Printable Vermont In 111 Template

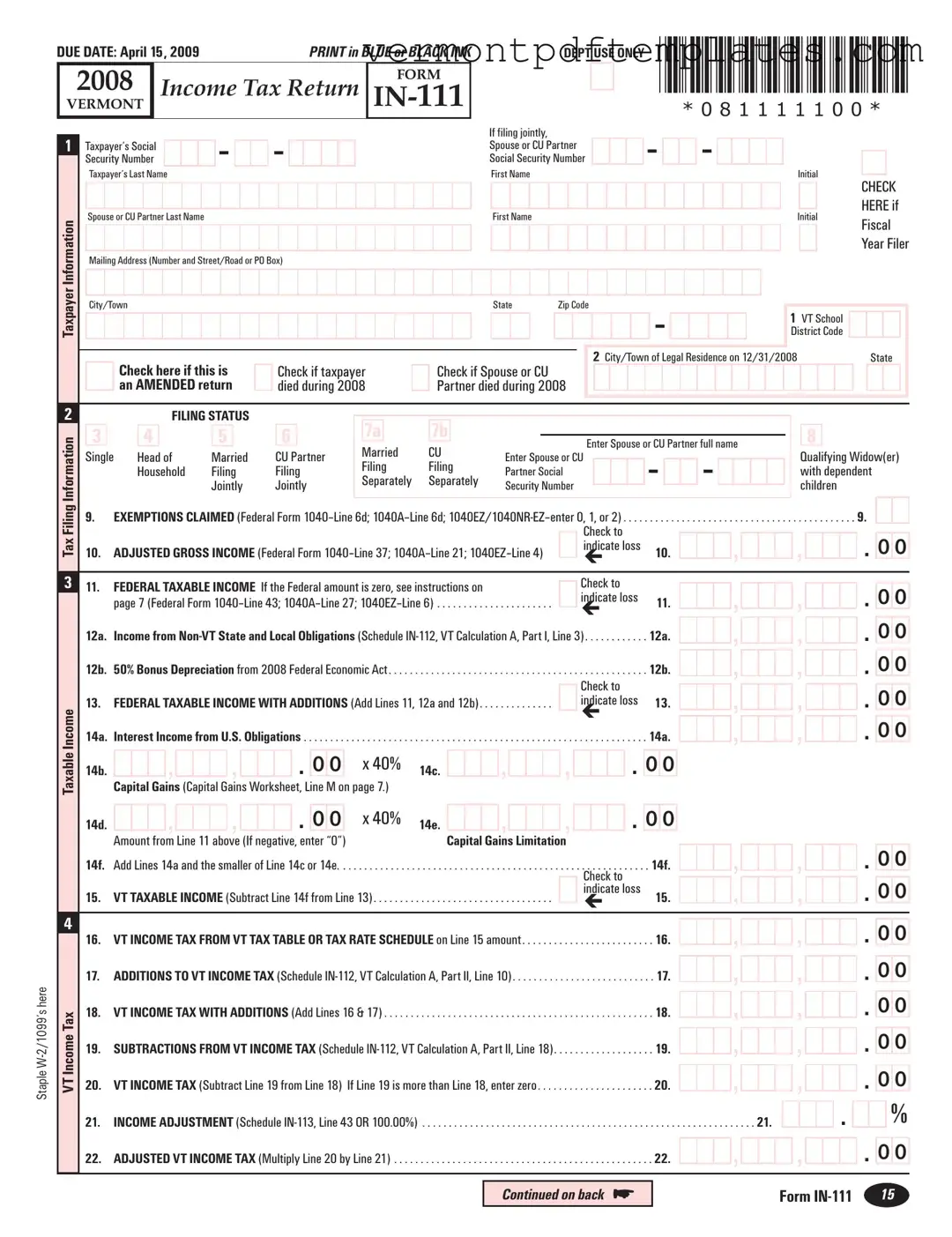

The Vermont IN-111 form is a crucial document for residents preparing their state income tax returns. This form is designed for individuals and couples filing their taxes in Vermont and serves as the primary means of reporting income, deductions, and tax liabilities. Key sections of the IN-111 include personal information such as Social Security numbers and filing status, which can impact tax rates and exemptions. Taxpayers must also report their adjusted gross income, federal taxable income, and any applicable credits or deductions. Additionally, the form allows for various calculations related to Vermont tax rates, ensuring that taxpayers accurately determine their tax obligations. The deadline for submission is typically April 15, making timely completion essential to avoid penalties. Understanding the components of the IN-111 is vital for anyone looking to fulfill their tax responsibilities in Vermont effectively.

Misconceptions

- Misconception 1: The Vermont IN-111 form is only for residents.

- Misconception 2: Filing the Vermont IN-111 is optional if you owe no taxes.

- Misconception 3: You can file the IN-111 form at any time during the year.

- Misconception 4: You do not need to attach W-2s or 1099s if you file electronically.

- Misconception 5: The IN-111 form is the same as the federal tax return.

