Quitclaim Deed Template for Vermont State

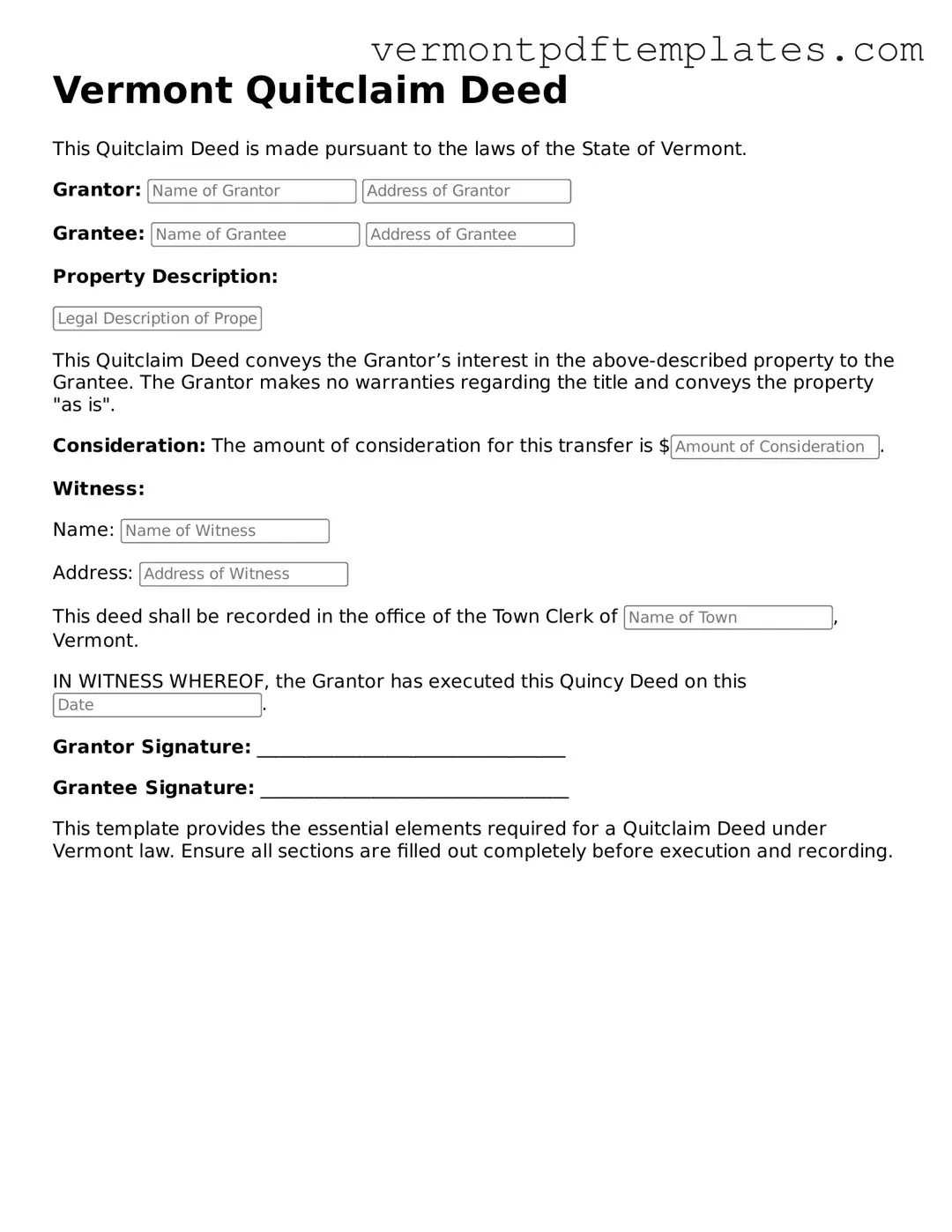

The Vermont Quitclaim Deed form serves as a crucial legal instrument for property transfers, enabling individuals to convey their interest in real estate without guaranteeing a clear title. This straightforward document is often used in situations where the grantor wishes to relinquish any claim they may have to a property, whether due to a sale, gift, or other arrangements. Unlike warranty deeds, which provide assurances about the title's validity, a quitclaim deed carries no such guarantees, making it essential for parties to understand the implications of this type of transfer. The form typically includes details such as the names of the grantor and grantee, a description of the property, and the date of the transfer. Additionally, it requires signatures from the parties involved, along with notarization to ensure authenticity. Understanding the nuances of the Vermont Quitclaim Deed is vital for anyone considering a property transfer, as it can have significant legal and financial consequences.

Misconceptions

When it comes to real estate transactions in Vermont, the Quitclaim Deed is often misunderstood. Here are five common misconceptions about this form, along with clarifications to help you navigate the process.

-

A Quitclaim Deed offers a guarantee of clear title.

This is not true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the title is free of defects. Buyers should conduct thorough title searches to ensure there are no liens or claims against the property.

-

Quitclaim Deeds are only used between family members.

While it is common for family members to use Quitclaim Deeds for transferring property, they can be used in various situations, including sales, gifts, or settling disputes. They are a flexible option for any type of property transfer.

-

Using a Quitclaim Deed is the same as selling a property.

This is a misconception. A Quitclaim Deed does not involve a sale or exchange of money. Instead, it simply transfers ownership rights. If a sale is involved, a different type of deed, such as a Warranty Deed, is typically used.

