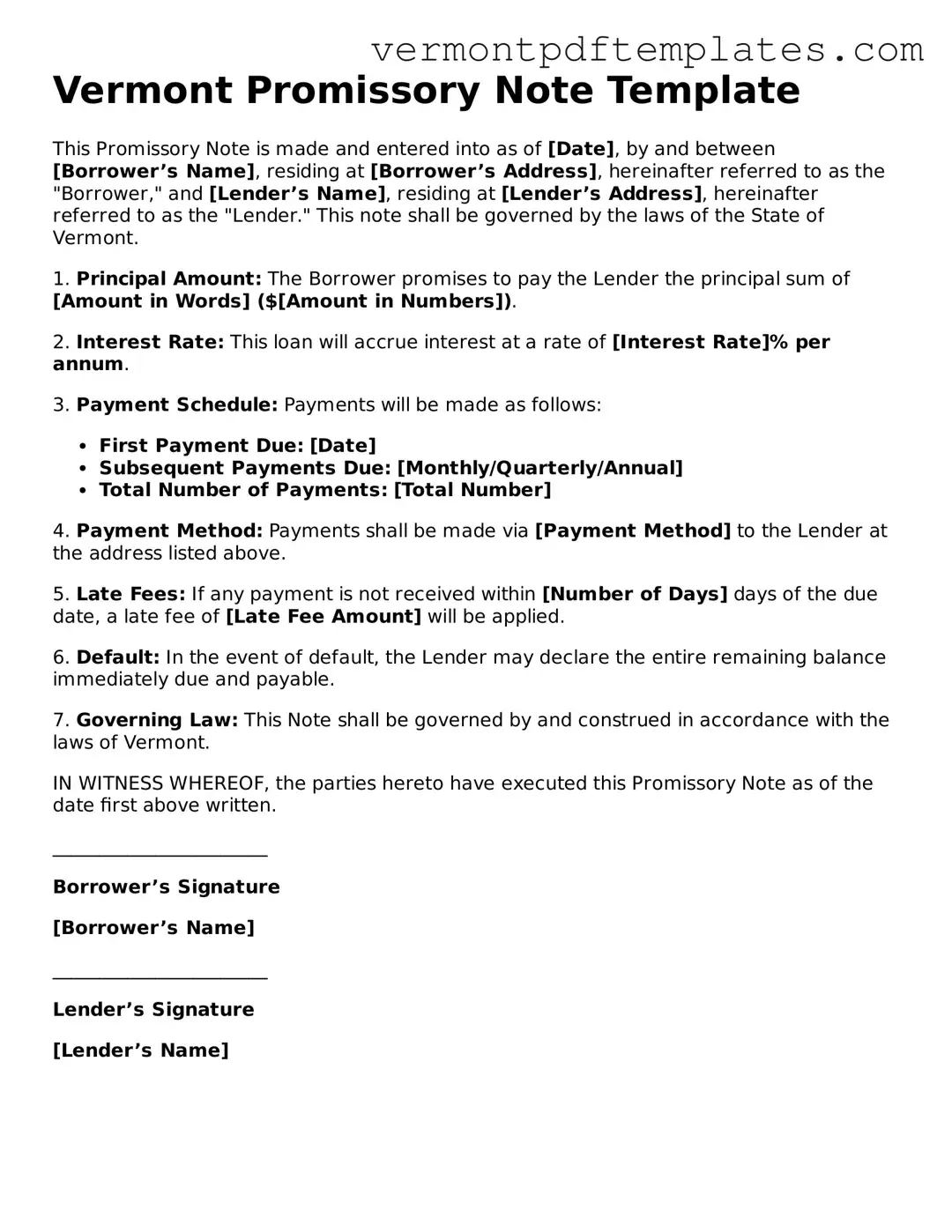

Promissory Note Template for Vermont State

The Vermont Promissory Note form is an essential document for individuals and businesses engaging in lending transactions within the state. This form outlines the terms of the loan agreement between the borrower and the lender, ensuring that both parties have a clear understanding of their rights and obligations. Key components include the principal amount, interest rate, repayment schedule, and any applicable fees. Additionally, the form may specify the consequences of default, providing protection for the lender. It is crucial for borrowers to carefully review the terms before signing, as this document serves as a legally binding commitment to repay the borrowed funds. By utilizing the Vermont Promissory Note form, both parties can establish a transparent and enforceable agreement, fostering trust and accountability in their financial dealings.

Misconceptions

Understanding the Vermont Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here is a list of common misunderstandings about this important legal document.

- It must be notarized. Many people believe that a promissory note needs to be notarized to be valid. In Vermont, notarization is not a requirement for the note to be enforceable.

- Only banks can issue promissory notes. This is not true. Individuals can create and sign promissory notes for personal loans as well.

- Verbal agreements are sufficient. While verbal agreements can be legally binding, they are difficult to enforce. A written promissory note provides clear evidence of the terms.

- Promissory notes are only for large loans. Promissory notes can be used for any amount, regardless of size. They are suitable for both small and large loans.

- They must be complicated. Many believe that promissory notes need to be complex legal documents. In reality, they can be straightforward and simple, as long as they include the essential terms.

