Printable S 3C Vermont Template

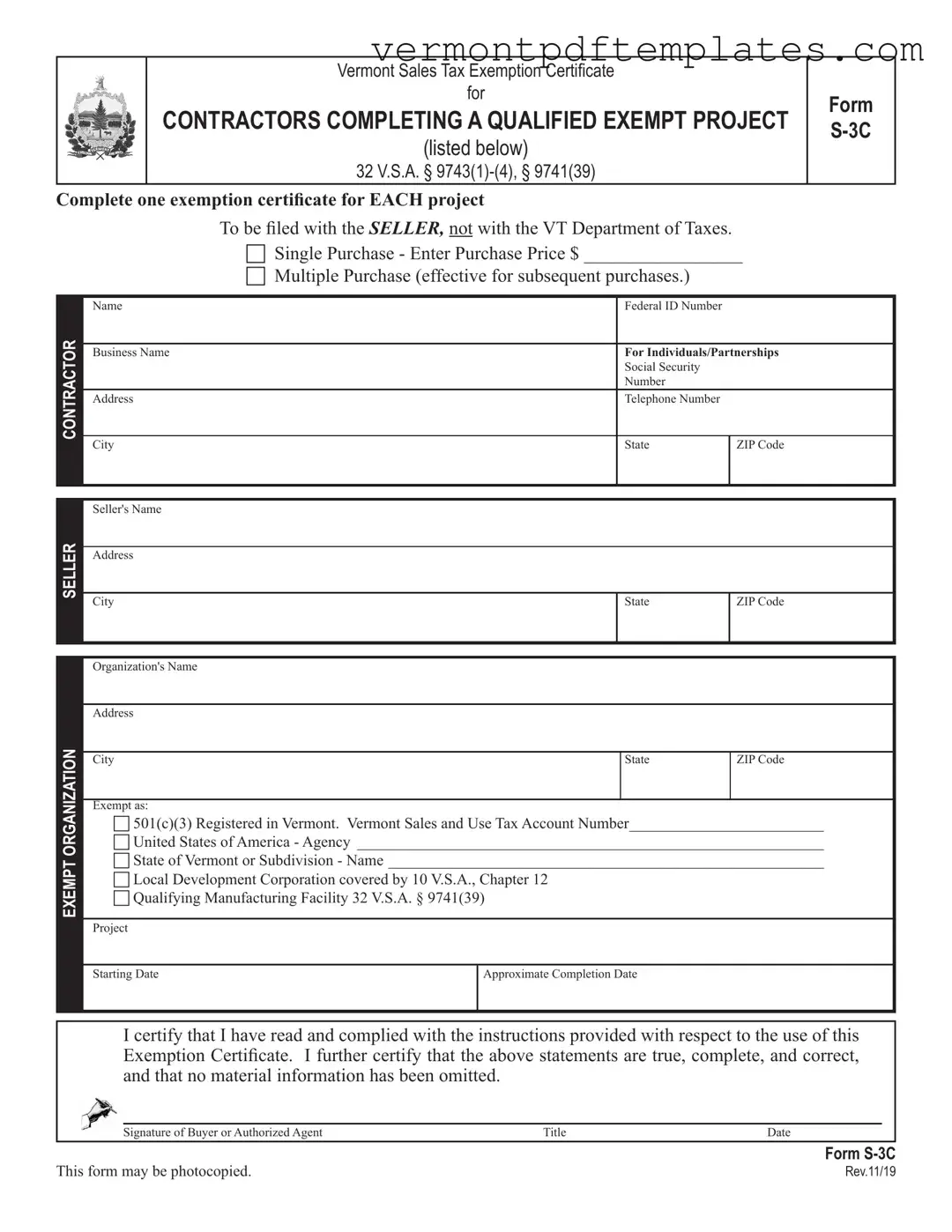

The S 3C Vermont form serves as a vital tool for contractors engaged in projects that qualify for sales tax exemptions. Designed specifically for contractors completing exempt projects, this form allows them to avoid paying sales tax on materials and supplies used in their work. To utilize this exemption, contractors must provide detailed information about each project, including the purchase price, contractor details, and the nature of the exempt organization involved. It’s important to note that each project requires a separate exemption certificate. The form also distinguishes between single and multiple purchases, ensuring that contractors can benefit from exemptions across multiple transactions. Furthermore, it outlines the eligibility criteria for organizations and projects that qualify, such as those owned by the federal government, the State of Vermont, or registered 501(c)(3) organizations. By completing this form accurately and submitting it to the seller, contractors can ensure compliance with Vermont tax regulations while minimizing their tax burden on qualified projects.

Misconceptions

There are several misconceptions regarding the S 3C Vermont form that can lead to confusion. Below are four common misunderstandings, along with clarifications.

- Misconception 1: The S 3C form must be filed with the Vermont Department of Taxes.

- Misconception 2: Any contractor can use the S 3C form for any project.

- Misconception 3: All purchases made by contractors are exempt from sales tax.

- Misconception 4: A single exemption certificate covers all future purchases for a project.

This form is not submitted to the Vermont Department of Taxes. Instead, it should be given directly to the seller involved in the transaction.

The form can only be used for qualified exempt projects. These projects must involve specific qualifying organizations or meet certain criteria outlined in the law.

