Printable Vermont Hs 132 Template

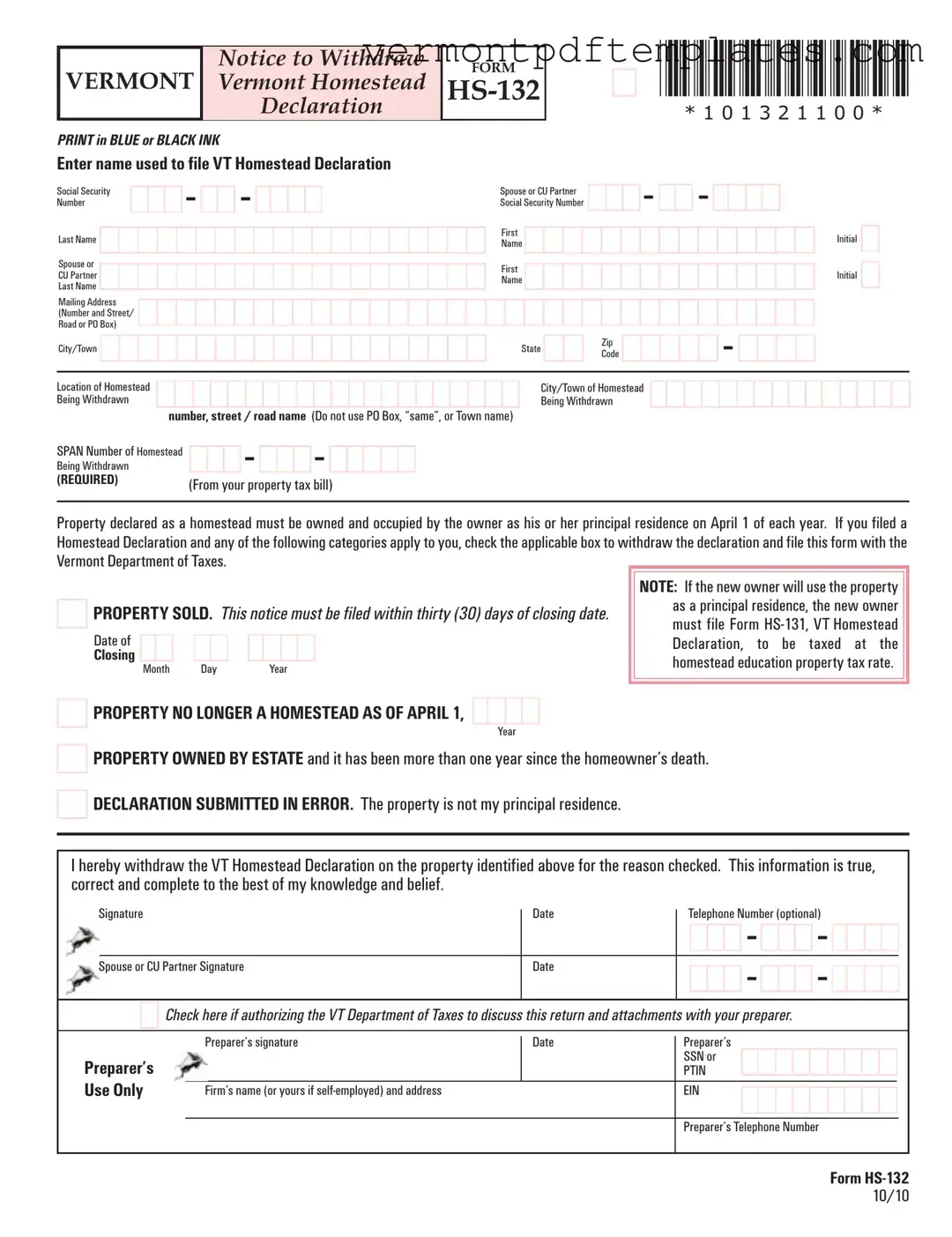

The Vermont HS-132 form serves as a crucial tool for homeowners looking to withdraw their Homestead Declaration. This form is necessary when specific changes occur regarding the property, such as selling it, ceasing to use it as a homestead, or if it is owned by an estate after the homeowner's passing. Homeowners must act within thirty days of a property sale to notify the Vermont Department of Taxes, ensuring that the new owner can file their own Homestead Declaration if they plan to use the property as their principal residence. Additionally, the form allows for withdrawal if the property is no longer occupied as a primary home or if the declaration was mistakenly submitted. Accurate information is vital, including the homeowner's name, Social Security number, and the property's physical address. Homeowners must also provide the School Property Account Number (SPAN) found on their property tax bill. By completing the HS-132 form, homeowners can clarify their tax status and avoid potential complications with the state tax department.

Misconceptions

Understanding the Vermont HS-132 form can be challenging due to various misconceptions. Here are nine common misunderstandings about this form:

- It is only for homeowners who sell their property. While selling a property is one reason to use the HS-132 form, it is also applicable if the property is no longer a homestead or if the declaration was submitted in error.

- All property sales require an HS-132 form. Only properties that were declared as homesteads and are being sold need to use this form. If the property was never declared as a homestead, this form is unnecessary.

- The form must be filed immediately after selling the property. The HS-132 must be filed within thirty days of the closing date, not immediately upon the sale.

- Only the homeowner can withdraw the declaration. If the homeowner is deceased, an authorized representative can file the HS-132 on behalf of the estate.

- The HS-132 is only relevant for tax purposes. While it does have tax implications, the form also serves to officially notify the state about changes in property status.

- Once the HS-132 is filed, the property cannot be classified as a homestead again. The property can be reclassified as a homestead if the new owner files a new Homestead Declaration.

- Filing the HS-132 is optional. If the property meets any of the criteria for withdrawal, filing the HS-132 is required to avoid potential tax issues.

- The SPAN number is not important. The SPAN (School Property Account Number) is a crucial part of the form and must be included for proper identification of the property.

