Printable Vt Registration Template

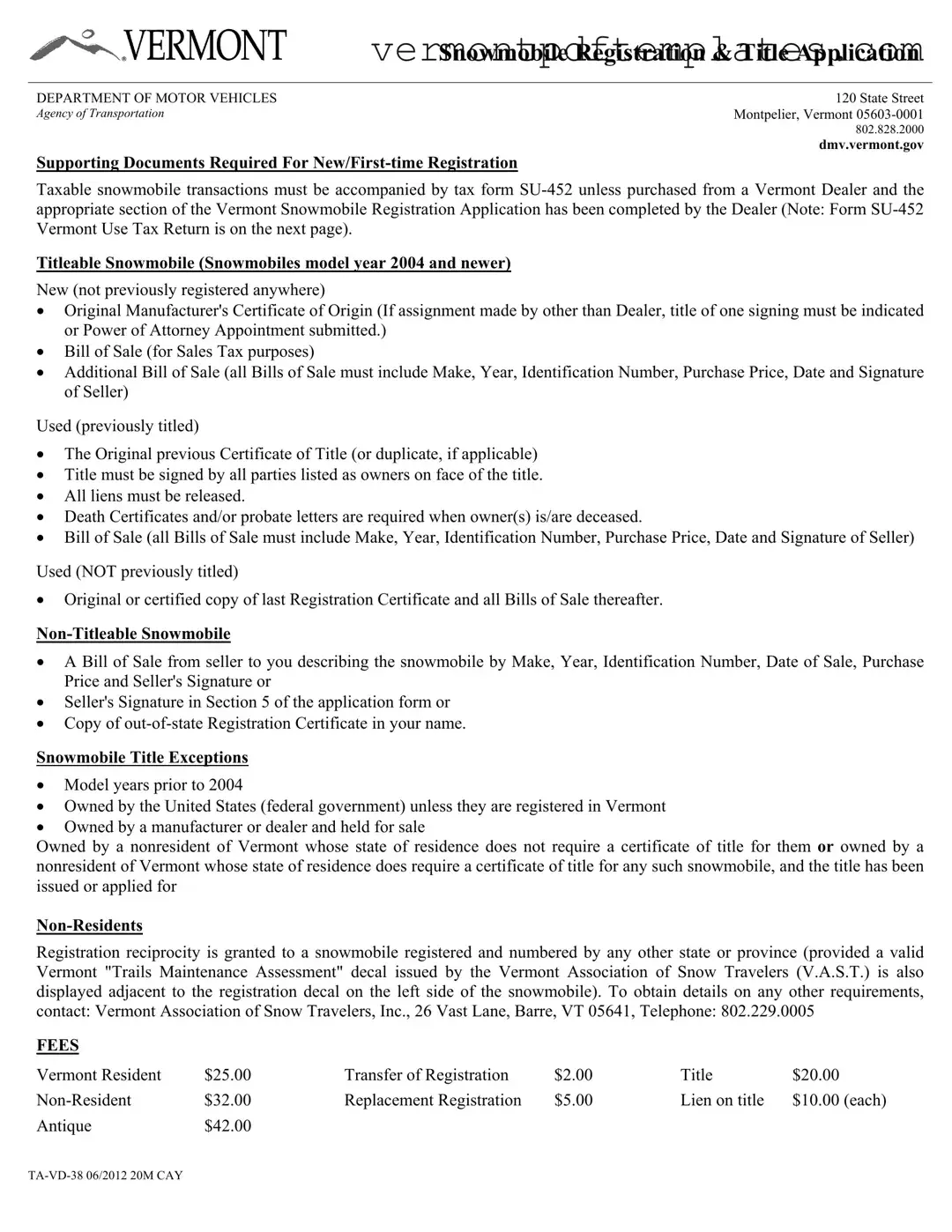

The Vermont Snowmobile Registration and Title Application is a crucial document for individuals looking to register or title their snowmobiles in the state. This form is essential for both new and used snowmobiles, and it outlines the necessary steps and supporting documents required for registration. For first-time registrations, applicants must provide a Manufacturer's Certificate of Origin or a Bill of Sale, along with the completed tax form SU-452, unless the snowmobile was purchased from a Vermont dealer. Different requirements apply depending on whether the snowmobile is new, used, or non-titleable. For example, used snowmobiles must have their previous titles signed by all owners, and any liens must be released. Non-residents can also register their snowmobiles in Vermont, provided they display a valid "Trails Maintenance Assessment" decal. The application requires detailed information, including the snowmobile's identification number, ownership details, and any liens. It is critical to complete all sections accurately, as incomplete forms can lead to delays in processing. Additionally, various fees apply based on residency status and the type of registration being requested, underscoring the importance of understanding the financial obligations involved in the registration process.

Misconceptions

- All snowmobiles require a title. This is not true. Only snowmobiles from model year 2004 and newer require a title. Older models do not need one.

- Non-residents cannot register snowmobiles in Vermont. Non-residents can register their snowmobiles if they display a valid Vermont "Trails Maintenance Assessment" decal.

- A Bill of Sale is not necessary for used snowmobiles. A Bill of Sale is required for all used snowmobiles, regardless of their registration status.

- Only Vermont dealers can complete the registration form. While dealers can assist, individuals can also fill out and submit the form themselves.

- There are no fees for registration transfers. There is a fee of $2.00 for transferring registration, even if it is between snowmobiles owned by the same person.

- Odometer readings are optional. Odometer readings are now a mandatory requirement on the registration form.

- All snowmobiles must have a sales tax paid at the time of purchase. Sales tax is not required if proof of tax payment from another state is provided or if specific exemptions apply.

- Antique snowmobiles can be registered anywhere. Antique snowmobiles must be registered specifically through the Vermont DMV and cannot be processed by V.A.S.T. agents.

- Registration forms can be submitted without supporting documents. All required supporting documents must accompany the registration form for it to be processed.

