Printable Vermont Pt 172 S Template

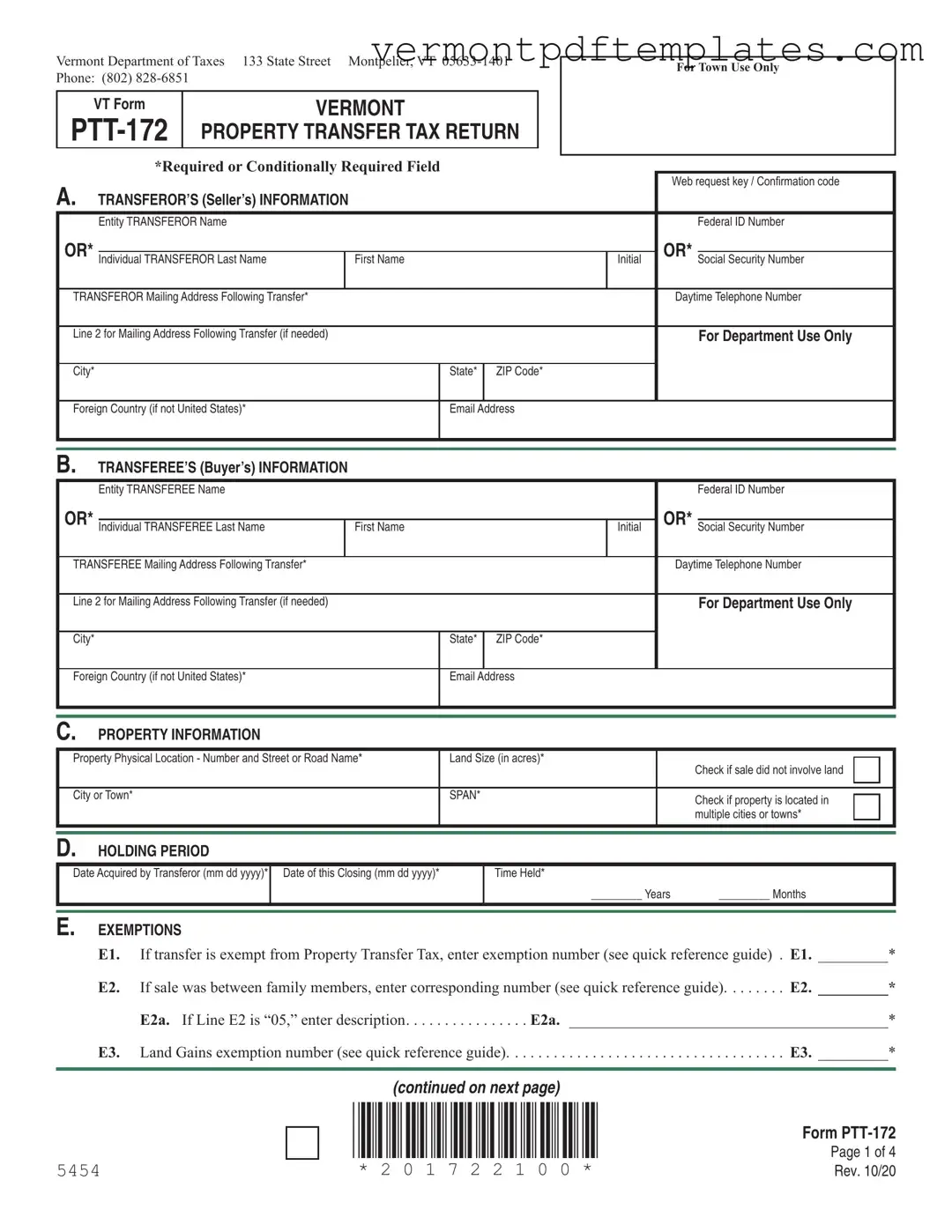

The Vermont Property Transfer Tax Return, known as Form PTT-172, is an essential document for anyone involved in real estate transactions within the state. This form serves multiple purposes, primarily to report the transfer of property and calculate any applicable taxes. It requires detailed information from both the seller (transferor) and buyer (transferee), including names, addresses, and identification numbers. The form also collects specific data about the property itself, such as its physical location and size, which is crucial for tax assessment. Additionally, it includes sections to claim exemptions from the property transfer tax, should they apply. For example, transfers between family members may qualify for special considerations. The form must be completed accurately and submitted within a specific timeframe to ensure compliance with state regulations. Understanding the nuances of this form can help facilitate a smoother transaction and avoid potential penalties. Overall, the Vermont PTT-172 is a vital tool for managing property transfers, ensuring all parties are informed and obligations are met.

Misconceptions

Understanding the Vermont Pt 172 S form is crucial for anyone involved in property transfers in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It's only for residential properties. The form is used for all types of property transfers, including commercial and agricultural properties.

- Only the seller needs to fill it out. Both the transferor (seller) and transferee (buyer) must provide information on the form.

- It's optional if you're not transferring land. Even if the sale does not involve land, the form is still required for property transfers.

