Printable Vermont S 3 Template

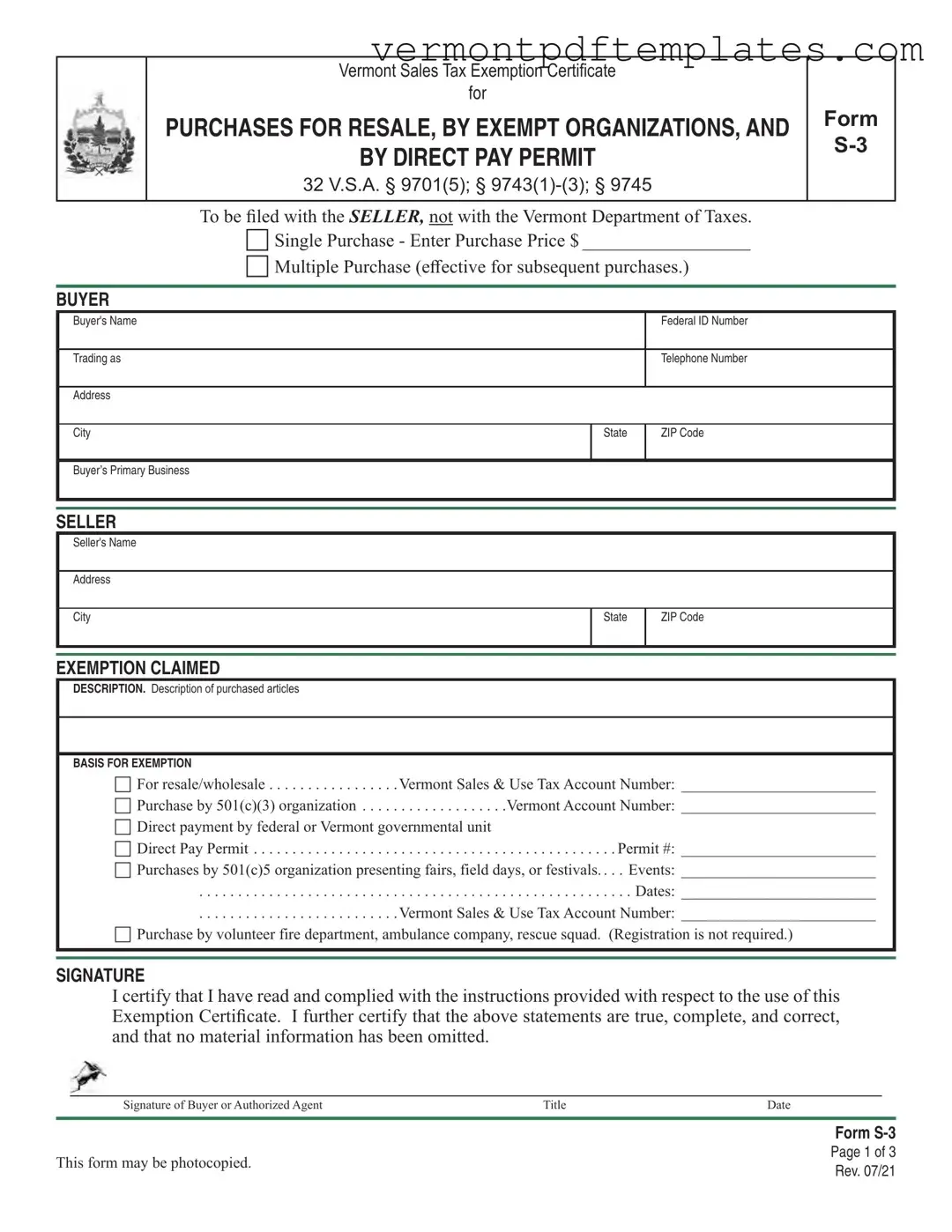

The Vermont S-3 form serves as a vital tool for buyers seeking sales tax exemptions on certain purchases. Designed primarily for tangible personal property intended for resale, this form also extends to specific organizations, including those classified as 501(c)(3) by the IRS, as well as governmental units and volunteer emergency services. Buyers must fill out the form accurately, providing essential information such as their Federal ID number, business name, and the nature of the purchased items. The form requires the buyer to select either a single purchase or a multiple purchase exemption, with the latter being effective for subsequent transactions. It is important to note that this exemption does not apply to contractors, who must pay sales tax on materials incorporated into real estate. Sellers benefit from accepting the S-3 form in good faith, as it relieves them of liability for tax collection on exempt sales. However, sellers must retain these certificates for a minimum of three years to substantiate their tax-exempt transactions. Understanding the nuances of the Vermont S-3 form is crucial for both buyers and sellers to navigate the complexities of sales tax exemptions effectively.

Misconceptions

Understanding the Vermont S-3 form is crucial for buyers seeking sales tax exemptions. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- Only non-profit organizations can use the S-3 form. Many believe this exemption certificate is exclusive to 501(c)(3) organizations. In reality, it can also be used by buyers for resale purposes and certain government units.

- The S-3 form must be filed with the Vermont Department of Taxes. This is incorrect. The form is submitted directly to the seller, not the tax department. Buyers need to ensure the seller retains it for their records.

- All purchases made by a 501(c)(3) organization are tax-exempt. This is a misconception. The exemption only applies to purchases that are for specific purposes, such as religious, educational, or scientific activities.

- Contractors can use the S-3 form for their materials. This is false. Contractors must pay sales tax on materials used in construction, as the S-3 form does not apply to their purchases.