Form Information

| Fact Name | Description |

|---|---|

| Governing Law | The Vermont Snowmobile Registration is governed by Title 23, Chapter 34 of the Vermont Statutes Annotated. |

| Registration Fees | Vermont residents pay a $25.00 registration fee. Non-residents pay $32.00. |

| Tax Form Requirement | Taxable snowmobile transactions require form SU-452 unless purchased from a Vermont dealer. |

| Title Eligibility | Snowmobiles from model year 2004 and newer are eligible for a title. |

| Ownership Documentation | All owners must sign the title. Death certificates are needed if an owner is deceased. |

| Non-Resident Registration | Non-residents can register snowmobiles from other states if they display a Vermont "Trails Maintenance Assessment" decal. |

| Antique Snowmobile | A one-time registration fee of $42.00 applies to snowmobiles at least 25 years old used for exhibitions or parades. |

| Odometer Reading | Odometer readings are now a required part of the registration process. |

| Liens on Title | Each lien on the title incurs a fee of $10.00. |

| Temporary Registration | Temporary registrations can be issued by V.A.S.T. agents or dealers for a limited time. |

Different PDF Forms

Vermont Dcf - Civil penalties apply for failure to submit the report.

The ADP Pay Stub form is an indispensable document that provides employees with a clear breakdown of their income, deductions, and taxes for each pay period. For more information, check out the comprehensive guide to managing your Adp Pay Stub needs.

Vermont 813B - The form allows for additional documentation to be attached if necessary.

Vt Sales Tax - Sales tax exemptions rely on properly filled exemption certificates.

Similar forms

The Vermont Snowmobile Registration & Title Application shares similarities with the Boat Registration Application. Both documents require detailed information about the vehicle, including the identification number, make, and year. They also necessitate proof of ownership, such as a Bill of Sale or a Certificate of Origin. Just like the snowmobile registration process, boat registration mandates the payment of specific fees and taxes, including sales tax, and both forms must be submitted to the respective state department for processing.

Another comparable document is the Motorcycle Registration Application. This application also requires personal information from the owner, including name, address, and identification number. Just like the snowmobile registration, applicants must provide proof of ownership, which can include a Bill of Sale or a previous title. Both documents involve similar fee structures and tax obligations, ensuring that all vehicles are properly registered with the state.

