Deed Template for Vermont State

The Vermont Lady Bird Deed form represents an innovative approach to estate planning, allowing property owners to transfer their real estate while retaining significant control during their lifetime. This unique deed enables individuals to maintain the right to live in and manage the property, ensuring they can enjoy their home without interruption. Upon the owner’s passing, the property automatically transfers to designated beneficiaries, bypassing the often lengthy and costly probate process. This streamlined transfer not only simplifies the distribution of assets but also offers potential tax benefits and protection from creditors. With its growing popularity, the Lady Bird Deed serves as a valuable tool for those looking to balance their personal needs with their estate planning goals, making it an essential consideration for Vermont residents contemplating their legacy.

Misconceptions

The Vermont Lady Bird Deed is a tool that many people may not fully understand. Misconceptions can lead to confusion about its purpose and benefits. Here are nine common misconceptions about the Vermont Lady Bird Deed form, along with explanations to clarify these misunderstandings.

- It is only for wealthy individuals. Many believe that the Lady Bird Deed is exclusively for the affluent. In reality, it can benefit anyone looking to manage their property effectively, regardless of their financial status.

- It eliminates all taxes. Some people think that using a Lady Bird Deed means avoiding all taxes. While it can provide certain tax advantages, such as avoiding probate, it does not eliminate tax responsibilities altogether.

- It is the same as a traditional will. A common misconception is that a Lady Bird Deed functions like a will. However, it is a different legal instrument that allows property to pass outside of probate, which can streamline the transfer process.

- It can only be used for primary residences. Many individuals assume that the Lady Bird Deed is limited to primary homes. In fact, it can be applied to various types of real estate, including vacation homes and rental properties.

- Once signed, it cannot be changed. Some people think that a Lady Bird Deed is irrevocable once executed. However, the grantor retains the right to modify or revoke the deed at any time during their lifetime.

- It protects against all creditors. There is a belief that a Lady Bird Deed offers complete protection from creditors. While it can help with estate planning, it does not shield the property from all potential claims.

- It is only useful for Medicaid planning. While the Lady Bird Deed can be advantageous in Medicaid planning, it serves broader purposes, such as facilitating property transfer and avoiding probate.

- All states have the Lady Bird Deed. Many people mistakenly think that the Lady Bird Deed is available in every state. However, this legal tool is specific to certain states, including Vermont, and its rules may vary.

- It's too complicated to use. Some individuals perceive the Lady Bird Deed as overly complex. In reality, it can be a straightforward process when guided by a knowledgeable professional, making it accessible for many.

Understanding these misconceptions is crucial for anyone considering the Vermont Lady Bird Deed. By dispelling these myths, individuals can make informed decisions about their property and estate planning needs.

Form Features

| Fact Name | Description |

|---|---|

| Purpose | The Vermont Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Vermont Statutes Title 27, Section 501. |

| Benefits | It helps avoid probate and provides a way to manage property without losing ownership. |

