Power of Attorney Template for Vermont State

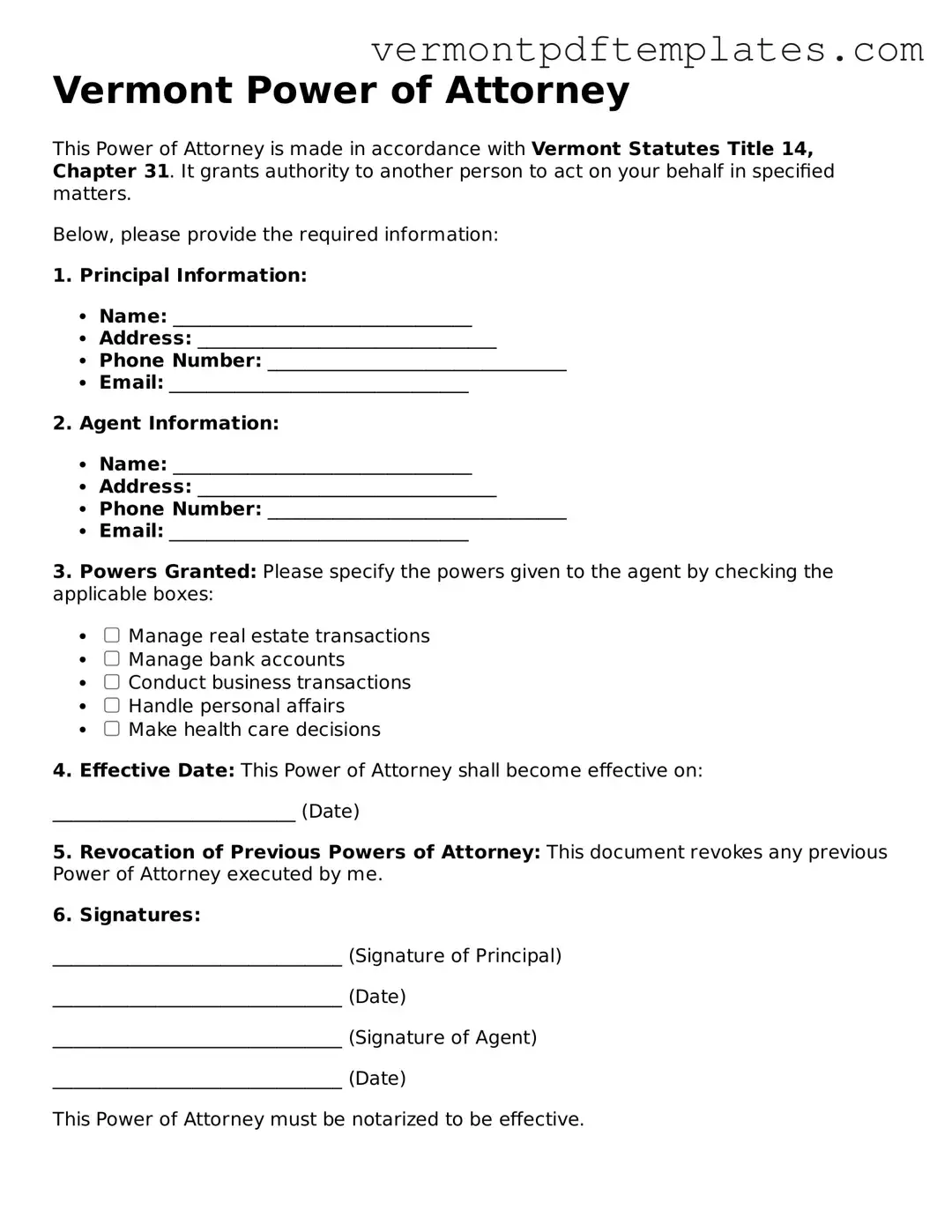

The Vermont Power of Attorney form serves as a crucial legal document that enables individuals to appoint someone they trust to manage their financial and legal affairs when they are unable to do so themselves. This form can be tailored to fit specific needs, allowing for either a general or limited scope of authority. A general Power of Attorney grants broad powers, while a limited Power of Attorney restricts the agent's authority to specific tasks or timeframes. It is essential to understand that the appointed agent, often referred to as the attorney-in-fact, must act in the best interest of the principal, the person granting the authority. In Vermont, the form requires clear identification of both parties, detailed descriptions of the powers being granted, and must be signed in the presence of a notary public to ensure its validity. Additionally, individuals should be aware of the potential for revocation, which can occur at any time as long as the principal is mentally competent. Understanding these aspects is vital for anyone considering the use of a Power of Attorney in Vermont, as it ensures that the principal's wishes are respected and upheld during times of need.

Misconceptions

Understanding the Vermont Power of Attorney form is crucial for anyone considering its use. However, several misconceptions can lead to confusion. Here are five common misunderstandings about this important legal document:

-

It can only be used for financial matters.

Many people believe that a Power of Attorney is solely for handling financial affairs. In reality, it can also be used for medical decisions, real estate transactions, and other personal matters. The scope of authority can be tailored to fit specific needs.

-

It becomes effective only when the principal is incapacitated.

Some assume that a Power of Attorney only activates when the person who created it (the principal) is no longer able to make decisions. However, a Power of Attorney can be set up to take effect immediately or only upon incapacitation, depending on the principal's wishes.

-

Anyone can be appointed as an agent.

While it is true that the principal can choose their agent, it’s important to note that the agent should be someone trustworthy and capable of managing the responsibilities. This is not just a formality; the agent will have significant authority over the principal’s affairs.

-

It is a permanent arrangement.

Many people think that once a Power of Attorney is established, it cannot be changed or revoked. In fact, the principal has the right to revoke or modify the Power of Attorney at any time, as long as they are mentally competent.

