Printable Vermont In 152 Template

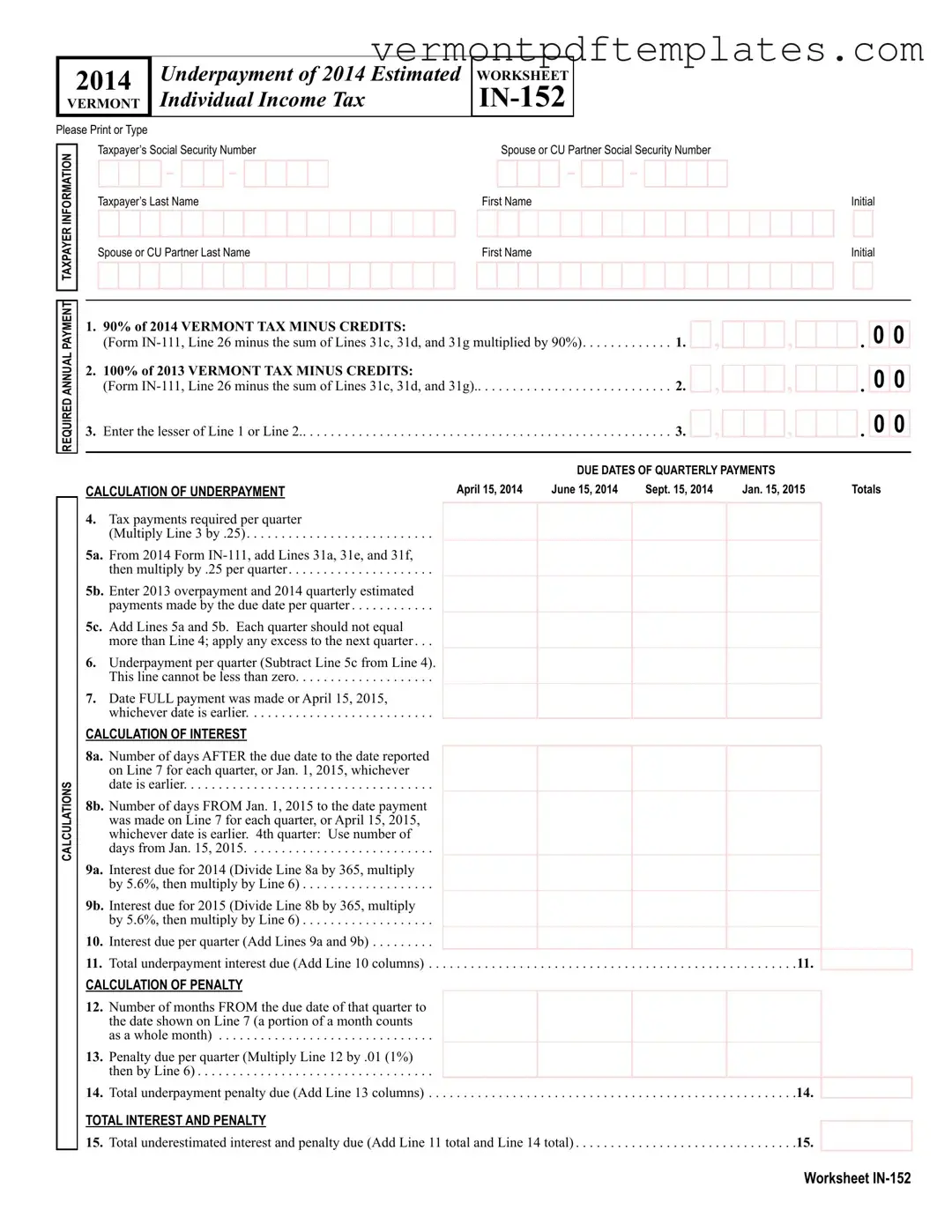

The Vermont IN-152 form is an essential tool for taxpayers who may have underpaid their estimated income tax for the year 2014. This form helps individuals calculate their underpayment of estimated taxes, allowing them to determine the amount owed to the state of Vermont. Key components of the IN-152 include the taxpayer's and spouse's or civil union partner's personal information, such as Social Security numbers and names. The form requires calculations based on two primary figures: 90% of the 2014 Vermont tax liability minus applicable credits and 100% of the 2013 Vermont tax liability minus credits. Taxpayers must enter the lesser of these two amounts to establish their required annual payment. Additionally, the form outlines the due dates for quarterly payments and provides a method for calculating underpayment for each quarter. Taxpayers must also account for any interest and penalties associated with late payments. By meticulously following the instructions on the IN-152, individuals can ensure compliance with Vermont tax regulations while avoiding potential financial repercussions.

Misconceptions

Understanding the Vermont IN-152 form can be challenging due to common misconceptions. Here are seven prevalent misunderstandings, along with clarifications for each.

- Misconception 1: The IN-152 form is only for high-income earners.

- Misconception 2: You only need to file the IN-152 if you receive a notice from the state.

- Misconception 3: The form is only relevant for the current tax year.

- Misconception 4: You can ignore penalties if you pay the tax owed later.

- Misconception 5: The IN-152 form is too complicated for the average taxpayer.

- Misconception 6: You cannot contest an underpayment calculation.

- Misconception 7: The IN-152 form is only for individuals.

This form applies to anyone who has underpaid their estimated Vermont income tax, regardless of income level. It is essential for all taxpayers who meet the criteria.

Taxpayers should proactively file the IN-152 if they believe they have underpaid their estimated taxes, even without a notice. Waiting for a notice may result in penalties or interest.

The IN-152 form can also apply to previous tax years if a taxpayer discovers they have underpaid in those years. It is important to review past filings.

Paying the owed tax does not eliminate penalties or interest accrued from the underpayment. These additional charges will still apply unless addressed through the IN-152 form.

