Printable Vermont Bi 472 Template

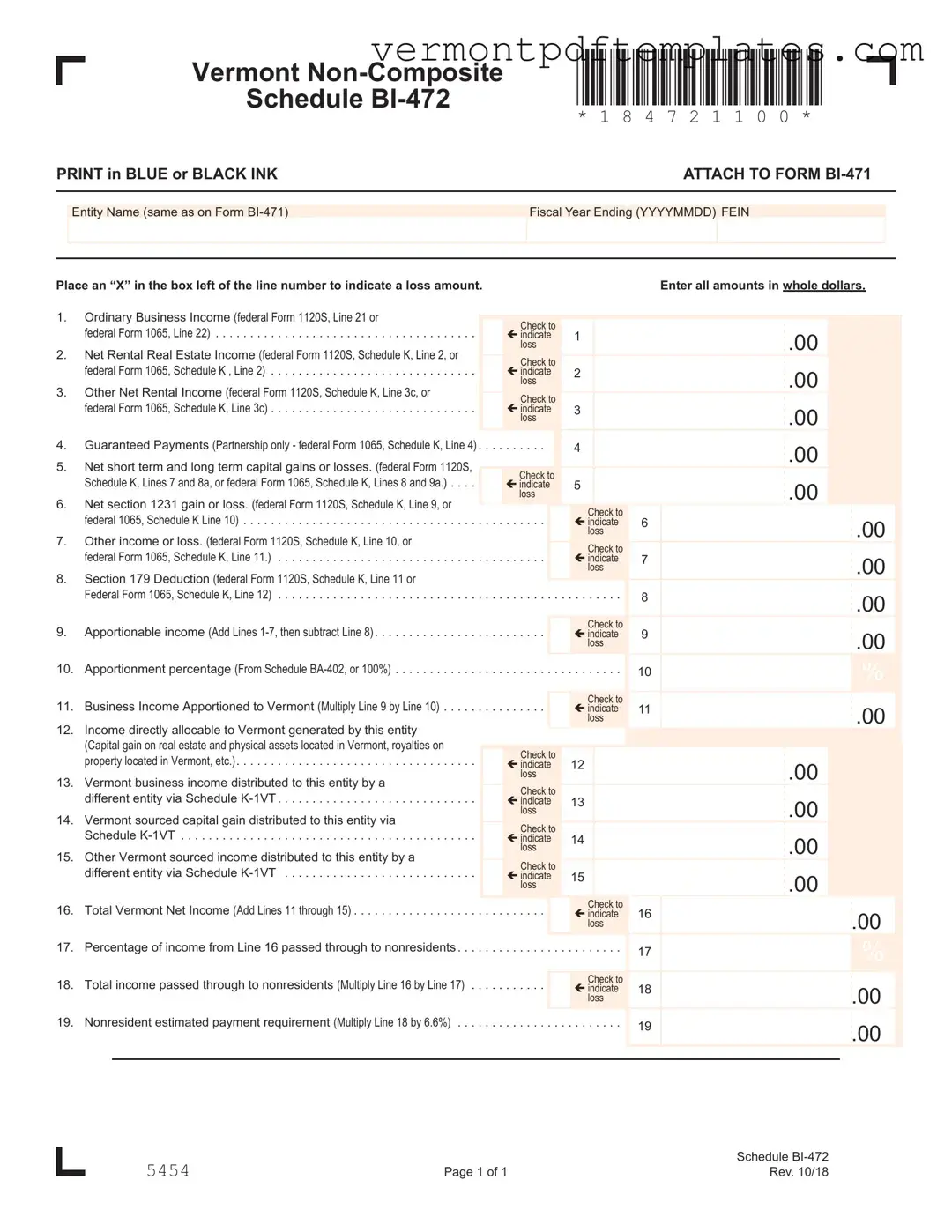

The Vermont BI-472 form is an important document for businesses operating in Vermont. It is used to report various types of income and losses, ensuring that entities comply with state tax regulations. The form requires detailed information, including the entity's name, fiscal year ending date, and Federal Employer Identification Number (FEIN). Specific lines on the form capture ordinary business income, net rental income, guaranteed payments, and capital gains or losses. Businesses must indicate loss amounts by marking an "X" in the appropriate boxes. Additionally, the form calculates apportionable income and the percentage of income allocated to Vermont. Understanding how to accurately fill out this form can help entities determine their Vermont business income and any estimated payment requirements for nonresidents. Overall, the BI-472 form plays a crucial role in the financial reporting process for businesses in the state.

Misconceptions

Understanding the Vermont Bi 472 form is crucial for accurate tax reporting. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: The Vermont Bi 472 form is only for corporations.

- Misconception 2: You can skip sections if there are no amounts to report.

- Misconception 3: The form is only for businesses with profits.

- Misconception 4: The apportionment percentage is always 100%.

This form is not limited to corporations. It is applicable to various entities, including partnerships and S corporations, that need to report their business income in Vermont.

All sections must be completed, even if the amount is zero. Indicating a zero amount helps clarify the entity's financial position and ensures compliance with state requirements.

The Vermont Bi 472 form also accommodates businesses that report losses. Properly indicating losses is essential for accurate tax calculations and potential future benefits.

The apportionment percentage varies based on the business's operations in Vermont. Entities must calculate this percentage based on their specific circumstances, which may result in a figure less than 100%.

