Printable S 3M Vermont Template

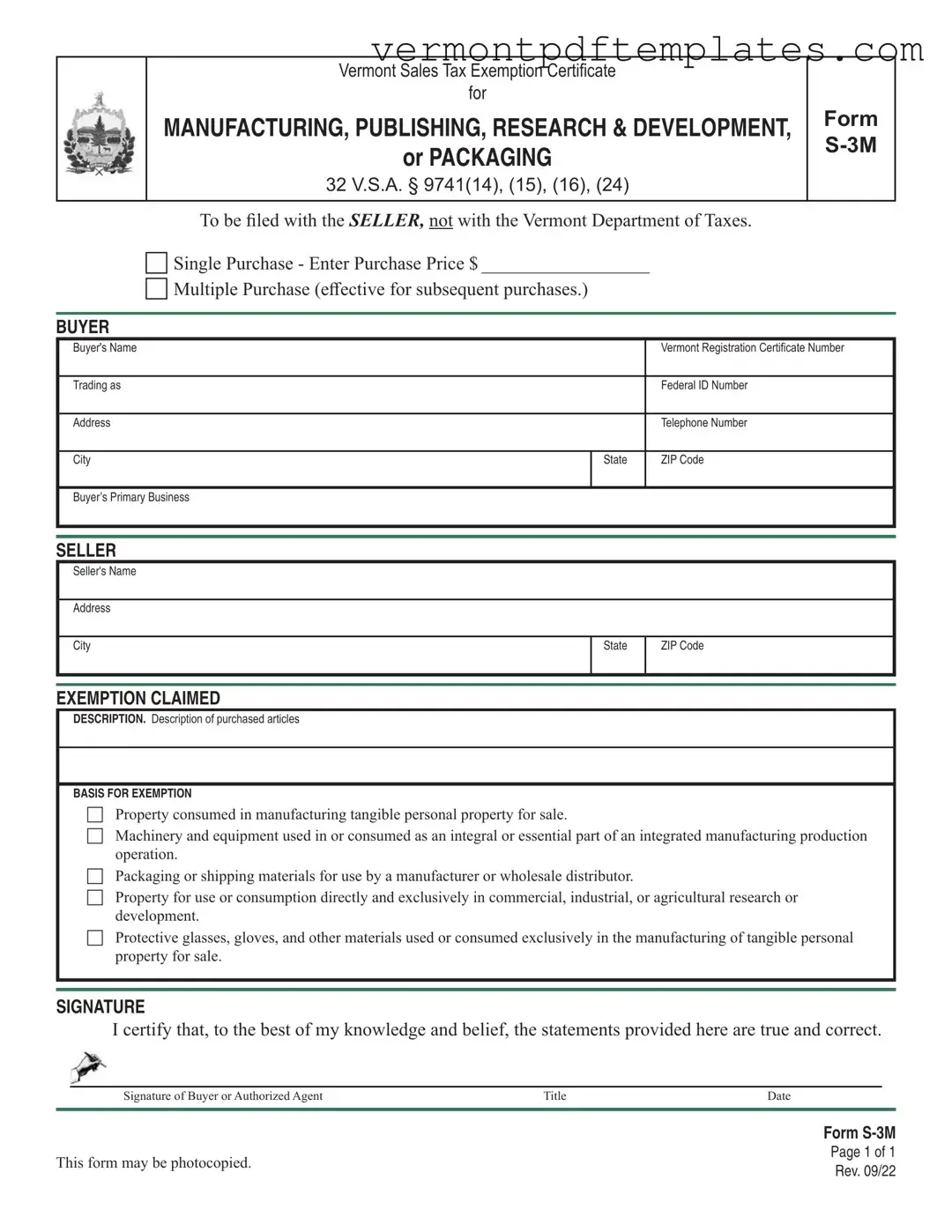

The S 3M Vermont form serves as a vital tool for businesses involved in manufacturing, publishing, research and development, and packaging. This form allows eligible buyers to claim sales tax exemptions on specific purchases related to their operations. It is important to note that the form must be filed with the seller and not with the Vermont Department of Taxes. Buyers can use the S 3M for either a single purchase or multiple purchases, making it versatile for various business needs. Key information required on the form includes the buyer's name, business address, and registration details, along with the seller's information. The exemptions claimed can cover machinery and equipment used directly in the manufacturing process, as well as packaging materials intended for resale. The form also emphasizes the need for accurate and truthful statements, as any discrepancies can affect the validity of the exemption. Sellers are encouraged to accept the form in good faith to avoid tax liabilities, provided all conditions are met. Proper retention of the form is crucial, as sellers must keep it for at least three years from the date of the last sale covered by the certificate. Understanding the S 3M form is essential for businesses seeking to navigate sales tax exemptions effectively.

Misconceptions

Understanding the S 3M Vermont form can be challenging, and there are several common misconceptions that can lead to confusion. Here are seven of those misconceptions explained for clarity.

- Misconception 1: The S 3M form must be filed with the Vermont Department of Taxes.

- Misconception 2: The S 3M form is only for single purchases.

- Misconception 3: All types of businesses qualify for the exemption.

- Misconception 4: The exemption covers all activities related to manufacturing.

- Misconception 5: A seller is always liable for collecting tax if they accept the exemption certificate.

- Misconception 6: There is no need to keep records of exemption certificates.

- Misconception 7: The S 3M form can be used for any type of property.

This is incorrect. The S 3M form is meant to be filed with the seller, not the Vermont Department of Taxes. It is essential for the seller to have this form to validate the exemption.

In reality, the form can be used for both single and multiple purchases. If you select the multiple purchase option, it will apply to subsequent purchases of the same type of property.