- Signature is only needed from the homeowner. If the declaration is filed on behalf of an estate or another party, the signature of the authorized representative is also required.

Clarifying these misconceptions can help ensure that individuals properly navigate the process of withdrawing their Homestead Declaration in Vermont.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The HS-132 form is used to withdraw a Vermont Homestead Declaration. |

| Governing Law | This form is governed by Vermont Statutes Annotated, Title 32, Sections 5401(7)(D) and 6062(e). |

| Filing Deadline | It must be filed within thirty (30) days of the closing date if the property has been sold. |

| Required Information | Homeowner's name, Social Security Number, and the SPAN number are required on the form. |

| Reasons for Withdrawal | Reasons include property sale, no longer a homestead, owned by an estate, or submitted in error. |

| Principal Residence | The property must be the owner's principal residence as of April 1 of each year. |

| Signature Requirement | The homeowner must sign the form. If signed by another party, preparer's information is needed. |

| Mailing Address | The form requires a mailing address for correspondence regarding the Homestead Declaration. |

| Estate Classification | Estates can maintain homestead classification for one year after the homeowner's death if not rented. |

Different PDF Forms

Registration Vt - Include all previous registration details when transferring ownership.

Vermont Dcf - Documentation must be returned within 15 days if directed.

In addition to defining the distribution of assets, the California Last Will and Testament form also highlights the importance of addressing all relevant legal considerations, ensuring that all wishes are clearly articulated. For those looking to create or modify their legal documents, it's important to have access to streamlined resources, such as All California Forms, which can simplify the process and provide guidance in estate planning.

Vermont 813 - All financial details must be accurately disclosed to avoid any legal repercussions.

Similar forms

The Vermont HS-132 form is similar to the IRS Form 1040, which is the standard individual income tax return form. Both documents require personal information, including names and Social Security numbers, to identify the taxpayer. They serve as official notifications to the respective government agencies regarding the status of an individual's financial or property situation. Just as the HS-132 allows a homeowner to withdraw a homestead declaration, the 1040 allows taxpayers to report changes in income or deductions that may affect their tax obligations.