Not all purchases are exempt. Contractors are generally considered end-users of the materials. Only specific items used for qualified exempt projects may be exempt from sales tax.

A separate exemption certificate must be completed for each project. If a contractor intends to make multiple purchases for a single project, a “Multiple Purchase” exemption certificate must be used.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The S-3C form serves as a Sales Tax Exemption Certificate for contractors completing qualified exempt projects in Vermont. |

| Governing Law | The form is governed by Vermont Statutes Annotated, specifically 32 V.S.A. § 9743(1)-(4) and § 9741(39). |

| Filing Instructions | This exemption certificate must be filed with the seller, not submitted to the Vermont Department of Taxes. |

| Single vs. Multiple Purchases | Contractors can use the form for a single purchase or a multiple purchase exemption, which applies to subsequent purchases for a specific project. |

| Eligibility Criteria | To qualify, the project must be for a qualifying exempt organization, such as a 501(c)(3) or a government agency. |

| Taxable Materials | All tangible personal property purchased by contractors is generally taxable unless it is incorporated into real estate or used on an exempt project. |

| Good Faith Acceptance | Sellers accepting the exemption certificate in good faith are relieved from liability for collecting sales tax on the covered property. |

| Retention Requirement | Sellers must retain exemption certificates for at least three years from the last sale date to document tax exemption claims. |

Different PDF Forms

Vermont 813B - The affidavit helps the court assess financial standings in a relationship.

To ensure a smooth process in creating your corporation, it is essential to complete the necessary paperwork, including the California Articles of Incorporation form, which you can find detailed guidance on. For your convenience, you can download the pdf here to have a clear template to follow, ensuring that your application meets all legal requirements.

Registration Vt - Indicate if the application is a new, transfer, or renewal registration.

Similar forms

The S-3C Vermont form is similar to the IRS Form 4506-T, which is used to request a transcript of tax returns. Both documents serve as formal requests for information related to tax exemptions or filings. While the S-3C is specifically tailored for contractors working on exempt projects in Vermont, Form 4506-T allows individuals or entities to obtain copies of their tax documents from the IRS. Each form requires detailed information about the requester, ensuring that the appropriate parties receive the necessary documentation. Both forms emphasize the importance of accuracy and completeness to avoid delays in processing.

The ADP Pay Stub form serves as a crucial document for both employees and employers, offering a comprehensive breakdown of earnings and deductions for each pay period. Understanding its significance is vital, especially since it aids in accurate financial planning and payroll record-keeping. For additional resources on managing pay stubs effectively, you can visit https://smarttemplates.net.

Another document akin to the S-3C is the IRS Form 8821, which is used to authorize the IRS to disclose tax information to a third party. Similar to the S-3C, this form requires the taxpayer to provide identifying information and details about the specific tax matters involved. Both forms facilitate communication between parties regarding tax matters, but while the S-3C focuses on sales tax exemptions for contractors, Form 8821 allows for broader access to tax information. This ensures that authorized individuals can handle tax-related issues efficiently.

The S-3C form also shares similarities with the Connecticut Sales and Use Tax Exemption Certificate. Like the S-3C, this certificate is designed for use by contractors and exempt organizations. Both documents require the buyer to certify their status as an exempt organization and detail the specific project for which the exemption is being claimed. The purpose of both forms is to streamline the process of obtaining tax exemptions while ensuring compliance with state tax regulations. Each form requires careful completion to validate the exemption status and avoid potential tax liabilities.

Lastly, the Massachusetts Sales Tax Exempt Certificate is another document comparable to the S-3C. This certificate allows qualified organizations to purchase goods and services without paying sales tax. Both forms are utilized by contractors and organizations engaged in specific exempt projects. The Massachusetts certificate, like the S-3C, necessitates that the buyer provide their identification details and the purpose of the exemption. By requiring this information, both forms help maintain transparency and accountability in tax-exempt transactions, ensuring that only eligible purchases are exempt from sales tax.

Key takeaways

The S 3C Vermont form is an important document for contractors engaged in qualified exempt projects. Understanding its proper use can facilitate compliance with state tax regulations.

- Each project requires a separate exemption certificate. This ensures that the exemption is properly documented for tax purposes.

- The completed form must be filed with the seller, not the Vermont Department of Taxes. This distinction is crucial for proper record-keeping.

- Contractors can choose between a single purchase or multiple purchase exemption. A single purchase exemption applies to one specific transaction, while a multiple purchase exemption covers subsequent purchases related to the same project.

- Exempt organizations must be properly identified. This includes federal agencies, state subdivisions, and registered 501(c)(3) organizations.

- It is essential that the tangible personal property purchased is incorporated into real estate or consumed on the job site to qualify for exemption.

- Contractors must pay use tax on materials that are later used in a taxable project. This underscores the importance of accurate project classification.

- Sellers are relieved of tax liability if they accept the exemption certificate in good faith, provided all conditions are met, including the timely presentation of the certificate.

- Improperly executed certificates can lead to tax liability for sellers. Therefore, it is critical to ensure that all information is accurate and complete.

- Exemption certificates must be retained by sellers for at least three years. This retention period supports compliance and provides documentation in case of audits.