-

A notarized Power of Attorney is not necessary.

Some believe that simply signing the document is sufficient. However, in Vermont, it is generally recommended to have the Power of Attorney notarized to ensure its validity and to help avoid any disputes regarding its authenticity.

By understanding these misconceptions, individuals can make more informed decisions about using the Vermont Power of Attorney form. It’s always a good idea to consult with a professional to ensure that your needs are met and that the document is set up correctly.

Form Features

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | The Vermont Power of Attorney form is governed by Title 14, Chapter 31 of the Vermont Statutes. |

| Types of POA | Vermont recognizes several types of POA, including durable, non-durable, and springing powers of attorney. |

| Durable POA | A durable POA remains effective even if the principal becomes incapacitated. |

| Springing POA | A springing POA only takes effect upon the occurrence of a specific event, such as the principal's incapacitation. |

| Agent's Authority | The agent can be granted broad or limited authority, depending on the principal's wishes as outlined in the document. |

| Signing Requirements | The POA must be signed by the principal and witnessed by two individuals or acknowledged by a notary public. |

| Revocation | The principal can revoke the POA at any time, as long as they are competent to do so. |

| Legal Advice | It is advisable to seek legal counsel when creating or modifying a Power of Attorney to ensure it meets all legal requirements. |

Fill out More Templates for Vermont

Colst - Validates a patient’s right to choose their care according to their values and beliefs.

Vermont Rental Application - Incorporate any special requests that could impact your rental approval.

For those looking to understand the importance of ownership transfer, the comprehensive Tennessee bill of sale serves as a crucial document that outlines the specifics of the transaction. To learn more about this form, visit https://smarttemplates.net/fillable-bill-of-sale/.

Vermont Residential Lease Agreement - Includes a clause for tenant notifications and communications.

Similar forms

The Vermont Power of Attorney form shares similarities with the General Power of Attorney. Both documents grant authority to an agent to make decisions on behalf of the principal. This includes financial and legal matters. The key distinction lies in the scope of authority; a General Power of Attorney is typically broader and can encompass a wide range of powers, while the Vermont version may be tailored to specific needs or situations.

