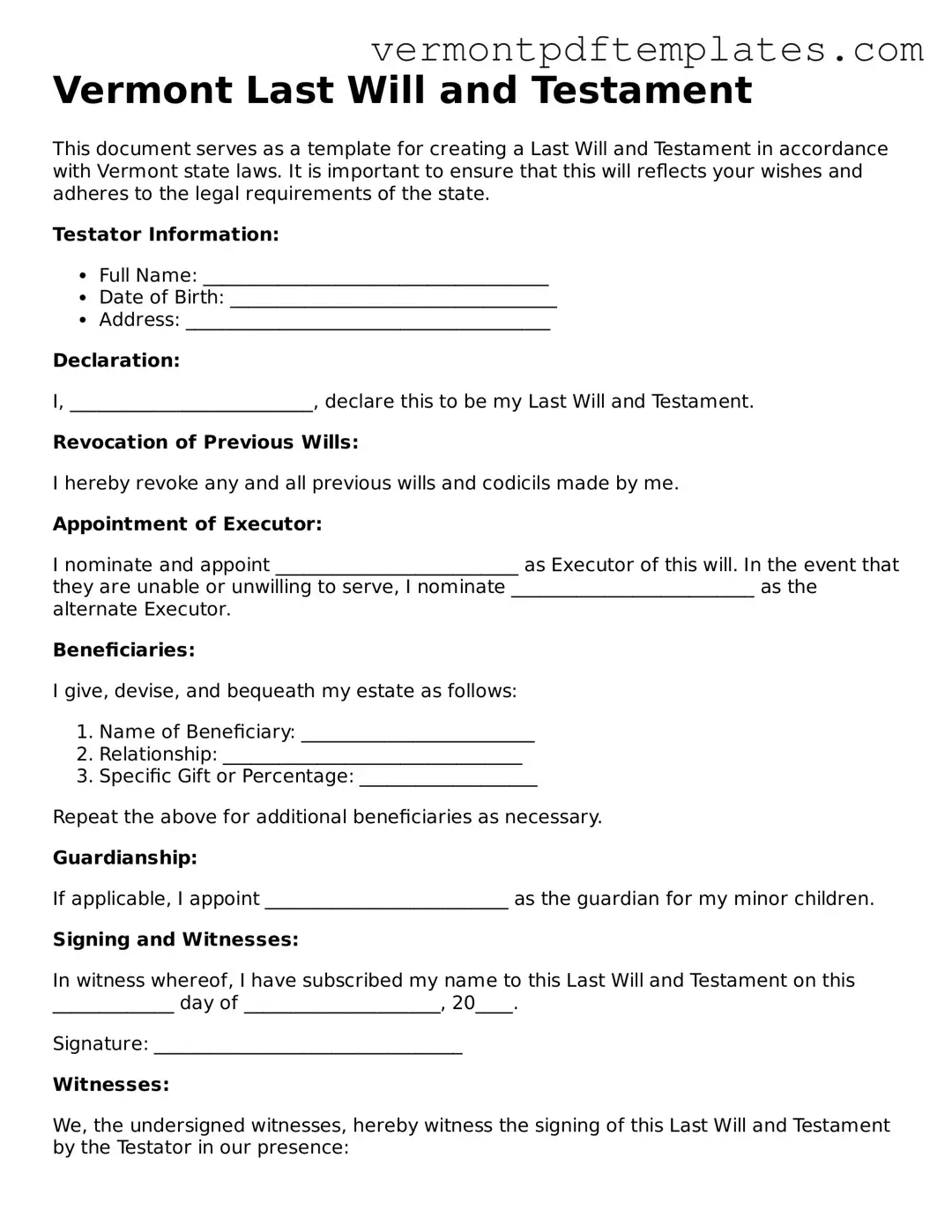

Last Will and Testament Template for Vermont State

Creating a Last Will and Testament is an essential step in ensuring that your wishes are respected after your passing. In Vermont, this legal document outlines how your assets will be distributed and who will manage your estate. The form typically includes key sections such as the appointment of an executor, designation of guardians for minor children, and specific bequests to individuals or organizations. It allows you to specify your final wishes clearly, making it easier for your loved ones to navigate the process during a difficult time. Additionally, Vermont law provides guidelines to ensure that your will is valid and enforceable, which includes requirements for signatures and witnesses. Understanding these aspects can help you create a comprehensive will that reflects your intentions and protects your family's future.

Misconceptions

Understanding the Vermont Last Will and Testament form is essential for anyone looking to plan their estate. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Only wealthy individuals need a will. Many people believe that a will is only necessary for those with significant assets. In reality, anyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are honored after your death.

- Verbal wills are valid. Some think that expressing their wishes verbally is sufficient. However, Vermont law requires a written document to be legally recognized as a will.

- Handwritten wills are not valid. While it is true that formal requirements exist, Vermont does allow handwritten (holographic) wills if they are signed and dated by the testator. However, clarity and intent must be evident.

- Wills can be changed without formalities. Many assume that simply altering a will is enough. In Vermont, any changes should be documented through a codicil or a new will to ensure they are legally binding.

- All assets automatically go to the spouse. While many assume that a spouse inherits everything, this is not always the case. The distribution of assets depends on how they are titled and the specifics outlined in the will.

- Once a will is created, it cannot be modified. This misconception can lead to outdated estate plans. In Vermont, wills can be updated or revoked at any time, as long as the testator is of sound mind.

- Witnesses are not necessary. Some people believe that a will can be valid without witnesses. In Vermont, at least two witnesses are required to sign the will for it to be legally enforceable.

