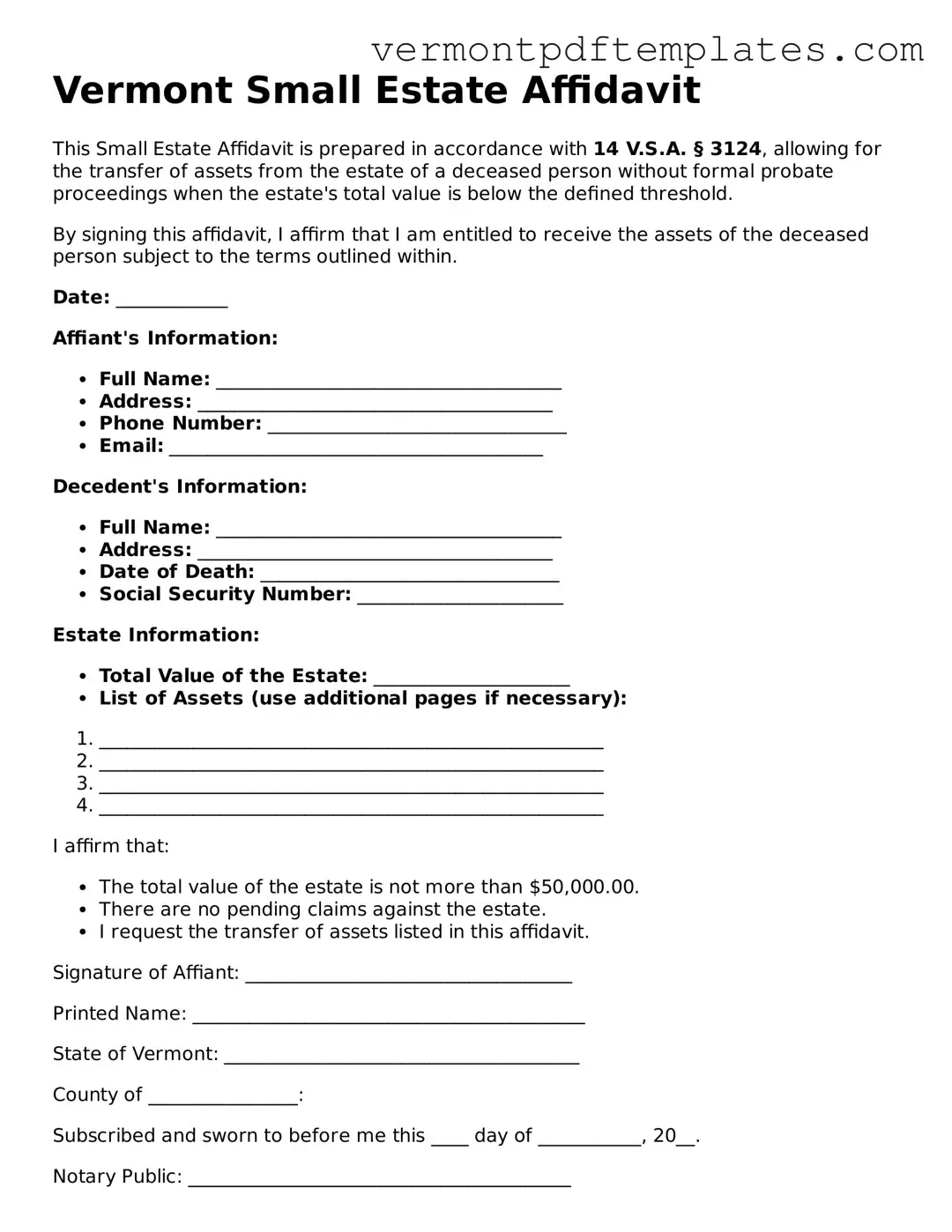

Small Estate Affidavit Template for Vermont State

When a loved one passes away, the process of settling their estate can often feel overwhelming, especially during such an emotional time. For those in Vermont, the Small Estate Affidavit offers a streamlined solution for handling the affairs of a deceased person whose estate falls below a certain value threshold. This legal document simplifies the process, allowing heirs to claim assets without the need for formal probate proceedings. By using the Small Estate Affidavit, individuals can assert their rights to the decedent's property, such as bank accounts, personal belongings, or real estate, provided the total value does not exceed the limit set by state law. This form not only saves time and money but also alleviates some of the burdens associated with estate administration. Understanding how to properly complete and file this affidavit is crucial for those seeking to navigate the complexities of estate settlement in a more efficient manner.