- All fields are mandatory. Some fields are only conditionally required, depending on the specifics of the transaction.

- You can submit it anytime after the closing. The form must be submitted within 60 days of the closing date to comply with Vermont law.

- Exemptions are easy to claim without documentation. If claiming an exemption, you must provide the appropriate exemption number and documentation as specified in the quick reference guide.

- Only the transferor's information is important. Accurate information from both parties is essential for the form to be processed correctly.

- It’s not necessary to check if the property is subject to local regulations. Buyers and sellers have a responsibility to investigate any local zoning, building, or environmental regulations that may apply.

- Once submitted, you can't make changes. If you discover an error after submission, you may need to file an amended return to correct it.

Being aware of these misconceptions can help ensure a smoother property transfer process in Vermont. Always consult the instructions that accompany the form for the most accurate guidance.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The Vermont PTT-172 form is used to report property transfers and calculate the associated property transfer tax. |

| Governing Law | The form is governed by Vermont Statutes Annotated, Title 32, Chapter 9601, which outlines property transfer tax regulations. |

| Required Information | Key information includes details about the transferor, transferee, property location, and any applicable exemptions. |

| Submission Deadline | The completed form must be submitted to the Vermont Department of Taxes within 30 days of the property transfer closing date. |

Different PDF Forms

Vermont Resale Certificate - This exemption certificate streamlines the process for eligible organizations to make tax-exempt purchases.

For those looking to navigate through vehicle transactions, understanding the specific requirements of the Arizona bill of sale form is crucial. This document not only validates the sale but also ensures that all involved parties have a clear record of the transaction. To access a resource that provides detailed information about the process, explore our comprehensive guide on the Arizona bill of sale.

Vt Co 411 - Corporations with liabilities over $500 are advised to review estimated payment requirements on the accompanying forms.

Similar forms

The Vermont Property Transfer Tax Return (Form PTT-172) shares similarities with the IRS Form 1099-S, which is used for reporting proceeds from real estate transactions. Both forms require detailed information about the transferor and transferee, including names, addresses, and taxpayer identification numbers. While the PTT-172 focuses on property transfer tax obligations specific to Vermont, the 1099-S is a federal requirement that ensures the IRS is informed about capital gains from real estate sales. Both forms ultimately serve to document the financial aspects of property transfers and facilitate tax compliance.

Another document that resembles the Vermont PTT-172 is the Real Estate Purchase Agreement. This agreement outlines the terms of a property sale, including the identities of the buyer and seller, the property description, and the agreed-upon price. Like the PTT-172, it requires accurate details about the parties involved and the property itself. While the purchase agreement is primarily a contract governing the sale, the PTT-172 is a tax form that must be filed with the state to report the transaction and calculate any applicable taxes.

As various states maintain specific documentation for property transactions, those interested in ensuring they meet all regulatory requirements may benefit from resources like smarttemplates.net, where templates can simplify the process of completing essential forms effectively.

The Quitclaim Deed also has similarities with the Vermont PTT-172. This legal document transfers ownership of real property from one party to another without any warranties. Both documents include essential information about the transferor and transferee. The Quitclaim Deed serves to formally record the change in ownership, while the PTT-172 is used to report the tax implications of that transfer. Together, they ensure that ownership changes are legally recognized and tax obligations are met.

Form 1040, Schedule A (Itemized Deductions) is another document that shares a connection with the Vermont PTT-172. While Schedule A is focused on individual tax deductions, it can include deductions related to property taxes. Homeowners may use information from the PTT-172 to determine the amount of property tax they can deduct on their federal tax return. Both forms require accurate financial reporting, although they serve different purposes within the tax filing process.

The Declaration of Value is another document similar to the Vermont PTT-172. This form is often required during real estate transactions to declare the value of the property being transferred. Both documents require detailed information about the property and the parties involved. The Declaration of Value is typically used to assess transfer taxes, while the PTT-172 serves to report those taxes to the state. Both are essential for ensuring compliance with tax regulations during real estate transactions.

Lastly, the Local Property Tax Exemption Application can be compared to the Vermont PTT-172. This application is used to request exemptions from local property taxes based on specific criteria. Similar to the PTT-172, it requires detailed information about the property and the owner. Both documents play a role in determining tax liabilities and ensuring that property owners are aware of their rights and responsibilities regarding tax exemptions. Together, they contribute to the overall understanding of property tax obligations and potential relief options available to homeowners.

Key takeaways

Ensure all required fields are completed accurately. Missing information can delay processing and may lead to complications.

Familiarize yourself with the exemption numbers and quick reference guides provided. This knowledge can help you identify if your transfer qualifies for any exemptions, which may save you money.

Be aware of the tax calculation process. Understanding how to compute taxes owed based on the property's value is crucial. This includes knowing the special rates and general rates applicable to your situation.

Remember to submit the form to the Vermont Department of Taxes within 30 days of the closing date. Timely submission is essential to avoid penalties and ensure compliance.