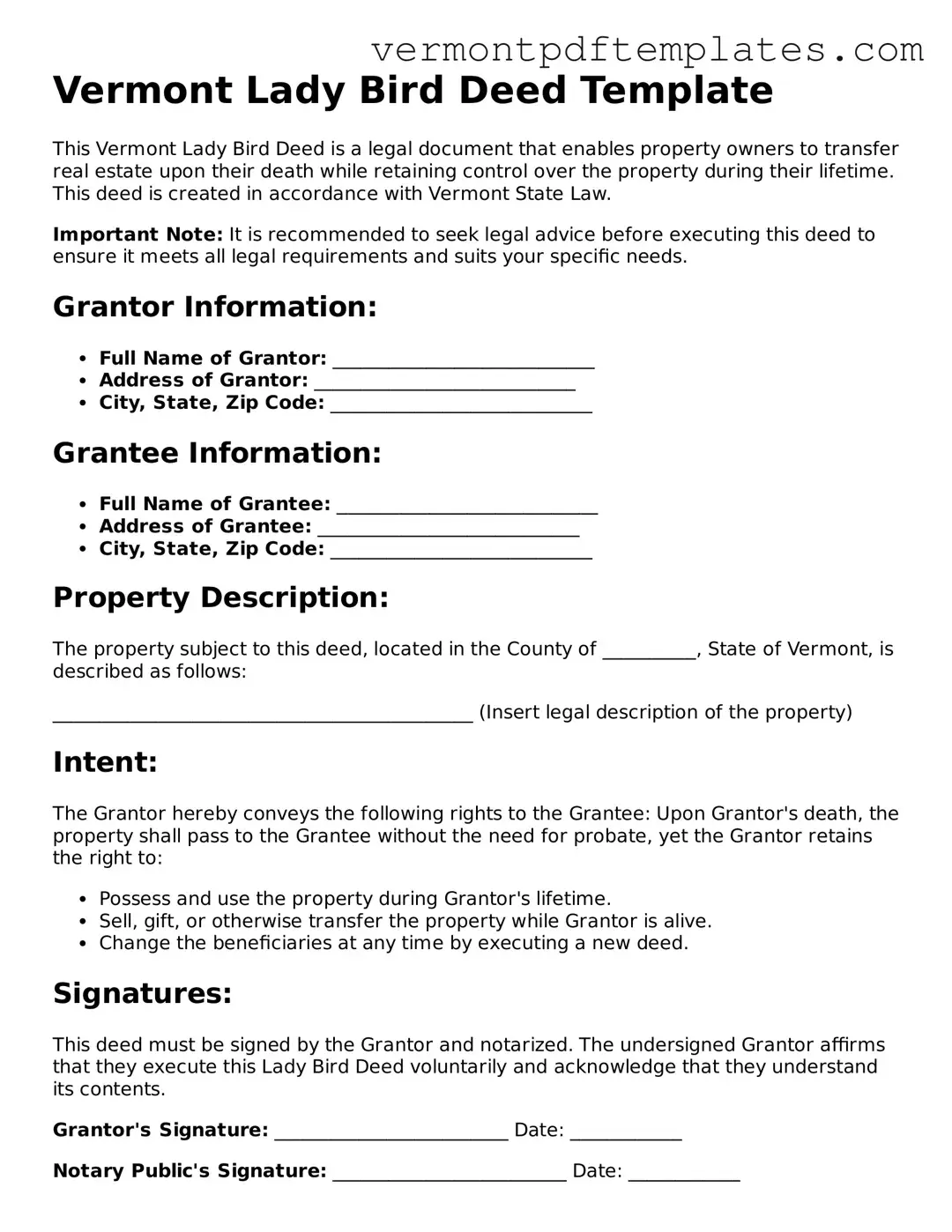

| Requirements | The deed must be signed by the property owner and notarized to be valid. |

Fill out More Templates for Vermont

Vermont Mobile Home Bill of Sale - Safeguard the transaction by documenting everything in this bill of sale template.

The AAA International Driving Permit Application form is a document that enables drivers to legally operate a motor vehicle while abroad in countries that recognize the permit. This form establishes the driver’s eligibility and provides a translation of their state-issued driver’s license into several languages. It is an essential tool for Americans planning to drive when visiting foreign destinations. For more information on how to complete the application, visit OnlineLawDocs.com.

How to Get Out of a Non Compete - Many companies require a Non-compete Agreement to safeguard proprietary technologies.

Similar forms

The Vermont Lady Bird Deed is similar to a traditional life estate deed. Both documents allow a property owner to retain certain rights during their lifetime while transferring the property to beneficiaries upon death. However, the life estate deed typically restricts the owner's ability to sell or mortgage the property without the consent of the remainderman, whereas the Lady Bird Deed allows the owner to sell or change the beneficiaries without such restrictions. This flexibility can be particularly beneficial for individuals who wish to maintain control over their property while planning for the future.

Another document akin to the Vermont Lady Bird Deed is the revocable living trust. Like the Lady Bird Deed, a revocable living trust allows property to pass directly to beneficiaries upon the owner's death, bypassing probate. The trust can be altered or revoked during the owner's lifetime, similar to how the Lady Bird Deed allows changes to beneficiaries. However, a living trust requires more formal setup and ongoing management compared to the simplicity of executing a Lady Bird Deed.

The transfer-on-death (TOD) deed shares similarities with the Lady Bird Deed in that it allows property to transfer directly to designated beneficiaries upon the owner’s death. Both documents avoid probate, which can simplify the transfer process. However, the TOD deed does not provide the same level of control during the owner’s lifetime since the owner cannot sell or mortgage the property without the beneficiaries’ consent once the deed is recorded.

A general warranty deed is another document that bears resemblance to the Lady Bird Deed. Both types of deeds transfer ownership of property, but the general warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike the Lady Bird Deed, which retains certain rights for the original owner, a general warranty deed fully transfers ownership and rights immediately upon signing.

The quitclaim deed is similar in that it transfers property interests, but it does so without any warranties. The Lady Bird Deed, on the other hand, retains rights for the owner while ensuring the property will pass to the beneficiaries. A quitclaim deed is often used to clear up title issues or transfer property between family members, but it does not offer the same level of control or protection as the Lady Bird Deed.

To effectively establish your business in Florida, consider utilizing the required Articles of Incorporation document, providing a clear outline of your corporation’s structure and operational details. For a deeper understanding, you can refer to this comprehensive Articles of Incorporation guide.

The enhanced life estate deed is closely related to the Lady Bird Deed, as it allows the property owner to retain the right to live in the home for life while designating beneficiaries. The key difference is that the enhanced life estate deed may not allow the owner to sell or mortgage the property without the beneficiaries’ consent, whereas the Lady Bird Deed explicitly allows for such actions. This makes the Lady Bird Deed a more flexible option for property owners.

Lastly, a special warranty deed is similar to the Lady Bird Deed in that it transfers property ownership but only warrants the title against claims arising during the seller's ownership. Like the Lady Bird Deed, it does not provide the same lifetime rights to the seller. The special warranty deed is often used in commercial transactions, while the Lady Bird Deed is more commonly used in estate planning to maintain control over property until death.

Key takeaways

The Vermont Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate while retaining certain rights during their lifetime. Understanding its nuances is essential for effective use. Here are key takeaways regarding the filling out and utilization of this form:

- The deed allows property owners to retain the right to live in and use the property for the duration of their lives.

- Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

- The form must be filled out accurately to ensure that the intended beneficiaries are clearly identified.

- It is important to include a legal description of the property, which can usually be found in the current deed or tax records.

- The deed should be signed in the presence of a notary public to ensure its validity.

- Property owners may revoke the deed at any time during their lifetime, allowing for flexibility in estate planning.

- Consulting with a legal professional is advisable to navigate potential tax implications or other legal considerations.

- Beneficiaries should be informed about the deed to avoid confusion or disputes after the property owner’s passing.

- In Vermont, this deed can be particularly beneficial for married couples, as it simplifies the transfer of property between spouses.

Utilizing the Vermont Lady Bird Deed effectively can provide peace of mind and streamline the transfer of property, making it a valuable option in estate planning.