Printable Vt Co 411 Template

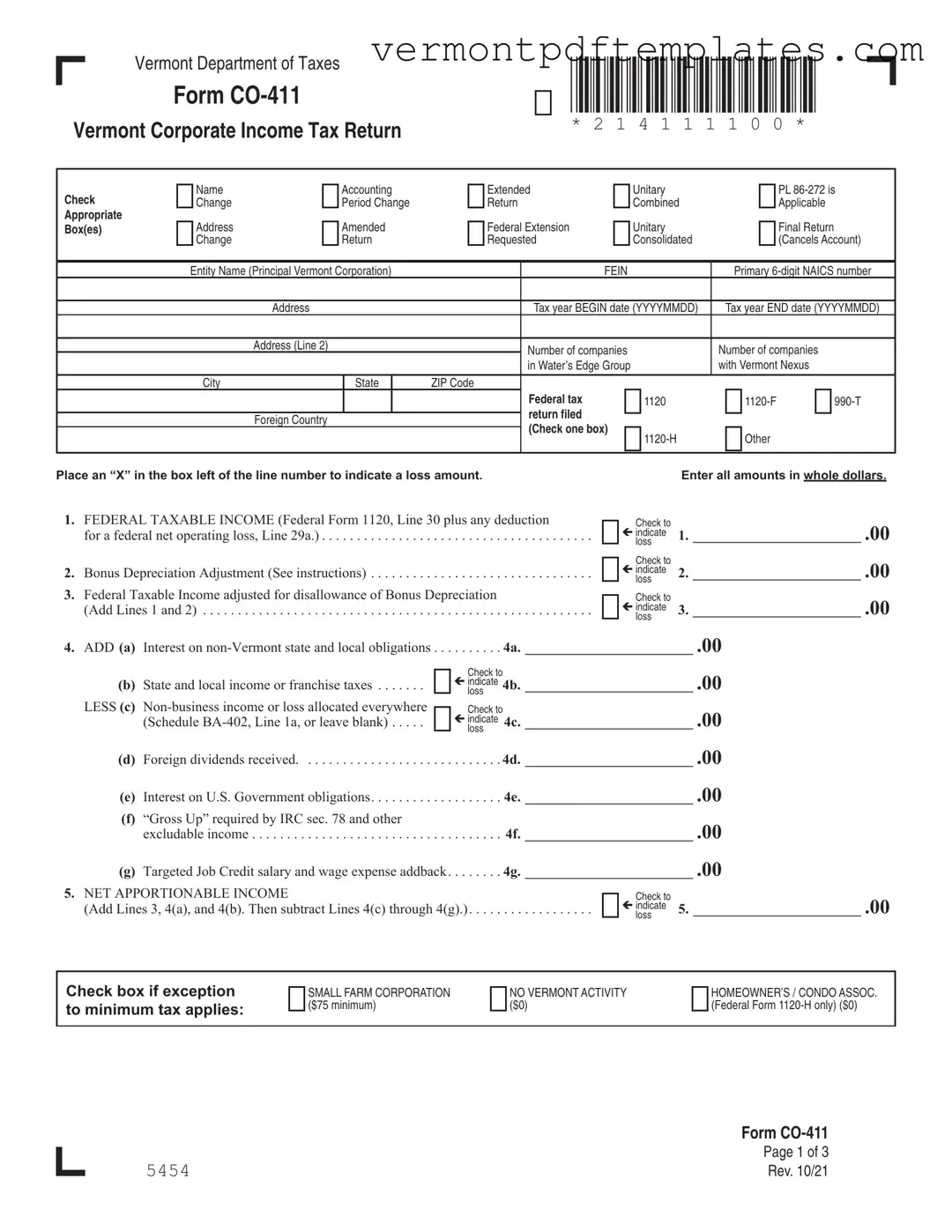

The Vermont Corporate Income Tax Return, known as Form CO-411, is a crucial document for businesses operating within the state. It facilitates the reporting of corporate income and the calculation of tax obligations. This form is designed for Vermont corporations and requires essential information such as the entity name, federal employer identification number (FEIN), and the primary North American Industry Classification System (NAICS) number. Businesses must specify their tax year, including both the start and end dates. The form also includes sections for reporting federal taxable income, bonus depreciation adjustments, and net apportioned income. Additionally, it addresses various deductions and credits that may apply, ensuring that corporations can accurately compute their Vermont tax liability. Understanding how to complete this form is vital for compliance and can significantly impact a corporation's financial standing in Vermont.

Misconceptions

- Misconception 1: The Vt Co 411 form is only for large corporations.

- Misconception 2: The form can be submitted at any time during the year.

- Misconception 3: Only corporations with profits need to file the form.

- Misconception 4: The form is the same as the federal corporate tax return.

- Misconception 5: Filing an extension for the federal return automatically extends the state filing deadline.

- Misconception 6: All income is taxable in Vermont.

- Misconception 7: Corporations can ignore the Vt Co 411 if they are inactive.

- Misconception 8: The form is simple and does not require professional assistance.

- Misconception 9: The Vt Co 411 form is only for domestic corporations.

- Misconception 10: Once filed, there is no need to keep records related to the Vt Co 411.

This form is applicable to all corporations operating in Vermont, regardless of size. Small businesses must also file to comply with state tax regulations.

The Vt Co 411 form must be filed by the due date specified under the Internal Revenue Code. Timely submission is essential to avoid penalties.

Even if a corporation incurs losses, it is still required to file the Vt Co 411 form. Reporting losses can be beneficial for future tax deductions.