- Having a will avoids probate. Many think that a will eliminates the probate process. In reality, a will must go through probate to be validated, although it can simplify the process compared to dying intestate (without a will).

By addressing these misconceptions, individuals can better navigate the estate planning process and ensure their wishes are fulfilled after their passing.

Form Features

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | The Vermont Last Will and Testament is governed by Title 14, Chapter 111 of the Vermont Statutes Annotated. |

| Age Requirement | In Vermont, individuals must be at least 18 years old to create a valid Last Will and Testament. |

| Witnesses | The will must be signed by at least two witnesses who are present at the same time. They should not be beneficiaries of the will. |

| Revocation | A Last Will and Testament can be revoked at any time by the testator, typically through a new will or a written declaration. |

| Self-Proving Wills | Vermont allows for self-proving wills, which means that the signatures of the testator and witnesses can be notarized to simplify the probate process. |

| Digital Wills | As of now, Vermont does not recognize digital or electronic wills, so a physical document is required. |

Fill out More Templates for Vermont

Vermont Hold Harmless Indemnity Agreement - Signing this agreement often requires participants to acknowledge potential hazards.

Dmv Bill of Sale Vt - A Bill of Sale outlines the details of the transaction, including the buyer, seller, and item description.

To ensure accurate payroll handling, employers and employees alike rely on accessible resources for the ADP Pay Stub form. For those seeking a reliable option, templates can be found at smarttemplates.net, which can help streamline the documentation process and enhance financial management.

Vermont Purchase and Sale Agreement - The agreement may cover any included fixtures and personal property.

Similar forms

The Vermont Last Will and Testament is similar to a Living Will. A Living Will outlines a person's wishes regarding medical treatment in case they become unable to communicate. While a Last Will deals with the distribution of assets after death, a Living Will focuses on healthcare decisions during a person's life. Both documents reflect an individual's preferences and can provide peace of mind to families by clarifying intentions.

The California Articles of Incorporation form is a document that officially marks the creation of a corporation in the state. It establishes the corporation's name, purpose, and structure within legal parameters, serving as a vital first step for businesses aiming to incorporate. For those looking for detailed information, you can find more about the form at https://toptemplates.info/articles-of-incorporation/california-articles-of-incorporation/.

Another document akin to the Last Will is the Durable Power of Attorney. This document allows someone to make financial or legal decisions on behalf of another person if they become incapacitated. Like a Last Will, it ensures that a person's wishes are respected, but it operates during their lifetime rather than after death. Both documents serve to protect an individual's interests when they are unable to advocate for themselves.

The Revocable Trust shares similarities with a Last Will in that both can dictate how a person's assets are distributed. However, a Revocable Trust can take effect during a person's lifetime, allowing for the management of assets while they are still alive. This can help avoid probate, which is a process that a Last Will typically goes through after death. Both documents aim to provide clarity and direction regarding asset management.

A Healthcare Proxy is another document similar to a Last Will. It designates someone to make medical decisions on behalf of an individual if they are unable to do so. Like a Living Will, it focuses on healthcare but differs in that it appoints a specific person to make those decisions. Both documents ensure that medical care aligns with the individual's wishes.

The Codicil is closely related to a Last Will as it serves to modify or add to an existing will. This document allows for changes without needing to create an entirely new will. It can be used to update beneficiaries or change specific provisions. Both documents must be executed with the same legal formalities to ensure they are valid.

A Letter of Instruction can complement a Last Will by providing additional guidance to loved ones. While a Last Will specifies the distribution of assets, a Letter of Instruction can include personal messages, funeral preferences, and information about financial accounts. This informal document helps to clarify intentions and can ease the burden on family members during a difficult time.

The Prenuptial Agreement is another document that shares some similarities with a Last Will. While it is created before marriage, it outlines how assets will be divided in case of divorce or death. Both documents deal with asset management and distribution, ensuring that individuals' wishes are respected in different circumstances.

The Estate Plan encompasses a Last Will and other documents, like trusts and powers of attorney. It provides a comprehensive strategy for managing a person's assets and healthcare decisions. While a Last Will focuses on post-death asset distribution, an Estate Plan considers both lifetime and posthumous wishes, ensuring a holistic approach to an individual's affairs.

Finally, the Beneficiary Designation is similar to a Last Will in that it determines who will receive specific assets, such as life insurance policies or retirement accounts. Unlike a Last Will, which addresses a broader range of assets, a Beneficiary Designation specifically names individuals who will receive certain assets directly, bypassing the probate process. Both documents play a crucial role in ensuring that a person's wishes regarding asset distribution are honored.

Key takeaways

When filling out and using the Vermont Last Will and Testament form, keep these key takeaways in mind:

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Vermont.

- Written Document: The will must be in writing. Oral wills are not recognized in Vermont.

- Signature Requirement: You need to sign the will at the end. If you cannot sign, you can direct someone else to sign on your behalf in your presence.

- Witnesses: At least two witnesses must sign the will. They should be present at the same time and witness your signature.

- Witness Eligibility: Witnesses should not be beneficiaries of the will. This helps avoid any potential conflicts of interest.

- Revocation: You can revoke or change your will at any time by creating a new will or by physically destroying the old one.

- Storing the Will: Keep the will in a safe place, such as a safe deposit box or with an attorney. Inform your executor of its location.

- Executor Selection: Choose a reliable executor to carry out your wishes. This person will be responsible for managing your estate after your passing.

- Updating the Will: Review your will regularly, especially after major life events like marriage, divorce, or the birth of a child.

- Legal Advice: Consider seeking legal advice when drafting your will to ensure it meets all legal requirements and accurately reflects your wishes.