-

A Quitclaim Deed is a complicated legal document.

In reality, Quitclaim Deeds are relatively straightforward. They require basic information such as the names of the parties involved, the property description, and the signature of the grantor. However, it is advisable to seek assistance if you're unsure about the process.

-

Once a Quitclaim Deed is filed, it cannot be changed or revoked.

This is misleading. While a Quitclaim Deed is a legal document that transfers ownership, it can be revoked or altered through another legal instrument, provided that all parties agree. It’s essential to understand the implications before proceeding.

Understanding these misconceptions can help ensure a smoother property transfer process. Always consider consulting with a real estate professional or legal advisor when dealing with property deeds.

Form Features

| Fact Name | Description |

|---|---|

| Definition | A Vermont Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties regarding the title. |

| Governing Law | The Vermont Quitclaim Deed is governed by Title 27, Chapter 2 of the Vermont Statutes Annotated. |

| Parties Involved | The form includes a grantor (the person transferring the property) and a grantee (the person receiving the property). |

| Consideration | While consideration is often included in the deed, it is not mandatory for a quitclaim deed to be valid. |

| Notarization Requirement | The deed must be signed in the presence of a notary public to ensure its authenticity. |

| Recording | To provide public notice of the property transfer, the quitclaim deed should be recorded in the town clerk's office where the property is located. |

| Title Assurance | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor holds a valid title to the property. |

| Use Cases | Commonly used among family members, in divorce settlements, or for clearing up title issues. |

| Tax Implications | Property transfers via quitclaim deeds may have tax implications, and it is advisable to consult a tax professional. |

Fill out More Templates for Vermont

Vermont Residential Lease Agreement - Outlines conditions for security deposits and their return.

To successfully establish a corporation in Florida, individuals must complete and file the Florida Articles of Incorporation form, which provides essential details to the Florida Department of State. This document includes the corporation’s name, address, and the names of its directors, serving as the fundamental step in legitimatizing a business entity. Comprehensive guidance on this process can be found at floridaforms.net/blank-articles-of-incorporation-form.

Vermont Business Entity Search - The document lays the groundwork for compliance with federal laws as well.

Vermont Bill of Sale for Watercraft - A Boat Bill of Sale may also include warranties or guarantees offered by the seller.

Similar forms

The Warranty Deed is a document used to transfer ownership of real estate, similar to a Quitclaim Deed. However, the Warranty Deed offers a guarantee from the seller that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding the title after the transfer, the seller may be held responsible. In contrast, a Quitclaim Deed does not provide such assurances, making it a less secure option for the buyer.

The Bargain and Sale Deed also serves to transfer property ownership but typically implies that the seller has some interest in the property. Unlike a Quitclaim Deed, which transfers whatever interest the seller may have without any warranties, a Bargain and Sale Deed suggests that the seller has the right to sell the property, although it does not guarantee a clear title. This document is often used in transactions involving foreclosures or tax sales.

A Special Purpose Deed, such as a Personal Representative’s Deed, is another document that can resemble a Quitclaim Deed. This type of deed is used when property is transferred by an estate’s representative, often after the death of the owner. Like a Quitclaim Deed, it typically conveys the property without warranties, meaning the new owner takes the property "as is." This document is often utilized in estate settlements.

The Trustee’s Deed is similar in function to a Quitclaim Deed, as it is used to transfer property held in a trust. A Trustee’s Deed transfers the property to a beneficiary or buyer and usually does not include any warranties regarding the title. This type of deed is frequently used in real estate transactions involving trust properties, and like a Quitclaim Deed, it conveys whatever interest the trust holds.

In the intricate landscape of property transactions and estate management, understanding the various legal documents is paramount. Among them is the California Last Will and Testament form, which allows the testator to specify the distribution of their assets posthumously, preventing disagreements among heirs. For those navigating such complexities, resources like All California Forms can provide essential guidance.

The Deed in Lieu of Foreclosure is another document that can be compared to a Quitclaim Deed. This type of deed is used when a borrower voluntarily transfers the property back to the lender to avoid foreclosure. It typically does not provide warranties regarding the title, similar to a Quitclaim Deed. The lender accepts the property in exchange for releasing the borrower from the mortgage obligation, making it a mutually beneficial arrangement in certain situations.

Key takeaways

When completing the Vermont Quitclaim Deed form, it is essential to keep the following key points in mind:

- Understand the Purpose: A Quitclaim Deed is used to transfer ownership of property without guaranteeing that the title is clear. It’s often used among family members or in divorce settlements.

- Identify the Parties: Clearly list the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: Provide a detailed description of the property being transferred. This includes the address and any relevant parcel identification numbers.

- Consider Legal Requirements: Ensure that the form is signed in front of a notary public. This adds a layer of authenticity and is often required for the deed to be legally recognized.

- File the Deed: After completing the form, file it with the appropriate town or county office. This step is crucial to make the transfer official.

- Check for Fees: Be aware of any filing fees that may apply when submitting the Quitclaim Deed. These can vary by location.

- Consult Professionals: If there are any uncertainties or complex issues regarding the property, consider consulting a real estate attorney for guidance.

- Keep Copies: Always retain copies of the completed Quitclaim Deed for your records. This documentation is important for future reference.

By following these guidelines, you can ensure a smoother process in transferring property ownership in Vermont.