Misconceptions

The Vermont Small Estate Affidavit form is often misunderstood. Below are ten common misconceptions about this form, along with clarifications for each.

- Only wealthy individuals can use the Small Estate Affidavit. Many people believe that only those with significant assets can utilize this form. In reality, it is designed for estates with a total value below a specific threshold, making it accessible to a broader range of individuals.

- The Small Estate Affidavit is the same as a will. Some may think that this affidavit serves the same purpose as a will. However, the affidavit is a tool for settling an estate without going through probate, while a will outlines how a person wishes their assets to be distributed after death.

- All debts must be paid before using the Small Estate Affidavit. It is a common belief that all outstanding debts must be settled prior to using the affidavit. While debts should be addressed, the affidavit allows for certain debts to be paid from the estate's assets after the affidavit is filed.

- The affidavit can be used for any type of asset. Some individuals think that all assets can be transferred using the Small Estate Affidavit. However, certain assets, such as real estate or those held in a trust, may not qualify.

- Filing the affidavit guarantees a quick settlement. Many assume that submitting the Small Estate Affidavit will lead to an immediate resolution. While it can expedite the process compared to probate, the timeline may still vary based on individual circumstances.

- Only heirs can file a Small Estate Affidavit. There is a misconception that only legal heirs have the right to file this affidavit. In fact, any person who has a legitimate claim to the estate can file, provided they meet the necessary requirements.

- The Small Estate Affidavit is only for Vermont residents. Some people believe that this form is exclusive to Vermont residents. While it is specific to Vermont law, individuals with property in Vermont may also use it, regardless of their state of residence.

- Legal assistance is required to complete the affidavit. Many think that hiring an attorney is necessary to fill out the Small Estate Affidavit. However, individuals can complete the form on their own, as long as they understand the instructions and requirements.

- The affidavit can be filed at any time. Some believe that there are no restrictions on when to file the Small Estate Affidavit. In fact, it must be filed within a certain timeframe after the death of the individual whose estate is being settled.

- Using the affidavit means there is no oversight. It is a common misconception that filing the Small Estate Affidavit means there is no oversight of the estate. While it simplifies the process, the affidavit still requires a declaration of the estate's assets and debts, providing a level of accountability.

Form Features

| Fact Name | Description |

|---|---|

| Eligibility | The Vermont Small Estate Affidavit can be used when the total value of the estate does not exceed $25,000, excluding real estate. |

| Governing Law | This form is governed by 14 V.S.A. § 3501 et seq., which outlines the procedures for small estate administration in Vermont. |

| Purpose | The affidavit allows heirs to claim assets without going through formal probate, simplifying the process of estate settlement. |

| Filing Requirements | To use the Small Estate Affidavit, the form must be signed by the heirs and filed with the appropriate financial institutions or asset holders. |

Fill out More Templates for Vermont

Vermont Divorce Laws Property Distribution - A Marital Separation Agreement outlines the terms under which a couple decides to live apart while remaining legally married.

In addition to understanding the importance of the California Last Will and Testament form, individuals may find it beneficial to explore various resources that can assist in the estate planning process. This includes utilizing templates and guidance available through All California Forms, which can offer clarity and support in crafting a comprehensive will that meets legal requirements and reflects the testator's desires.

How to Create a Employee Handbook - This handbook also covers company-sponsored events and activities.

Vermont Residential Lease Agreement - Explains the process for returning the security deposit.