Another related document is the Durable Power of Attorney. Like the Vermont Power of Attorney, a Durable Power of Attorney remains effective even if the principal becomes incapacitated. This ensures that the agent can continue to act on the principal's behalf during times of diminished capacity, providing peace of mind for both parties involved.

The Medical Power of Attorney is also similar, as it allows an agent to make healthcare decisions for the principal. While the Vermont Power of Attorney focuses on financial and legal matters, the Medical Power of Attorney specifically addresses health-related issues. Both documents empower an agent to act in the best interest of the principal, but in different contexts.

The Limited Power of Attorney is another document that bears resemblance to the Vermont form. This type of power of attorney restricts the agent's authority to specific tasks or a defined time period. While the Vermont Power of Attorney can be comprehensive, the Limited Power of Attorney is more focused, allowing the principal to retain control over other aspects of their life.

In addition, the Springing Power of Attorney is comparable. This document activates only upon the occurrence of a specific event, such as the principal's incapacity. The Vermont Power of Attorney can also be structured to become effective under certain conditions, making both documents useful for those who want to maintain control until a triggering event occurs.

The Financial Power of Attorney is another relevant document. It specifically authorizes an agent to manage the principal's financial affairs. While the Vermont Power of Attorney can include financial powers, the Financial Power of Attorney is dedicated solely to financial matters, ensuring that the agent can handle bills, investments, and other financial obligations efficiently.

The importance of understanding various financial documents cannot be overstated, particularly when it comes to forms such as the ADP Pay Stub form, which serves a vital role in summarizing an employee's earnings and deductions for a specific pay period. Knowledge of these forms is crucial for accurate personal finance management, especially in contexts involving employment verification or legal matters. For comprehensive templates and resources related to these financial statements, visit TopTemplates.info, which provides valuable insights and tools for navigating the complexities of payroll documentation.

The Revocable Living Trust is similar in that it allows for the management of assets during the principal's lifetime. While not a power of attorney, a Revocable Living Trust can serve a similar purpose by designating a trustee to manage assets, providing a level of control and flexibility. Both documents can be modified or revoked by the principal, ensuring their wishes are honored.

The Healthcare Proxy is akin to the Medical Power of Attorney, allowing an agent to make healthcare decisions when the principal is unable to do so. Both documents emphasize the importance of having a trusted individual to advocate for the principal’s medical needs. The Vermont Power of Attorney does not typically cover healthcare decisions, making these documents essential for comprehensive planning.

Lastly, the Advance Directive for Healthcare is similar in its purpose of outlining the principal's wishes regarding medical treatment. While the Vermont Power of Attorney may not explicitly include healthcare preferences, an Advance Directive ensures that the principal's desires are communicated to healthcare providers. Both documents work together to provide a holistic approach to planning for future medical needs.

Key takeaways

When filling out and using the Vermont Power of Attorney form, consider the following key takeaways:

- Understand the Purpose: A Power of Attorney allows you to appoint someone to make decisions on your behalf, especially in financial or legal matters.

- Choose Your Agent Wisely: Select a trustworthy individual who understands your wishes and can act in your best interest.

- Specify Powers Clearly: Clearly outline the specific powers you are granting to your agent to avoid confusion later.

- Consider Alternatives: If you only need someone to handle specific tasks, consider a limited Power of Attorney instead of a general one.

- Sign in Front of Witnesses: In Vermont, you must sign the form in front of a notary public or two witnesses to make it legally binding.

- Revocation is Possible: You can revoke the Power of Attorney at any time, as long as you are mentally competent.

- Keep Copies: After completing the form, make copies for yourself, your agent, and any relevant financial institutions.

- Review Regularly: Periodically review the document to ensure it still reflects your wishes and circumstances.

- Consult Legal Help if Needed: If you have questions or concerns, consider seeking legal advice to ensure everything is in order.