For those needing to formalize asset transactions, a useful resource is an informative guide on the California bill of sale procedure. This document ensures clarity in the transfer of ownership between parties, highlighting crucial details that protect the rights of both the buyer and seller.

Another comparable document is the IRS Form 8822, which is used to change an address. Like the HS-132, this form is essential for ensuring that the correct information is recorded by the government. Both forms require the submission of personal details and are designed to keep the respective agencies informed about changes in residency or property status. In both cases, accuracy is critical to prevent any future complications or miscommunications with the tax authorities.

The Vermont HS-132 also resembles the IRS Form 4506-T, which is a request for a transcript of tax returns. This form is used to obtain information about previous filings, similar to how the HS-132 communicates the withdrawal of a homestead declaration. Both documents require the taxpayer's identification details and ensure that the correct records are maintained with the appropriate agency. They serve as formal requests to update or clarify a taxpayer's status.

Form HS-132 is similar to the Vermont HS-131, which is the Homestead Declaration form. While HS-132 is used to withdraw a declaration, HS-131 is used to declare a property as a homestead for tax purposes. Both forms share the same purpose of informing the Vermont Department of Taxes about the homeowner's intentions regarding their property. They require similar information, such as names, addresses, and property details, making them closely related in function.

The Vermont Property Transfer Tax Return (Form PT-172) is another document that shares similarities with the HS-132. This form is used when a property is sold, requiring the seller to report the transfer of ownership. Both forms require timely submission, with the HS-132 needing to be filed within 30 days of closing. They both ensure that the state is kept informed about changes in property ownership and usage, which is crucial for tax assessment purposes.

Additionally, the Vermont Declaration of Domicile serves a similar purpose by establishing a person's primary residence. Like the HS-132, this document is essential for tax classification and benefits. Both forms require proof of residence and identification details, ensuring that the state can accurately assess the taxpayer's obligations based on their primary residence. They are both critical in determining eligibility for various tax rates and exemptions.

The IRS Form 8862, which is used to claim the Earned Income Credit after a previous disallowance, has similarities with the HS-132 in that both require the taxpayer to provide information regarding their eligibility for benefits. Each form necessitates the submission of personal information and the reason for the request, ensuring that the appropriate agency can assess the taxpayer's situation accurately. Both forms aim to rectify previous errors or changes in status that affect tax obligations.

The Vermont Land Use Permit Application shares a connection with the HS-132 as both documents relate to property and its use. While the HS-132 is about withdrawing a homestead declaration, the Land Use Permit Application is about obtaining permission to use land for specific purposes. Both forms require detailed information about the property and its ownership, ensuring that the state can make informed decisions regarding property classifications and uses.

Finally, the Vermont Tax Credit Application is akin to the HS-132 in that both are used to report changes in status that can affect tax benefits. The Tax Credit Application requires personal and property information to determine eligibility for various credits, much like the HS-132 communicates changes regarding homestead status. Both forms aim to provide the state with accurate information to ensure fair tax treatment for property owners.

Key takeaways

Here are some key takeaways regarding the Vermont HS-132 form, which is used to withdraw a Homestead Declaration:

- Purpose of the Form: The HS-132 form is specifically designed for homeowners who need to withdraw their Homestead Declaration under certain circumstances.

- Eligibility Criteria: You can use this form if you have sold the property, it is no longer being used as a homestead, the property is owned by an estate after the homeowner's death, or if the declaration was submitted in error.

- Filing Deadline: If you sold the property, you must file the HS-132 within thirty days of the closing date.

- Required Information: Complete the form with your name, Social Security Number, and the address of the property being withdrawn.

- SPAN Number: This unique identification number is essential and can be found on your property tax bill.

- Signature Requirement: The form must be signed by the individual who filed the original Homestead Declaration.

- New Owner's Responsibility: If the new owner will use the property as their principal residence, they must file Form HS-131 to be taxed at the homestead education property tax rate.

- Notification of Changes: If the property is no longer used as a homestead, you must withdraw the declaration to avoid potential tax issues.

- Contact Information: Optionally, you can provide a telephone number for further communication regarding the form.