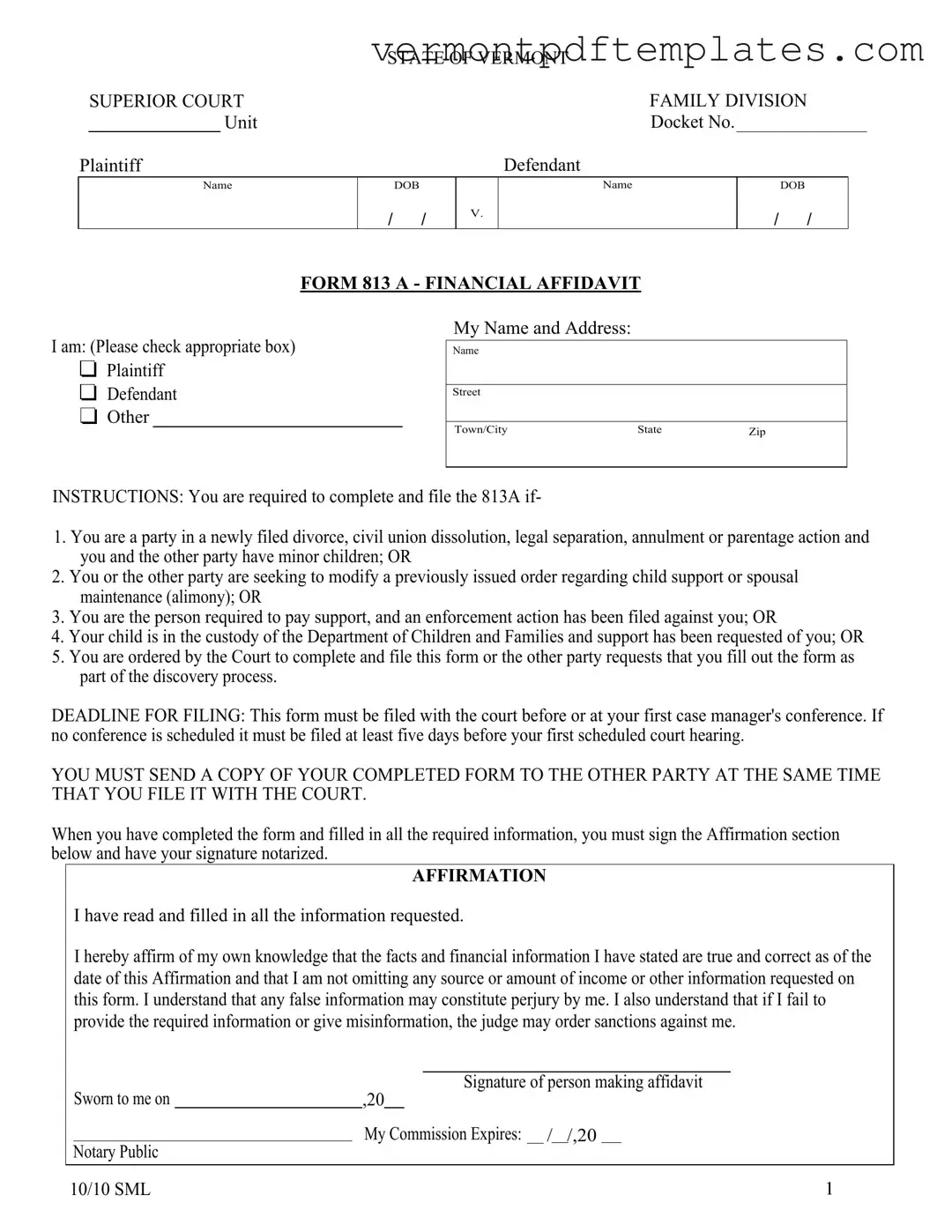

Printable Vermont 813 Template

The Vermont 813 form is a crucial document used in family law proceedings, particularly when minor children are involved. This form serves multiple purposes, including the requirement for parties in divorce, civil union dissolution, legal separation, annulment, or parentage actions to disclose their financial circumstances. It is also necessary when seeking modifications to existing child support or spousal maintenance orders, or if an enforcement action has been initiated against a support payer. Furthermore, the form must be completed if a child is in the custody of the Department of Children and Families and support has been requested, or if the court mandates its completion as part of the discovery process. Timeliness is essential, as the 813 form must be filed before the first case manager's conference or at least five days before a scheduled court hearing. Completing this form accurately is vital; it requires detailed financial disclosures, including income from various sources, public benefits received, and information about minor children and their expenses. The form also includes an affirmation section that emphasizes the importance of truthful reporting, as any inaccuracies could lead to legal consequences.

Misconceptions

Here are some common misconceptions about the Vermont 813 form, along with clarifications to help you understand its purpose and requirements.

- It’s only for divorce cases. The Vermont 813 form is required not only for divorce but also for civil union dissolutions, legal separations, annulments, and parentage actions involving minor children.

- You don’t need to file it if you don’t have minor children. Even if there are no minor children, you may still need to file the form if you or the other party are seeking to modify an existing order regarding child support or spousal maintenance.

- Filing is optional. Filing the 813 form is mandatory in specific situations, such as when a court orders it or when an enforcement action has been initiated against you.