In addition to the various forms required for vehicle and property registration, it's essential to consider the importance of having a comprehensive estate plan, which includes the California Last Will and Testament form. This legal document not only outlines the distribution of possessions but also helps in managing personal assets effectively. For those interested in ensuring their legacy is preserved, visiting All California Forms can provide valuable resources related to estate planning and other legal documentation.

The All-Terrain Vehicle (ATV) Registration Application is also similar to the Vermont Snowmobile Registration form. Each requires owners to provide identification details and vehicle specifications. Both forms necessitate proof of ownership and may require a Bill of Sale or previous registration documentation. The fee structure for ATVs mirrors that of snowmobiles, emphasizing the importance of adhering to state regulations for off-road vehicles.

The Vehicle Title Application is another document that aligns closely with the snowmobile registration form. Both require applicants to fill out personal and vehicle information. The title application also requires proof of ownership, such as a Bill of Sale or a Certificate of Origin. Furthermore, both documents involve similar processes for lien releases and the payment of applicable fees, ensuring that ownership is clearly established and recorded.

In addition, the Form SU-452 Vermont Use Tax Return is relevant when registering a snowmobile. This form is necessary for reporting the use tax on purchases where sales tax was not paid. Similar to the snowmobile registration, it requires the buyer's information and details about the purchased item. Both documents serve to ensure that tax obligations are met when registering vehicles in Vermont.

The Tax Exempt Certificate serves a similar purpose for individuals who may qualify for tax exemptions when registering their snowmobiles. This document requires the applicant to provide information about their tax-exempt status and the specific vehicle being registered. Like the snowmobile registration form, it ensures compliance with state tax regulations and helps streamline the registration process for qualifying individuals.

The Vermont Title Transfer Application is comparable as it involves transferring ownership of a vehicle, including snowmobiles. This document requires the seller's and buyer's information, along with the vehicle's identification details. Both forms demand proof of ownership, such as a previous title or Bill of Sale, and both require the payment of applicable fees to complete the transfer process legally.

The DMV Registration Renewal Application is also similar in that it requires the owner to provide personal and vehicle information to renew their registration. Like the snowmobile registration form, it includes sections for verifying ownership and paying necessary fees. Both applications aim to keep vehicle registrations current and compliant with state regulations.

The Vermont Dealer Registration Application is another document that resembles the snowmobile registration form. This application requires dealers to provide information about the vehicles they sell, including snowmobiles. Both documents require proof of ownership and compliance with state regulations, ensuring that all vehicles sold are properly registered and documented.

Lastly, the Vermont Emissions Inspection Certificate can be seen as similar due to its role in ensuring that vehicles, including snowmobiles, meet state environmental standards. While it serves a different purpose, it still requires vehicle information and compliance with state regulations. Both documents are essential for maintaining lawful operation of vehicles within the state.

Key takeaways

Filling out and using the Vermont Snowmobile Registration & Title Application can seem daunting, but understanding the key points can make the process smoother. Here are some essential takeaways:

- Gather Required Documents: Before starting the application, ensure you have all necessary documents, such as a Bill of Sale and, if applicable, the original Certificate of Title. Different requirements exist for new and used snowmobiles, so check carefully.

- Understand Tax Obligations: When registering a snowmobile, you may need to submit tax form SU-452 unless purchased from a Vermont dealer. Make sure to familiarize yourself with the sales tax implications based on where you bought the snowmobile.

- Complete All Sections: Every part of the application must be filled out completely. This includes providing the Snowmobile Identification Number and ensuring all signatures are present. Missing information can delay processing.

- Know Ownership Types: When registering with multiple owners, indicate the type of ownership and rights of survivorship. This is crucial, especially if the snowmobile is co-owned.

- Fees Vary: Be aware of the different fees associated with registration. Residents pay $25, while non-residents pay $32. Additional fees may apply for title transfers or replacements.

By keeping these key points in mind, you can navigate the registration process with greater confidence and efficiency.