Printable Vermont 813B Template

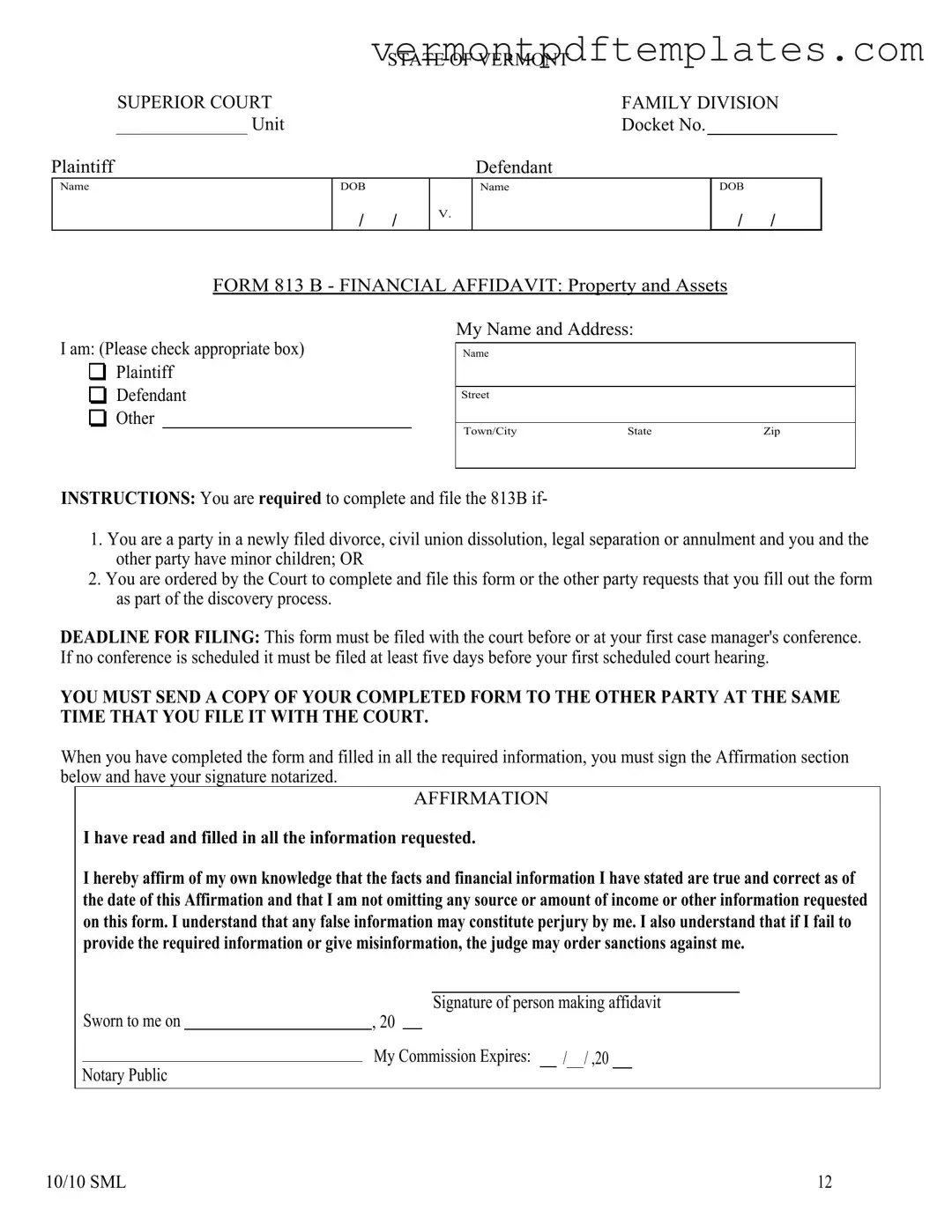

The Vermont 813B form is a crucial document utilized in family law proceedings, specifically in cases involving divorce, civil union dissolution, legal separation, or annulment where minor children are involved. This form requires individuals to disclose detailed financial information, including assets, liabilities, and income sources. Parties must complete the form if they are either a plaintiff or defendant in such cases, or if ordered by the court. The form must be filed with the court prior to the first case manager's conference or at least five days before the first scheduled court hearing. It is essential for individuals to send a copy of the completed form to the other party simultaneously with the filing. The 813B form includes sections for real estate, personal property, vehicles, bank accounts, investments, retirement accounts, life insurance policies, and business interests. Each section prompts the individual to check applicable boxes and provide detailed information about their financial situation. Additionally, an affirmation section requires the individual to attest to the truthfulness of the information provided, highlighting the importance of accuracy to avoid potential legal repercussions. This comprehensive financial affidavit plays a significant role in ensuring transparency and fairness during the legal proceedings.

Misconceptions

Misconceptions about the Vermont 813B form can lead to confusion and mistakes. Here are nine common misunderstandings explained:

- Only the Plaintiff needs to file the form. Both parties in a divorce or separation involving minor children are required to complete and file the Vermont 813B form.

- The form is optional. This form is mandatory if you are involved in a divorce, civil union dissolution, legal separation, or annulment with minor children, or if the court orders it.

- Filing deadlines are flexible. The form must be filed before or at your first case manager's conference, or at least five days before your first scheduled court hearing.

- Not sending a copy to the other party is acceptable. You must send a copy of your completed form to the other party at the same time you file it with the court.

- Providing inaccurate information is harmless. Any false information may be considered perjury. It is crucial to provide accurate and complete information.

- All assets must be listed on the first page. You only need to complete the remaining pages of the form if you answer "Yes" to questions about selling or transferring assets in the last 12 months.