- It can be filed anytime before the hearing. The form must be filed before or at your first case manager's conference or at least five days before your first scheduled court hearing.

- There’s no need to notify the other party. You must send a copy of the completed form to the other party at the same time you file it with the court.

- Only one party needs to complete the form. Both parties involved in the case may be required to file their own 813 forms, depending on the circumstances.

- It’s just a simple form. The 813 form requires detailed financial information, including income, expenses, and debts, which can be complex to compile accurately.

- Notarization isn’t necessary. Your signature on the form must be notarized, affirming that the information provided is true and correct.

- It’s the same as other financial affidavits. While similar, the Vermont 813 form has specific requirements and instructions unique to Vermont’s legal system.

- Filling it out incorrectly has no consequences. Providing false information or omitting details can lead to sanctions by the court, including potential charges of perjury.

Form Information

| Fact Name | Description |

|---|---|

| Form Purpose | The Vermont 813 form is used to disclose financial information in family law cases, including divorce and child support modifications. |

| Filing Requirement | Parties must file the form if they have minor children or if they are involved in specific family law actions, such as divorce or annulment. |

| Filing Deadline | The form must be filed before or at the first case manager's conference or at least five days before the first court hearing. |

| Copy Requirement | A copy of the completed form must be sent to the other party at the same time it is filed with the court. |

| Affirmation Section | Signatures must be notarized to affirm the truthfulness of the information provided on the form. |

| Governing Law | The Vermont 813 form is governed by Vermont Family Law, specifically related to child support and spousal maintenance. |

Different PDF Forms

Vermont Tax Exempt Form - The S-3M is designed specifically to meet the needs of those in industrial and manufacturing sectors.

In addition to the Arizona Bill of Sale form, it is essential to be aware of the various legal documents required for transactions. You can find comprehensive options and resources for all necessary paperwork at All Arizona Forms, ensuring that you are fully prepared for your sale or purchase.

Vermont 813B - Parties must file this form before their first case manager's conference.

Similar forms

The Vermont 813 form shares similarities with the Financial Affidavit used in divorce proceedings in many states. This document requires individuals to disclose their financial status, including income, expenses, and assets. Like the Vermont 813, it aims to provide the court with a clear picture of each party's financial situation, which is crucial for determining issues such as child support and spousal maintenance. Both forms emphasize the importance of accuracy and honesty, as providing false information can lead to serious legal consequences.

Another document akin to the Vermont 813 is the Child Support Guidelines Worksheet. This form is often used to calculate the appropriate amount of child support one parent should pay to the other. Similar to the Vermont 813, it requires detailed financial disclosures, including income and expenses. Both documents serve the purpose of ensuring that child support is fair and based on the actual financial circumstances of each parent, thereby protecting the best interests of the children involved.

The Affidavit of Support is also comparable to the Vermont 813 form. This document is typically used in immigration cases to demonstrate that a sponsor has the financial means to support an immigrant. Just as the Vermont 813 requires a thorough breakdown of income and expenses, the Affidavit of Support requires the sponsor to provide detailed financial information. Both forms underscore the necessity of transparency in financial matters, ensuring that all parties are aware of the financial commitments involved.

Similarly, the Income and Expense Declaration form is utilized in family law cases across various jurisdictions. This document requires parties to list their income, expenses, and any debts they may have. Like the Vermont 813, it serves as a tool for the court to assess the financial capabilities of each party. Both forms highlight the importance of providing complete and accurate information, as this data plays a significant role in decisions related to support and custody.

The Statement of Assets and Liabilities is another document that parallels the Vermont 813 form. It requires individuals to outline their assets, such as property and bank accounts, alongside their liabilities, including loans and debts. Both forms are designed to give the court a comprehensive understanding of an individual's financial situation. By detailing both assets and liabilities, they help ensure that any financial decisions made by the court are well-informed and equitable.

Understanding the various financial declarations, such as the ADP Pay Stub form, is crucial for both employees and employers. For those looking to obtain a detailed record of their earnings and deductions, resources are available online, including fillable forms that can streamline this process, like those found at https://smarttemplates.net/. Having accurate financial documentation not only aids in personal financial management but also ensures compliance and transparency in payroll processes.

Lastly, the Financial Disclosure Statement is similar to the Vermont 813 in that it is often required in divorce and family law proceedings. This document requires parties to disclose their financial information in a structured format, including income, expenses, and debts. Both the Financial Disclosure Statement and the Vermont 813 are critical for transparency in legal proceedings, allowing the court to make informed decisions regarding financial support and division of assets.

Key takeaways

Understand the Purpose: The Vermont 813 form, specifically the Financial Affidavit, is essential for parties involved in divorce, civil union dissolution, legal separation, or parentage actions, particularly when minor children are involved. It is also necessary for those seeking to modify existing support orders or facing enforcement actions.

Filing Deadlines: Timeliness is crucial. This form must be filed with the court before or at your first case manager's conference. If no conference is scheduled, it should be submitted at least five days prior to your first court hearing.

Sharing Information: It is mandatory to send a copy of your completed form to the other party simultaneously when filing it with the court. This ensures transparency and allows both parties to prepare adequately for upcoming proceedings.

Accuracy is Key: When filling out the form, you must provide truthful and complete information. Any omissions or inaccuracies could lead to serious consequences, including potential sanctions from the court or allegations of perjury.