This is not true. While the form is primarily used by Vermont residents, non-residents who earn income in Vermont are also required to file this form. It is essential for anyone with Vermont-sourced income to ensure compliance with state tax regulations.

Many people believe that if they owe no taxes, they do not need to file the form. However, even if no tax is due, filing is often mandatory to report income and maintain compliance. Failing to file can lead to complications down the line.

There is a specific deadline for filing the Vermont IN-111 form, typically April 15 of the year following the tax year. Missing this deadline can result in penalties and interest on any amounts owed.

This is incorrect. Regardless of how you file, you must attach any required documentation, such as W-2s or 1099s, to support your income claims. This documentation is crucial for verifying your income and deductions.

While there are similarities, the Vermont IN-111 form is distinct from federal tax returns. It includes specific state-related income adjustments and credits that do not appear on federal forms. Understanding these differences is vital for accurate filing.

Form Information

| Fact Name | Details |

|---|---|

| Form Title | Vermont Income Tax Return IN-111 |

| Filing Deadline | April 15, 2009 |

| Governing Law | Vermont Statutes Title 32, Chapter 151 |

| Taxpayer Identification | Taxpayer's Social Security Number is required. |

| Filing Status Options | Options include Married Filing Jointly, Single, Head of Household, and Qualifying Widow(er). |

| Exemptions Claimed | Up to two exemptions can be claimed, based on Federal Form 1040. |

| Adjusted Gross Income | Calculated as per Federal Form 1040, Line 37. |

| VT Tax Calculation | VT taxable income is derived from federal taxable income with certain adjustments. |

| Tax Credits | Various credits available, including Earned Income Tax Credit and Renter Rebate. |

Different PDF Forms

Vt Co 411 - Tax credits available to corporations can reduce the total tax liability reported on the Vt Co 411.

To properly establish your business in Florida, it is crucial to understand the requirements surrounding Articles of Incorporation, which serve as a fundamental step in your company’s formation process. For further insights, you may refer to the Florida Articles of Incorporation guidelines.

Amendment Real Estate - This addendum applies specifically to real estate transactions in Vermont.

Similar forms

The Vermont IN-111 form is similar to the Federal Form 1040, which serves as the standard individual income tax return for U.S. taxpayers. Both forms require personal information such as the taxpayer's name, Social Security number, and filing status. Additionally, they both calculate taxable income and tax liability based on income earned during the tax year. Both forms also allow for various deductions and credits, ensuring taxpayers can accurately report their financial situation to the respective tax authorities.

Another comparable document is the Federal Form 1040A. This form is a simplified version of the 1040, designed for taxpayers with straightforward financial situations. Like the IN-111, it allows for the reporting of wages, interest, and certain deductions. The 1040A also offers a streamlined approach for taxpayers who do not itemize deductions, making it easier for individuals to complete their tax returns while still ensuring compliance with federal tax laws.

Understanding various tax forms is essential for effective financial management, and resources like the https://smarttemplates.net/fillable-adp-pay-stub can provide necessary templates for accurately documenting earnings and deductions, thereby streamlining the filing process for both individuals and businesses.

The Federal Form 1040EZ is another document that shares similarities with the Vermont IN-111 form. This form is the simplest of the federal income tax returns and is specifically designed for single or married filing jointly taxpayers with no dependents. Both forms require basic income reporting and do not allow for many of the more complex deductions and credits, making them accessible for those with uncomplicated financial situations.

The Vermont IN-112 form is also closely related, as it is used in conjunction with the IN-111 to provide additional calculations for Vermont income tax. The IN-112 focuses on specific adjustments to income and tax credits that may apply to Vermont residents. This form is essential for ensuring that all potential deductions and credits are accounted for in the overall tax calculation, similar to how the IN-111 summarizes the taxpayer's financial situation.

The IRS Schedule A is another document that bears resemblance to the Vermont IN-111 form. Schedule A is used for itemizing deductions on the federal tax return. While the IN-111 primarily focuses on Vermont state taxes, both documents allow taxpayers to detail their deductions and provide a clearer picture of their taxable income. This comparison highlights the importance of accurately reporting financial details to maximize tax benefits.

Lastly, the IRS Form 8862, used for claiming the Earned Income Credit after disallowance, shares a functional similarity with the Vermont IN-111. Both forms require specific information related to income and eligibility for tax credits. The IN-111 allows for various credits, including those similar to the Earned Income Credit, emphasizing the importance of ensuring that all eligible credits are claimed to reduce tax liability.

Key takeaways

When filling out the Vermont IN-111 form, use blue or black ink to ensure clarity and legibility.

Attach all necessary documents, such as W-2 and 1099 forms, to the front of the IN-111 form. This will help streamline the processing of your return.

Be mindful of your filing status, as it affects your tax calculation. Choose the correct option, whether single, married, or head of household.

Check the box for any applicable exemptions claimed. This can reduce your taxable income and potentially lower your tax bill.

Calculate your VT taxable income carefully. Subtract any allowable deductions from your total income to determine what is subject to tax.

Finally, ensure that both taxpayers sign the form if filing jointly. This is a crucial step to validate your return.