Similar forms

The Vermont Small Estate Affidavit is similar to a Will, as both documents deal with the distribution of a deceased person's assets. A Will outlines how a person's property should be divided after their death, while the Small Estate Affidavit allows heirs to claim assets without going through a lengthy probate process. Both documents serve to ensure that the deceased's wishes are honored, but the Small Estate Affidavit is typically used for smaller estates, making it a quicker and less formal option.

An Affidavit of Heirship is another document that shares similarities with the Vermont Small Estate Affidavit. This affidavit is used to establish the identity of heirs when someone passes away without a Will. Like the Small Estate Affidavit, it helps heirs claim property and assets. However, the Affidavit of Heirship is often used when there is no formal estate plan in place, while the Small Estate Affidavit is specifically for estates that meet certain value thresholds.

In Florida, if you are considering starting a corporation, it is essential to complete the Articles of Incorporation form, which outlines vital information required for registration. This important document can be found at floridaforms.net/blank-articles-of-incorporation-form/, and serves as the foundation for establishing your business entity within the state, detailing aspects such as the corporation's name, address, and directors.

The Executor's Deed is another related document. An Executor's Deed is used to transfer real property from an estate to heirs or beneficiaries. It is often executed after the probate process, whereas the Small Estate Affidavit is a tool for bypassing probate altogether. Both documents serve to transfer ownership, but the timing and process differ significantly.

The Affidavit of Support is similar in that it is a sworn statement used to affirm certain facts. While it is often used in immigration cases to demonstrate financial support, it shares the affidavit format with the Small Estate Affidavit. Both documents require the signer to provide truthful information under penalty of perjury, emphasizing the importance of honesty in legal declarations.

A Transfer on Death Deed (TOD) also resembles the Small Estate Affidavit. A TOD allows individuals to transfer property upon their death without going through probate. Like the Small Estate Affidavit, it simplifies the process of asset transfer. However, the TOD is specific to real estate, while the Small Estate Affidavit can be used for various types of assets.

The Power of Attorney document is another related form. Although it is primarily used to grant someone authority to act on another's behalf while they are alive, it can also impact estate matters. If someone becomes incapacitated and has a Power of Attorney in place, that individual can manage their affairs. The Small Estate Affidavit comes into play after death, but both documents deal with the management of assets and authority.

Lastly, the Petition for Probate shares some similarities. This legal document is filed to initiate the probate process for an estate. While the Small Estate Affidavit is used to avoid probate for smaller estates, the Petition for Probate is necessary for larger estates. Both documents are essential for asset distribution, but they cater to different situations and estate sizes.

Key takeaways

When dealing with the Vermont Small Estate Affidavit form, it’s essential to understand the key aspects of this legal document. Here are ten important takeaways to consider:

- Eligibility Criteria: The Small Estate Affidavit is applicable when the total value of the estate is below a specific threshold, which is set by Vermont law.

- Form Availability: You can obtain the Small Estate Affidavit form from the Vermont Secretary of State's website or your local probate court.

- Required Information: The form requires detailed information about the deceased, including their full name, date of death, and details about their assets.

- Asset Valuation: Accurately valuing the estate’s assets is crucial. This includes real estate, personal property, and any financial accounts.

- Signature Requirement: The affidavit must be signed by the affiant, who is typically an heir or a person entitled to inherit under Vermont law.

- Notarization: It is recommended to have the affidavit notarized to ensure its validity and to avoid potential disputes.

- Filing Process: Once completed, the affidavit may need to be filed with the probate court, depending on the situation and local requirements.

- Notification: Notify all interested parties, such as heirs and beneficiaries, about the filing of the Small Estate Affidavit.

- Limitations: This affidavit cannot be used for estates that include certain types of property, such as those with significant debts or complex assets.

- Legal Assistance: While the form can be completed without an attorney, seeking legal advice can help navigate any complications that may arise.

Understanding these key points can simplify the process of managing a small estate in Vermont and help ensure that all legal requirements are met efficiently.