Form Information

| Fact Name | Description |

|---|---|

| Form Purpose | The Vermont BI-472 form is used to report business income and losses for entities operating in Vermont, as part of the state tax filing process. |

| Governing Law | This form is governed by Vermont Statutes Title 32, Chapter 151, which outlines the state's income tax regulations. |

| Income Reporting | Entities must report various types of income, including ordinary business income and capital gains, as specified in the instructions of the form. |

| Filing Requirements | The BI-472 form must be attached to Form BI-471 and completed using blue or black ink, ensuring all amounts are entered in whole dollars. |

Different PDF Forms

Vermont Income Tax Forms - Choose your filing status from the list provided.

Vermont 813B - There are specific sections for different types of assets and debts.

The California Articles of Incorporation form is a document that officially marks the creation of a corporation in the state. It establishes the corporation's name, purpose, and structure within legal parameters, making it an essential first step for any business. For comprehensive resources and guidance related to this form, you can visit TopTemplates.info, which offers valuable insights into the incorporation process in California.

Vt Co 411 - This form reflects Vermont's commitment to equitable tax assessment for corporate entities operating within its jurisdiction.

Similar forms

The Vermont BI-472 form is quite similar to the IRS Form 1065, which is used by partnerships to report income, deductions, gains, and losses. Both forms require detailed reporting of various types of income, including ordinary business income and capital gains. Just as the BI-472 allows partnerships to indicate loss amounts, Form 1065 also provides sections for reporting losses alongside income. This parallel structure helps ensure that both state and federal tax obligations are accurately met.

Another document comparable to the Vermont BI-472 is the IRS Form 1120S. This form is specifically for S corporations and is used to report income, deductions, and credits. Like the BI-472, Form 1120S includes sections for reporting ordinary business income, net rental income, and capital gains or losses. Both forms emphasize the importance of accurate reporting and provide a framework for determining taxable income, ensuring compliance with tax laws at both state and federal levels.

The Vermont BI-472 also shares similarities with the Schedule K-1 (Form 1065). This document is used to report each partner's share of income, deductions, and credits from a partnership. The BI-472 references income distributed to the entity via Schedule K-1VT, highlighting how both documents are interconnected in tracking income and ensuring proper tax reporting. Each partner's share of income is crucial for determining their tax responsibilities, just as the BI-472 outlines the entity's overall business income.

The detailed record of an employee's Adp Pay Stub for effective payroll management is vital to both employees and employers, ensuring accuracy in financial reporting and personal finance tracking. This form is instrumental in verifying earnings and deductions for each pay period, underscoring its critical role in the payroll process.

Another related document is the IRS Form 1120, which is used by C corporations to report their income and expenses. While the BI-472 focuses on partnerships and S corporations, both forms require detailed reporting of various income types, including capital gains. They also both emphasize the importance of accuracy in reporting to avoid penalties. This similarity illustrates the consistent need for clear financial reporting across different business structures.

The Vermont BI-472 is also akin to the IRS Schedule E, which is used to report supplemental income and loss. This schedule includes income from rental real estate, royalties, and partnerships, much like the BI-472. Both documents require taxpayers to provide detailed information about their income sources, ensuring that all income is accounted for and taxed appropriately. This alignment helps maintain transparency in reporting income from various streams.

Additionally, the Vermont BI-472 form can be compared to the IRS Form 990, which is filed by tax-exempt organizations to report their income, expenses, and activities. Both forms require detailed financial information and aim to provide a clear picture of an entity's financial situation. While the BI-472 focuses on business income, Form 990 ensures that tax-exempt organizations maintain compliance with tax regulations, underscoring the importance of accurate financial reporting in different contexts.

Similar to the Vermont BI-472, the IRS Form 1040 Schedule C is used by sole proprietors to report income or loss from their business. Both forms require a breakdown of various income sources and allow for the reporting of losses. This similarity highlights the shared need for individuals and businesses to accurately report their financial activities to fulfill their tax obligations.

Lastly, the Vermont BI-472 is comparable to the IRS Form 941, which is used to report payroll taxes. Both forms require detailed information about income, though they focus on different aspects of taxation. While the BI-472 centers on business income, Form 941 deals with employment taxes. However, both documents underscore the importance of accurate reporting and compliance with tax laws, ensuring that all income and tax responsibilities are properly addressed.

Key takeaways

Filling out the Vermont Bi 472 form requires careful attention to detail. Here are key takeaways to consider:

- Entity Name: Ensure the entity name matches exactly as it appears on Form BI-471.

- Fiscal Year: Enter the fiscal year ending date in the format YYYYMMDD.

- FEIN: Provide the Federal Employer Identification Number accurately.

- Loss Indication: Place an "X" in the box next to the line number if reporting a loss.

- Whole Dollars: All amounts should be entered in whole dollars without cents.

- Ordinary Business Income: Report this from federal Form 1120S or Form 1065 as applicable.

- Guaranteed Payments: Only applicable for partnerships; report according to federal Form 1065.

- Apportionable Income: Calculate this by adding Lines 1-7 and then subtracting Line 8.

- Business Income Apportioned to Vermont: Multiply Line 9 by the apportionment percentage from Line 10.

- Total Vermont Net Income: This is the sum of Lines 11 through 15; ensure accuracy in each component.

Completing the form accurately is essential for compliance and to avoid potential penalties. Review all entries before submission to ensure correctness.