- They are only for personal loans. Promissory notes can be used in business transactions as well. They are versatile tools for various lending situations.

- Once signed, they cannot be changed. While changing a promissory note after it is signed can be challenging, it is possible if both parties agree to the modifications.

- They do not need to specify interest rates. It is advisable to include the interest rate in the note. This clarity helps prevent disputes later on.

- They are automatically enforceable in court. While a properly drafted promissory note can be enforceable, it still may require legal action to collect on the debt if the borrower defaults.

- All states have the same rules for promissory notes. Each state has its own laws governing promissory notes. It is crucial to understand Vermont's specific regulations.

By addressing these misconceptions, individuals can better navigate the lending process and ensure that their agreements are clear and enforceable.

Form Features

| Fact Name | Details |

|---|---|

| Definition | A Vermont Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | The Vermont Promissory Note is governed by Title 9, Chapter 104 of the Vermont Statutes Annotated. |

| Parties Involved | The note involves two primary parties: the maker (the borrower) and the payee (the lender). |

| Interest Rate | The interest rate can be specified in the note, and it must comply with Vermont's usury laws. |

| Payment Terms | Payment terms, including the due date and frequency of payments, should be clearly outlined in the note. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Enforceability | A properly executed promissory note is enforceable in a court of law, provided it meets all legal requirements. |

| Default Provisions | The note may include provisions that outline the consequences of default, such as late fees or acceleration of payment. |

Fill out More Templates for Vermont

Vermont Advance Directive Registry - Writing down your medical preferences can lead to better healthcare outcomes.

The process of setting up a corporation in California involves several important steps, beginning with the completion of the necessary documentation. It is essential for founders to familiarize themselves with the requirements and guidelines, which can be found in this page, ensuring a smooth and compliant incorporation process.

Vt Vehicle Registration - Facilitates the registration process of the trailer.

Similar forms

The Vermont Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Loan Agreement, however, may be more comprehensive, detailing the obligations of both parties, including any collateral involved. While a Promissory Note primarily focuses on the borrower's promise to repay, a Loan Agreement often includes additional clauses regarding default and remedies, making it a more formalized contract.

Another document comparable to the Vermont Promissory Note is the Installment Sale Agreement. This agreement is used when a buyer purchases property or goods and agrees to pay for them in installments. Like a Promissory Note, it includes payment terms and conditions. However, the Installment Sale Agreement typically involves the transfer of ownership upon signing, whereas a Promissory Note does not transfer ownership until the debt is fully repaid. Both documents serve to secure payment but differ in their treatment of ownership rights.

The ADP Pay Stub form serves as a detailed record of an employee's earnings and deductions for a specific pay period. This document is essential for both employers, who use it to maintain accurate payroll records, and employees, who need it for personal financial management and verification purposes. For those looking for resources related to pay stubs and forms, smarttemplates.net/ can provide valuable templates and information. Despite the document's importance, the file content is currently unavailable.

The Vermont Promissory Note also resembles a Mortgage Note. Both documents are used in financing transactions and outline the borrower's commitment to repay a loan. A Mortgage Note specifically relates to real estate transactions and is often secured by the property itself. In contrast, a standard Promissory Note can be unsecured or secured by various types of collateral. The key distinction lies in the nature of the collateral and the specific legal implications associated with real estate financing.

A similar document is the Secured Promissory Note. This type of note explicitly states that the loan is backed by collateral, which could be property or other assets. Like the Vermont Promissory Note, it includes the repayment terms and interest rate. The primary difference is the inclusion of collateral in the Secured Promissory Note, which provides additional security to the lender. This added layer of protection can influence the terms of the loan, such as interest rates and repayment options.

Finally, the Vermont Promissory Note can be compared to a Personal Guarantee. While a Promissory Note is a promise to pay a specific amount, a Personal Guarantee involves an individual agreeing to be responsible for a debt if the primary borrower defaults. Both documents are used to secure loans, but a Personal Guarantee shifts the liability from the business or entity to an individual. This can provide lenders with additional assurance, especially in cases where the borrower may have limited credit history or assets.

Key takeaways

Understand the purpose of a promissory note. It serves as a written promise to pay a specific amount of money to a designated person or entity.

Ensure that all parties involved are clearly identified. This includes the borrower (the person or entity borrowing the money) and the lender (the person or entity providing the loan).

Specify the loan amount in clear terms. This should be a precise figure to avoid any confusion later on.

Include the interest rate, if applicable. This is the cost of borrowing and should be stated clearly to inform the borrower of their obligations.

Outline the repayment terms. This includes the schedule of payments, such as monthly or quarterly, and the due dates for each payment.

Consider including a late fee clause. This can help enforce timely payments by specifying penalties for late payments.

Ensure the note is signed and dated by all parties. This step is crucial as it indicates agreement to the terms laid out in the document.

Keep a copy of the signed promissory note. Both the lender and borrower should retain a copy for their records, as it serves as proof of the agreement.

Consult a legal professional if needed. If there are any uncertainties about the terms or implications of the promissory note, seeking legal advice can provide clarity.