This is not true. Only specific businesses, such as manufacturers and wholesalers, are eligible for the exemption. Retailers selling directly to consumers do not qualify.

Not all activities are covered. The exemption only applies to tangible personal property used directly in the manufacturing process. Activities like storage and waste disposal do not qualify.

This is a misunderstanding. If a seller accepts the exemption certificate in good faith, they are relieved of the liability for tax collection on that transaction. However, certain conditions must be met to establish good faith.

This is misleading. Sellers must retain exemption certificates for at least three years from the date of the last sale covered by the certificate. Keeping these records is crucial for compliance.

This is incorrect. The form is specifically for tangible personal property used in manufacturing, publishing, research and development, or packaging. Other types of purchases may require different forms.

By understanding these misconceptions, you can navigate the S 3M Vermont form more effectively and ensure compliance with the relevant regulations.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The S 3M Vermont form serves as a Sales Tax Exemption Certificate for specific sectors including manufacturing, publishing, research and development, and packaging. |

| Governing Law | This form is governed by Vermont Statutes Annotated, Title 32, Section 9741, specifically subsections (14), (15), (16), and (24). |

| Submission Guidelines | The completed form must be filed with the seller, not with the Vermont Department of Taxes. |

| Single vs Multiple Purchases | The form allows for both single purchases and multiple purchases, with the latter being effective for subsequent transactions. |

| Buyer Information | Buyers must provide their name, address, primary business, Vermont Registration Certificate Number, and Federal ID Number on the form. |

| Exemption Claims | Exemptions can be claimed for property consumed in manufacturing tangible personal property and for packaging materials used by manufacturers or wholesalers. |

| Good Faith Acceptance | Sellers who accept the exemption certificate in good faith are relieved from liability for tax collection on transactions covered by the certificate. |

| Retention Requirement | Sellers must retain the exemption certificates for a minimum of three years from the date of the last sale covered by the certificate. |

| Improper Certificate Consequences | Transactions not supported by properly executed exemption certificates will be deemed taxable, placing the burden of proof on the seller. |

Different PDF Forms

Vermont Advance Directive Registry - Express your treatment wishes in part two, including what you want or do not want when facing serious illness.

Vermont 813 - Financial affidavits like the 813A play a crucial role in legal support actions.

In light of the need for accurate record-keeping, the ADP Pay Stub form is highly beneficial, as it provides detailed insights into earnings and deductions, which can be especially crucial when accessing resources like smarttemplates.net for assistance in managing payroll documentation.

Form 8879-te - Taxpayers must indicate the type of account for the refund deposit.

Similar forms

The S-3M Vermont form shares similarities with the IRS Form W-9, which is used to request taxpayer identification information. Both forms are designed to certify specific details about the buyer, such as their name, address, and identification numbers. The W-9 form is often used in business transactions to ensure accurate tax reporting, similar to how the S-3M is utilized to confirm eligibility for sales tax exemption. Each form requires the buyer's signature, affirming that the information provided is accurate and complete, which establishes a level of accountability in both scenarios.

Another document that resembles the S-3M form is the Certificate of Exemption (Form ST-5) used in Massachusetts. This certificate serves a similar purpose by allowing certain businesses to make tax-exempt purchases of tangible personal property. Just like the S-3M, the ST-5 requires the buyer to specify the type of exemption claimed and provides a space for the buyer's information. Both forms aim to streamline the process of tax exemption for qualifying entities, ensuring compliance with state tax regulations.

The S-3M form is also comparable to the New York State ST-120 form, which is a Resale Certificate. This form allows businesses to purchase items without paying sales tax if those items are intended for resale. Similar to the S-3M, the ST-120 requires the buyer to provide their business details and a description of the items being purchased. Both documents serve to facilitate tax-exempt transactions, reducing the financial burden on businesses that operate in specific sectors.

Completing the necessary forms is vital for businesses looking to establish their operations legally and efficiently. One such critical document is the Florida Articles of Incorporation form, which lays the groundwork for a corporation by requiring essential details like the business name and director information. For further guidance on how to complete this form, you can refer to the following resource: https://floridaforms.net/blank-articles-of-incorporation-form.

Additionally, the California Resale Certificate (Form BOE-230) shares characteristics with the S-3M form. This certificate is used by retailers to purchase goods for resale without incurring sales tax. Both forms require the buyer to affirm their status and the intended use of the purchased items, thereby providing a level of assurance to sellers. The California Resale Certificate and the S-3M form play essential roles in their respective states by promoting economic activity while ensuring compliance with tax laws.

Lastly, the Texas Sales and Use Tax Resale Certificate is another document akin to the S-3M. This certificate allows businesses to buy items tax-free if they plan to resell them. Like the S-3M, it necessitates the buyer's details and a declaration of the intended use of the purchased goods. Both forms are critical in helping businesses manage their tax liabilities while ensuring that sales tax is collected appropriately when items are sold to the final consumer.

Key takeaways

Here are some key takeaways about filling out and using the S-3M Vermont form:

- Purpose of the Form: The S-3M form is used to claim a sales tax exemption for certain purchases related to manufacturing, publishing, research and development, or packaging.

- Who to Submit It To: This form should be provided to the seller, not submitted to the Vermont Department of Taxes.

- Types of Exemptions: Exemptions can apply to property consumed in manufacturing, packaging materials, and machinery used directly in the manufacturing process.

- Good Faith Requirement: Sellers must accept the certificate in good faith to avoid tax liability. This means the certificate must be complete, accurate, and received before or at the time of sale.

- Retention of Records: Sellers are required to keep the exemption certificates for at least three years after the last sale covered by the certificate.