While the form may seem complex, it is designed to be user-friendly. Many resources are available to help taxpayers understand and complete the form correctly.

Taxpayers have the right to contest any calculations they believe are incorrect. Supporting documentation can be submitted along with the IN-152 to clarify discrepancies.

The form is applicable to both individuals and couples filing jointly. Partners in civil unions also need to be aware of their obligations regarding this form.

Addressing these misconceptions can help taxpayers navigate the Vermont IN-152 form more effectively and ensure compliance with state tax laws.

Form Information

| Fact Name | Description |

|---|---|

| Form Title | Vermont IN-152 is the form used for the 2014 Underpayment of 2014 Estimated Vermont Individual Income Tax. |

| Governing Law | This form is governed by Vermont tax laws, specifically the Vermont Statutes Annotated Title 32. |

| Taxpayer Information | Taxpayers must provide their Social Security Number, last name, and first name on the form. |

| Spouse Information | If applicable, taxpayers must also include their spouse or civil union partner's information, including their Social Security Number. |

| Annual Payment Calculations | The form requires calculations based on 90% of the 2014 Vermont tax minus credits and 100% of the 2013 Vermont tax minus credits. |

| Quarterly Payment Due Dates | Quarterly payments are due on April 15, June 15, September 15, and January 15 of the following year. |

| Interest Calculation | Interest is calculated based on the number of days after the due date and is subject to a rate of 5.6%. |

| Penalty Calculation | A penalty is assessed based on the number of months from the due date to the payment date, calculated at 1% per month. |

| Total Due | The total amount due includes underestimated interest and penalties, which are summed at the end of the form. |

Different PDF Forms

Vermont Pt 172 S - The form outlines requirements for properties enrolled in the Current Use Value Program.

Vt Sales Tax - Turnkey projects generally do not qualify for sales tax exemption using the S-3C.

In light of the significance of the ADP Pay Stub form for both employers and employees, accessing templates for this document can greatly assist in ensuring accuracy and compliance. For those seeking to obtain a fillable version, consider visiting https://smarttemplates.net/fillable-adp-pay-stub to facilitate your payroll documentation needs.

Form 8879-te - Timely completion of this form helps ensure a smooth filing process.

Similar forms

The Vermont IN-152 form is similar to the IRS Form 2210, which is used to calculate underpayment penalties for federal income tax. Both forms help taxpayers determine if they owe additional penalties due to underpayment of estimated taxes. The IRS Form 2210 requires taxpayers to provide details about their estimated tax payments and the actual amounts owed, similar to how the Vermont IN-152 calculates underpayment based on previous years’ tax liabilities. This comparison highlights a shared purpose: ensuring taxpayers meet their obligations and avoid penalties for underpayment.

The California Articles of Incorporation form is a document that officially marks the creation of a corporation in the state. It establishes the corporation's name, purpose, and structure within legal parameters. This form is a critical first step for any business looking to establish itself as a corporation in California, much like how resources such as toptemplates.info/ can provide essential guidance in the process.

Another document that bears similarity to the Vermont IN-152 is the IRS Form 1040-ES. This form is used for estimating and paying quarterly taxes. Like the IN-152, it requires taxpayers to project their income for the year and calculate estimated tax payments based on that projection. Both forms emphasize the importance of timely payments throughout the year, helping individuals manage their tax responsibilities effectively. They serve as tools for taxpayers to avoid surprises when filing their annual returns.

The State of New York's IT-2105 form also parallels the Vermont IN-152. This form is used for making estimated income tax payments for New York State. Both documents require taxpayers to calculate their estimated tax liability based on prior year figures and expected income for the current year. Each form also includes similar due dates for quarterly payments, reinforcing the concept of regular tax contributions throughout the year. This consistency across states helps taxpayers understand their obligations regardless of where they reside.

Additionally, the California Form 540-ES shares features with the Vermont IN-152. Like the IN-152, this form is intended for making estimated tax payments to the state. Taxpayers must calculate their expected tax liability and determine quarterly payment amounts. Both forms also allow taxpayers to account for previous overpayments and credits, ensuring that individuals can accurately manage their tax situations. This similarity underscores the common goal of state tax systems: to facilitate compliance and minimize penalties.

Lastly, the Massachusetts Form 1-ES is another document akin to the Vermont IN-152. It serves a similar purpose by allowing taxpayers to make estimated income tax payments based on their expected annual tax liability. Both forms require calculations that take into account previous years’ taxes and current income projections. The emphasis on making quarterly payments is a shared characteristic, reinforcing the importance of proactive tax planning and compliance. This consistency helps taxpayers navigate their obligations across different states.

Key takeaways

- Understand the Purpose: The Vermont IN-152 form is used to calculate underpayment of estimated individual income tax for the tax year 2014. It helps taxpayers determine if they owe any additional tax and associated penalties.

- Gather Required Information: Before filling out the form, collect necessary documents such as your Social Security number, your spouse or civil union partner's information, and details from your 2014 Vermont tax return.

- Calculate Annual Payment: You need to determine your required annual payment by comparing 90% of your 2014 Vermont tax minus credits with 100% of your 2013 Vermont tax minus credits. Enter the lesser amount on the form.

- Quarterly Payment Breakdown: The form requires you to calculate your tax payments due for each quarter. This is done by multiplying your annual payment by 25% for each quarter.

- Account for Overpayments: If you had an overpayment in 2013 or made estimated payments in 2014, be sure to include these amounts in your calculations. This can help reduce the amount of underpayment you owe.

- Interest and Penalties: Be aware that if you underpay your estimated taxes, you may incur interest and penalties. The form includes sections to calculate these amounts, which are based on the number of days late and the total underpayment.