- Notarization is not necessary. Your signature must be notarized to validate the information provided on the form.

- The form is only about financial assets. While it focuses on financial information, it also requires details about real estate, personal property, vehicles, and more.

- It is okay to estimate values loosely. When estimating market values, you should use realistic amounts based on what you could receive if you sold the item today, not the purchase price.

Understanding these points can help ensure compliance and smooth processing of your case.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Vermont 813B form is used to disclose financial information in family court cases involving divorce, legal separation, or annulment when minor children are involved. |

| Governing Law | This form is governed by Vermont Statutes Title 15, which pertains to domestic relations. |

| Filing Requirement | Parties must file the 813B form before their first case manager's conference or at least five days prior to the first scheduled court hearing. |

| Notification | A copy of the completed form must be sent to the other party at the same time it is filed with the court. |

| Affirmation | The individual completing the form must sign an affirmation, declaring that the information provided is true and complete. |

| Consequences of False Information | Providing false information on the form may lead to perjury charges and potential sanctions from the court. |

| Sections Included | The form includes sections for real estate, personal property, vehicles, bank accounts, investments, retirement accounts, life insurance, and business ownership. |

| Deadline for Additional Information | If any assets were sold or transferred in the last 12 months, additional information must be provided on subsequent pages of the form. |

| Notarization | The signature on the form must be notarized to verify the identity of the individual completing it. |

| Financial Disclosure | Accurate financial disclosure is critical, as it affects the court's decisions regarding child support, alimony, and property division. |

Different PDF Forms

Registration Vt - VAST Agents can assist with temporary registrations.

Amendment Real Estate - The date of the purchase and sale contract is essential for validating the addendum.

The accurate bill of sale document template is crucial for anyone looking to formalize a transaction, providing clarity and legal assurance for both parties involved in the sale of an asset.

Vermont Advance Directive Registry - Designate an agent who understands your values and is willing to make tough decisions for you.

Similar forms

The Vermont 813B form, which serves as a financial affidavit in family court cases, shares similarities with the Form 13 Financial Affidavit used in many states. Like the 813B, Form 13 requires individuals to disclose their financial information, including assets, liabilities, and income. Both forms aim to provide the court with a clear picture of each party's financial situation, which is essential for matters such as child support and division of property. The structure of these forms often includes sections for real estate, personal property, and debts, making it easier for the court to assess financial circumstances fairly.

Another document that resembles the Vermont 813B is the Financial Disclosure Form used in divorce proceedings in California. This form, like the 813B, is mandatory for parties involved in divorce and requires detailed information about income, expenses, assets, and debts. Both documents emphasize the importance of transparency, as they require notarization and affirmations of truthfulness. The California form also includes similar sections for real estate and vehicles, ensuring that both parties disclose pertinent financial information to the court.

The Uniform Financial Affidavit, utilized in various jurisdictions, is another document that parallels the Vermont 813B. This affidavit is often required in divorce and custody cases to ensure that both parties provide a comprehensive overview of their financial situations. Much like the 813B, the Uniform Financial Affidavit includes sections for real estate, personal property, and income sources. Its standardized format helps streamline the process for judges and mediators, making it easier to compare financial disclosures from both parties.

In addition, the Affidavit of Financial Status, commonly used in New York, bears similarities to the Vermont 813B. This document is designed to outline a party's financial condition, including income, expenses, and assets. Both forms share the goal of ensuring that the court has a complete understanding of each party's financial landscape. The Affidavit of Financial Status also requires notarization, reinforcing the importance of honesty and accuracy in the information provided.

The Arizona Bill of Sale form is a legal document that records the sale of personal properties, such as vehicles or firearms, in the state of Arizona. It provides concrete evidence of the transfer of ownership, ensuring that all the details regarding the transaction are documented accurately and completely. To securely and efficiently complete your sale or purchase, consider filling out the form by visiting All Arizona Forms.

Lastly, the Statement of Net Worth, often required in family law cases in New Jersey, is comparable to the Vermont 813B. This statement outlines a party's assets, liabilities, income, and expenses in a clear and organized manner. Like the 813B, the Statement of Net Worth is used to assist the court in making informed decisions regarding support and property division. Both documents serve to facilitate transparency and fairness in the legal process, ensuring that all relevant financial information is disclosed to the court.

Key takeaways

Filling out and using the Vermont 813B form is a critical step for individuals involved in family law matters. Here are six key takeaways to ensure you understand the process and its requirements:

- Eligibility Requirements: You must complete the 813B form if you are involved in a divorce, civil union dissolution, legal separation, or annulment and have minor children. Additionally, the court may order you to fill out this form.

- Filing Deadline: It is essential to file the 813B form before or at your first case manager's conference. If no conference is scheduled, it must be submitted at least five days before your first scheduled court hearing.

- Notification Requirement: You are required to send a copy of the completed form to the other party at the same time you file it with the court. This ensures transparency in the process.

- Affirmation of Accuracy: After filling out the form, you must sign an affirmation stating that the information provided is true and complete. Understand that providing false information may lead to serious consequences, including perjury charges.

- Asset Disclosure: The form requires a thorough disclosure of your assets, including real estate, personal property, vehicles, bank accounts, investments, retirement accounts, life insurance, and business ownership. Be prepared to provide detailed information about each category.

- Additional Information: If you have sold or transferred any assets in the last 12 months, or withdrawn funds from an account for purposes other than normal household expenses, you must complete additional sections of the form. If you answered "no" to all questions regarding transfers, you do not need to fill out the remaining pages.