- A seller can accept the S-3 form without verifying its details. This is misleading. Sellers must ensure the certificate is complete and accurate. They are liable for tax if the certificate is not valid.

- Multiple Purchase exemption certificates can be used without restrictions. This is not true. Each purchase must be linked to the exemption certificate, and the sales slip or invoice must reflect the buyer’s information.

- Once the S-3 form is submitted, it does not need to be kept. This is incorrect. Sellers are required to retain the exemption certificates for at least three years to document why tax was not collected.

Clarifying these misconceptions can help buyers and sellers navigate the use of the Vermont S-3 form more effectively. Understanding the rules and requirements will ensure compliance and prevent unexpected tax liabilities.

Form Information

| Fact Name | Details |

|---|---|

| Form Title | Vermont Sales Tax Exemption Certificate S-3 |

| Governing Laws | 32 V.S.A. § 9701(5); § 9743(1)-(3) |

| Filing Requirement | This form must be filed with the seller, not with the Vermont Department of Taxes. |

| Single vs. Multiple Purchases | The form can be used for single purchases or multiple purchases effective for subsequent transactions. |

| Eligible Buyers | Buyers include organizations designated as 501(c)(3), governmental units, and volunteer fire departments. |

| Exemption Basis | Exemptions are claimed for resale, purchases by exempt organizations, and direct payments by government units. |

| Good Faith Acceptance | Sellers accepting the certificate in good faith are relieved of tax liability for the covered transactions. |

| Retention Period | Sellers must retain exemption certificates for at least three years from the last sale date. |

| Improper Use Consequences | Sales without a properly executed certificate are subject to tax, and the seller bears the burden of proof. |

Different PDF Forms

Vermont Income Tax Forms - Indicate any bonus depreciation claimed.

The ADP Pay Stub form is a valuable tool that aids in understanding the specifics of an employee's financial summary, and for those looking for more information about it, you can visit https://smarttemplates.net/fillable-adp-pay-stub. This document is essential for both employers, who use it to maintain accurate payroll records, and employees, who need it for personal financial management and verification purposes. Despite the document's importance, the file content is currently unavailable.

What Is Exempt From Sales Tax in Vermont - The form was last revised in October 2018, thus referencing the most recent guidelines is critical.

Similar forms

The Vermont S-3 form shares similarities with the IRS Form 8233, which is used to claim exemption from withholding on compensation for independent personal services of a nonresident alien individual. Both documents serve as a means for individuals or organizations to assert their tax-exempt status, allowing them to avoid certain tax obligations. Just as the S-3 form requires the buyer to provide specific information about the nature of their purchase and the basis for their exemption, Form 8233 necessitates detailed information about the services provided and the tax treaty benefits being claimed. In both cases, accurate completion and submission of the form are crucial to ensure compliance with tax regulations and to avoid potential penalties. The urgency in submitting these forms correctly cannot be overstated, as errors can lead to significant tax liabilities.

Another document akin to the Vermont S-3 form is the Certificate of Exempt Use, often utilized in various states for sales tax exemption on specific types of purchases. This certificate allows buyers to claim exemption from sales tax for items that will not be used for taxable purposes. Similar to the S-3, it requires the buyer to provide their identification details and a clear description of the items being purchased. Both forms emphasize the importance of the buyer's intent regarding the use of the purchased items, and they mandate that the buyer certifies the accuracy of the information provided. Misrepresentation on either form can result in serious repercussions, reinforcing the need for careful completion and understanding of the applicable laws.

The California Articles of Incorporation form is essential for establishing a corporation by outlining key information, much like the Vermont S-3 form serves in different contexts. For those interested in learning about the incorporation process in California and accessing useful resources, visit https://toptemplates.info/.

The Resale Certificate is another document comparable to the Vermont S-3 form. This certificate allows businesses to purchase goods intended for resale without paying sales tax at the point of sale. Like the S-3, it requires the buyer to furnish their business information and specify the nature of the goods being purchased. Both documents serve to facilitate commerce by ensuring that sales tax is only applied at the final point of sale to the end consumer. The urgency of utilizing these certificates correctly is paramount, as improper use can lead to tax liabilities for the seller, who must ensure they are compliant with state tax laws.

Lastly, the Exempt Organization Certificate is similar to the Vermont S-3 form in that it allows qualifying nonprofit organizations to make purchases without incurring sales tax. This certificate requires organizations to provide proof of their tax-exempt status, typically under section 501(c)(3) of the Internal Revenue Code. Both forms aim to support organizations that serve public interests by alleviating some financial burdens associated with tax obligations. Proper usage of this certificate is critical, as failure to adhere to the requirements can jeopardize an organization’s tax-exempt status and lead to unexpected tax liabilities.

Key takeaways

When filling out and using the Vermont S-3 form, keep the following key takeaways in mind:

- Purpose of the Form: The Vermont S-3 form is used to claim a sales tax exemption for purchases intended for resale or by specific exempt organizations.

- Submission Requirements: This form must be provided to the seller at the time of purchase, not filed with the Vermont Department of Taxes.

- Eligibility Criteria: Eligible buyers include those purchasing for resale, 501(c)(3) organizations, federal or Vermont governmental units, and volunteer fire departments or rescue squads.

- Good Faith Acceptance: Sellers who accept the form in good faith are relieved from the liability of collecting sales tax, provided all conditions are met.

- Retention of Records: Sellers must keep the exemption certificates for at least three years to justify why sales tax was not collected.

- Multiple Purchases: If using a "Multiple Purchase" exemption, each sales slip or invoice must clearly link to the exemption certificate.