The Vt Co 411 form is specific to Vermont and includes state-specific calculations and requirements that differ from federal forms.

An extension for the federal return does not apply to the Vermont filing. Corporations must file for an extension separately with the state.

Not all income is subject to Vermont taxation. Certain types of income may be allocated or exempt, depending on specific criteria outlined in the form instructions.

Inactive corporations must still file the form to maintain compliance. Failure to do so can lead to penalties or complications in reactivating the business.

While the form may seem straightforward, it can be complex. Seeking professional help can ensure accurate completion and compliance with all requirements.

Foreign corporations doing business in Vermont must also file the Vt Co 411 form. This applies to any entity with a nexus in the state.

Corporations should retain copies of the filed form and all supporting documents. These records may be necessary for future audits or inquiries from the Vermont Department of Taxes.

Form Information

| Fact Name | Description |

|---|---|

| Form Title | The form is officially known as the Vermont Corporate Income Tax Return, designated as CO-411. |

| Governing Law | This form is governed by Title 32 of the Vermont Statutes, which outlines corporate tax regulations. |

| Filing Requirement | Corporations must file this return annually to report their income and calculate tax liability in Vermont. |

| Tax Year Dates | Tax year start and end dates must be entered in the format YYYYMMDD. |

| Apportionable Income | Line 5 calculates net apportionable income, which is essential for determining Vermont tax obligations. |

| Vermont Tax Rates | Tax rates vary based on income brackets, with specific rates for income levels outlined in the form. |

| Minimum Tax | The minimum tax for corporations is based on gross receipts, with thresholds defined for different amounts. |

| Credits and Payments | Corporations can claim credits and report payments made towards their tax liability on the form. |

| Signature Requirement | An authorized officer must sign the form, certifying the accuracy and completeness of the information provided. |

Different PDF Forms

What Is Exempt From Sales Tax in Vermont - The apportionment percentage, which may come from Schedule BA-402, is crucial for calculating Vermont-specific income.

Form 8879-te - The 8879-VT is the Vermont Individual Income Tax Declaration for electronic filing.

The Florida Articles of Incorporation form is a document required for establishing a corporation within the state. It outlines the basic information needed to register the business with the Florida Department of State, such as the corporation’s name, address, and the names of its directors. To learn more about this essential form, you can visit https://floridaforms.net/blank-articles-of-incorporation-form/. Filing this form is the first official step in creating a recognized business entity in Florida.

Vermont 813 - The Vermont 813 form is essential for financial disclosure in family court cases.

Similar forms

The Vermont Corporate Income Tax Return (Form CO-411) shares similarities with the federal Form 1120, which is the U.S. Corporation Income Tax Return. Both forms are used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their tax liability. The structure of both forms includes sections for reporting taxable income, adjustments, and tax computations. Additionally, both require the corporation's identifying information, such as name and Employer Identification Number (EIN), and they must be filed annually by the due date specified by the respective tax authorities.

Another document similar to the CO-411 is the Vermont Corporate Estimated Tax Payment Form (Form CO-414). This form is used by corporations to make estimated tax payments throughout the year based on their expected income. Like the CO-411, it is specific to Vermont tax requirements and is designed to ensure that corporations meet their tax obligations in a timely manner. Both forms require the corporation's identifying details and involve calculations related to the corporation's income, ensuring compliance with state tax laws.

The Form 990-T, Exempt Organization Business Income Tax Return, is also comparable to the CO-411 in that it is used by certain tax-exempt organizations to report unrelated business income. Both forms require detailed reporting of income and deductions, as well as calculations of tax liability. While the CO-411 is specific to corporate entities, the 990-T serves a different purpose for tax-exempt organizations, yet both documents share a similar structure and require the reporting of financial information to the tax authorities.

Form 1120-F, the U.S. Income Tax Return of a Foreign Corporation, is another document that resembles the CO-411. This form is used by foreign corporations engaged in business in the United States to report their income and calculate their tax liability. Both forms necessitate detailed financial disclosures and are designed to assess tax obligations. They require information about the corporation's income sources and deductions, making them essential for compliance with federal and state tax regulations.

The California Last Will and Testament form not only serves essential purposes for individuals planning their estates but also connects to broader legal frameworks within which various forms operate, such as different state return documents. Understanding these interactions can be beneficial, and for those interested in exploring comprehensive legal documentation, refer to All California Forms which provide a valuable resource for managing various legal requirements.

Lastly, the Vermont Sales and Use Tax Return (Form S-1) is similar to the CO-411 in that both are used to report tax liabilities to the Vermont Department of Taxes. While the CO-411 focuses on corporate income tax, the S-1 is specifically for sales and use taxes. Both forms require the reporting of financial data, including gross receipts and applicable deductions. They are integral to the tax compliance process within Vermont and help ensure that businesses meet their tax responsibilities to the state.

Key takeaways

Ensure that all information is accurate and complete before submitting the Vt Co 411 form. This includes the entity name, FEIN, and tax year dates.

Check the appropriate boxes for any applicable changes, such as amended returns or final returns. This helps the Department of Taxes process your return correctly.

Report all amounts in whole dollars. This is crucial for accurate calculations and to avoid delays in processing.

Calculate the Vermont percentage carefully, as it will impact the income apportioned to Vermont. Ensure this is done to six decimal places.

Pay any tax due by the required due date, even if you have filed for an extension. Timely payment helps avoid penalties and interest.

Keep a copy of the completed form and all supporting documents for your records. This is important for future reference and compliance.